- TC Energy's Q1 2025 earnings decline, with significant focus on future EBITDA projections.

- Current analyst consensus suggests a "Hold" status for TC Energy with limited upside potential.

- GuruFocus estimates indicate a potential downside based on fair value assessment.

TC Energy (TRP, Financial) recently announced its financial outcomes for the first quarter of 2025, revealing a dip in comparable earnings to $1.0 billion, or $0.95 per share. This marks a decrease from $1.1 billion, or $1.02 per share, compared to the previous year. Looking ahead, the company projects EBITDA between $10.7 and $10.9 billion for the year 2025, paired with anticipated capital expenditures ranging from $5.5 to $6.0 billion.

Wall Street Analysts' Forecast

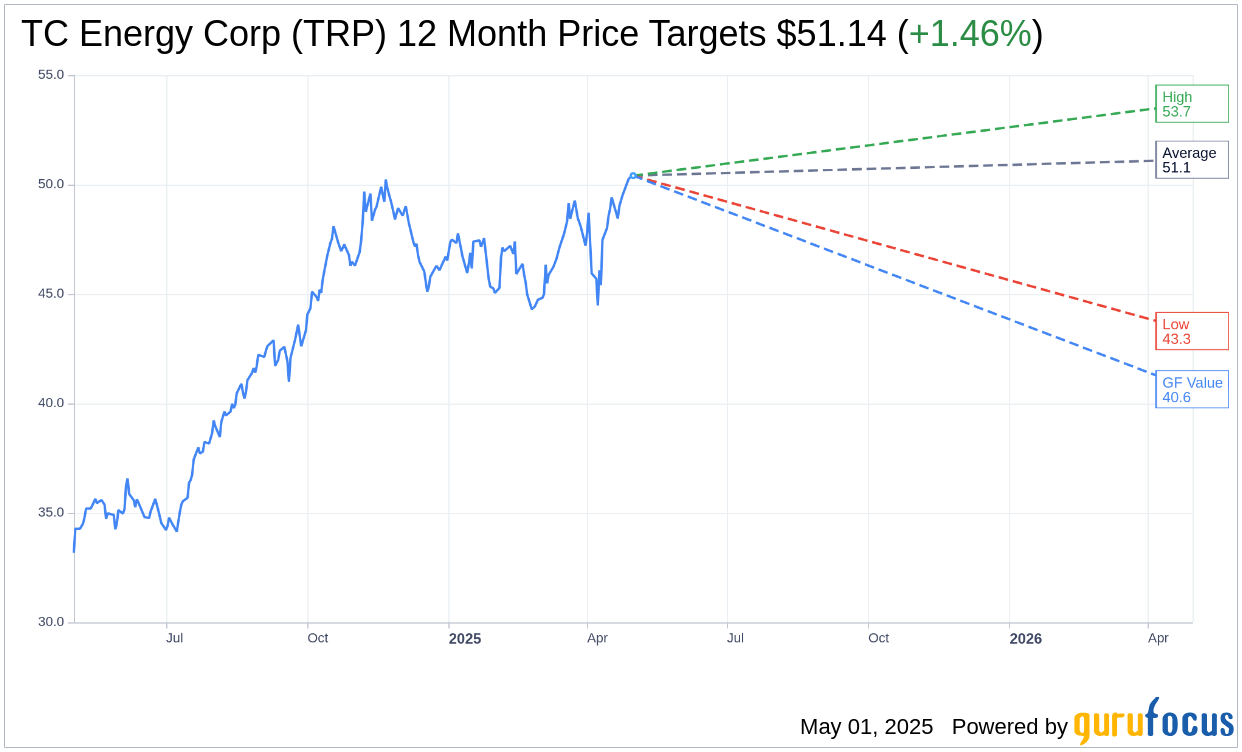

Insight from five analysts provides an average one-year price target for TC Energy Corp (TRP, Financial) at $51.14. The estimates span from a high of $53.70 to a low of $43.31, suggesting an average potential upside of 1.46% from the current market price of $50.41. For more comprehensive estimate data, visit the TC Energy Corp (TRP) Forecast page.

Brokerage Recommendations

The consensus from six brokerage firms reveals that TC Energy Corp (TRP, Financial) holds an average recommendation of 2.8, translating to a "Hold" status. This rating exists on a scale from 1 to 5, where 1 is a Strong Buy and 5 indicates Sell.

GuruFocus Valuation Insights

According to GuruFocus estimates, the anticipated GF Value for TC Energy Corp (TRP, Financial) in a year stands at $40.65, which reflects a potential downside of 19.36% from the current price of $50.41. The GF Value represents GuruFocus's calculation of the stock's fair value, derived from historical trading multiples, past business growth, and projected future performance. Access more detailed insights on the TC Energy Corp (TRP) Summary page.