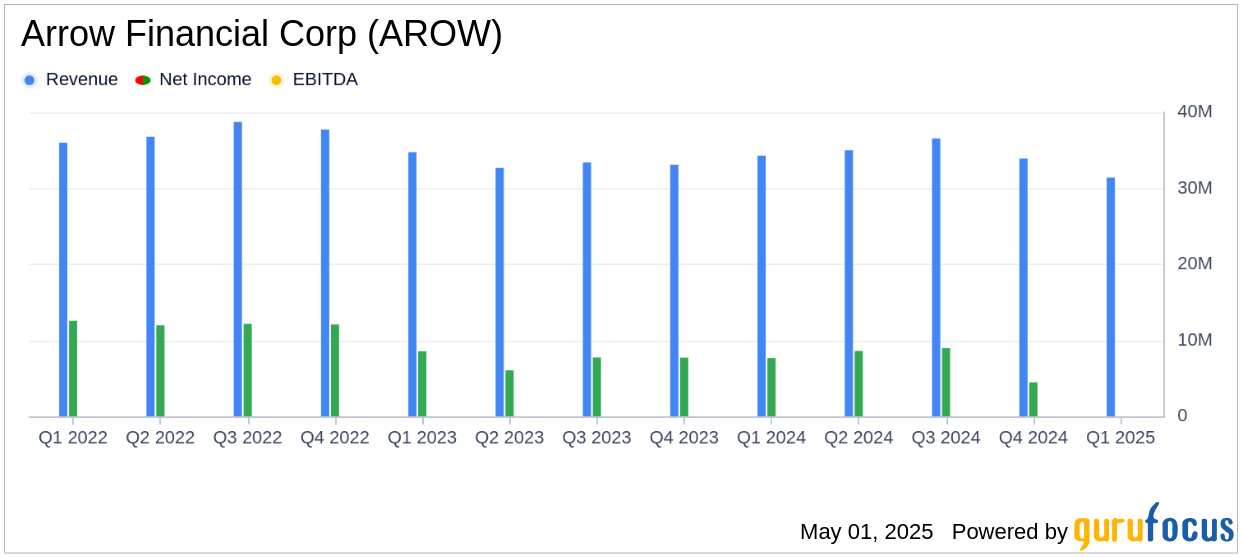

Arrow Financial Corp (AROW, Financial) released its 8-K filing on May 1, 2025, reporting a net income of $6.3 million for the first quarter of 2025, translating to an earnings per share (EPS) of $0.38. This result fell short of the analyst estimate of $0.43 per share. The company's revenue for the quarter was not explicitly stated, but the net interest income reached a record $31.4 million.

Company Overview

Arrow Financial Corp is a holding company that provides a range of financial services through its subsidiaries. These services include online and mobile banking, mortgages, commercial loans, investments, and various lending services. The company's primary revenue sources are interest income, fees, and commissions.

Performance and Challenges

Arrow Financial Corp's performance in the first quarter was marked by a significant increase in net income from $4.5 million in the previous quarter to $6.3 million. However, the EPS of $0.38 was below the analyst estimate of $0.43. The quarter was impacted by a $3.75 million specific reserve related to a commercial real estate loan, which affected the EPS by $0.17 per share. Additionally, non-core unification costs of $0.6 million were incurred, impacting EPS by $0.03 per share.

Financial Achievements

Despite the challenges, Arrow Financial Corp achieved a record net interest income of $31.4 million, a 5.6% increase from the previous quarter. The net interest margin improved to 3.07% from 2.83% in the prior quarter, driven by yield expansion on earning assets and a decrease in the cost of interest-bearing deposits by 23 basis points to 2.41%.

Key Financial Metrics

The company's total assets increased by 3.3% to $4.4 billion, with deposit balances rising to $4.0 billion. The loan-to-deposit ratio stood at 86.1%. The provision for credit losses increased to $5.0 million, primarily due to the specific reserve on the commercial real estate loan. The allowance for credit losses was $37.8 million, representing 1.11% of loans outstanding.

| Metric | Q1 2025 | Q4 2024 |

|---|---|---|

| Net Income | $6.3 million | $4.5 million |

| EPS | $0.38 | $0.27 |

| Net Interest Income | $31.4 million | $29.7 million |

| Net Interest Margin | 3.07% | 2.83% |

Analysis and Commentary

Arrow Financial Corp's strategic initiatives, including the expansion of its Corporate Banking Team, are aimed at driving growth despite the current economic volatility. The company's credit quality remains strong, with the recent commercial credit issue considered an isolated incident. Arrow's President and CEO, David S. DeMarco, stated,

“We delivered another quarter of strong margin expansion along with continued loan growth, further improving core profitability during these volatile economic times.”

Conclusion

Arrow Financial Corp's first-quarter performance highlights both achievements and challenges. While the company has shown resilience with improved net interest income and margin, the impact of specific reserves and unification costs has affected its EPS. As Arrow continues to execute its strategic initiatives, its ability to manage credit risks and operational costs will be crucial for future performance.

Explore the complete 8-K earnings release (here) from Arrow Financial Corp for further details.