Granite Construction Inc. (GVA, Financial) reported first-quarter revenue of $700 million, falling short of the consensus estimate of $706.15 million. Despite this, CEO Kyle Larkin expressed optimism about the company's future, noting a strong beginning to 2025. Larkin highlighted the growth in bidding opportunities over recent years, culminating in a record committed and awarded projects (CAP) of $5.7 billion by the end of the quarter. This positions Granite well to capitalize on opportunities in both public and private sectors throughout the year.

While acknowledging economic uncertainties, Larkin is confident in meeting the company's 2025 guidance and 2027 financial goals. The quarter also marked the introduction of product-level disclosures for aggregates and asphalt in the Materials segment, following a strategic realignment of operational leadership last year. This move aims to enhance the expertise and efficiency within the Construction and Materials segments. Larkin is particularly proud of the achievements in increasing aggregate margins and anticipates further growth as the company advances its vertical integration strategy.

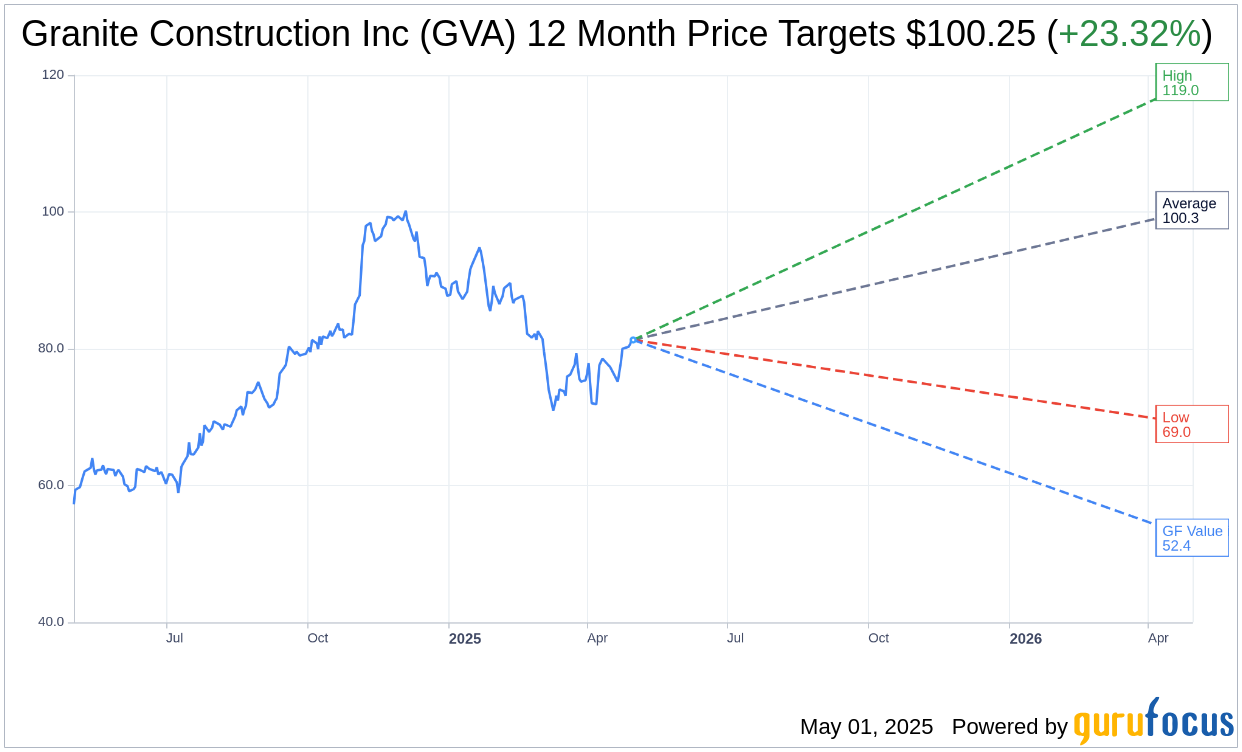

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for Granite Construction Inc (GVA, Financial) is $100.25 with a high estimate of $119.00 and a low estimate of $69.00. The average target implies an upside of 23.32% from the current price of $81.29. More detailed estimate data can be found on the Granite Construction Inc (GVA) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Granite Construction Inc's (GVA, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Granite Construction Inc (GVA, Financial) in one year is $52.38, suggesting a downside of 35.56% from the current price of $81.29. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Granite Construction Inc (GVA) Summary page.

GVA Key Business Developments

Release Date: February 13, 2025

- Revenue: Increased 14% to $4 billion for the year.

- Gross Profit: Increased 44% to $573 million for the year.

- Adjusted Net Income: Increased 45% to $214 million for the year.

- Adjusted EBITDA: Increased 44% to $402 million for the year.

- Operating Cash Flow: Increased 148% to $456 million for the year.

- Construction Segment Revenue: Increased 3% year-over-year to $821 million for the quarter.

- Construction Segment Gross Profit Margin: 16% for the quarter.

- Materials Segment Revenue: Increased $16 million year-over-year to $156 million for the quarter.

- Cash Gross Profit Margin (Materials Segment): Improved by 240 basis points year-over-year to 21.4% for the full year.

- Cash and Marketable Securities: $586 million at year-end.

- 2025 Revenue Guidance: Expected to grow to a range of $4.2 billion to $4.4 billion.

- 2025 Adjusted EBITDA Margin Guidance: Expected to be 11% to 12% of revenue.

- 2025 CapEx Guidance: Expected to be in the range of $140 million to $160 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Granite Construction Inc (GVA, Financial) achieved a record year in 2024 with a 14% increase in revenue to $4 billion.

- The company reported a 44% increase in gross profit to $573 million and a 45% increase in adjusted net income to $214 million.

- Operating cash flow increased significantly by 148% to $456 million, demonstrating strong cash generation capabilities.

- The materials segment saw a pivotal year with price increases and efficiency improvements, leading to a year-over-year increase in cash gross profit margin.

- Granite Construction Inc (GVA) is well-positioned for future growth with a strong CAP portfolio and robust bidding opportunities, supported by state transportation budgets and the Federal Infrastructure Bill.

Negative Points

- Despite strong performance, there were some project delays in the construction segment, which could impact future revenue.

- The company experienced a decrease in CAP since the third quarter, although it expects this to improve in 2025.

- Increased depreciation, depletion, and amortization in the materials segment due to investments may impact reported profits.

- The anticipated gain on sales of assets was not realized in the fourth quarter, potentially affecting financial results.

- Inflation is expected to rise slightly in 2025, which could impact costs and margins if not managed effectively.