Following a thorough review of MAA's (MAA, Financial) first quarter performance, Baird has increased its price target for the company from $161 to $162. The firm has also maintained a Neutral rating on the shares. This decision comes as MAA's quarterly trends show signs of improvement and the company holds steady on its guidance outlook.

Wall Street Analysts Forecast

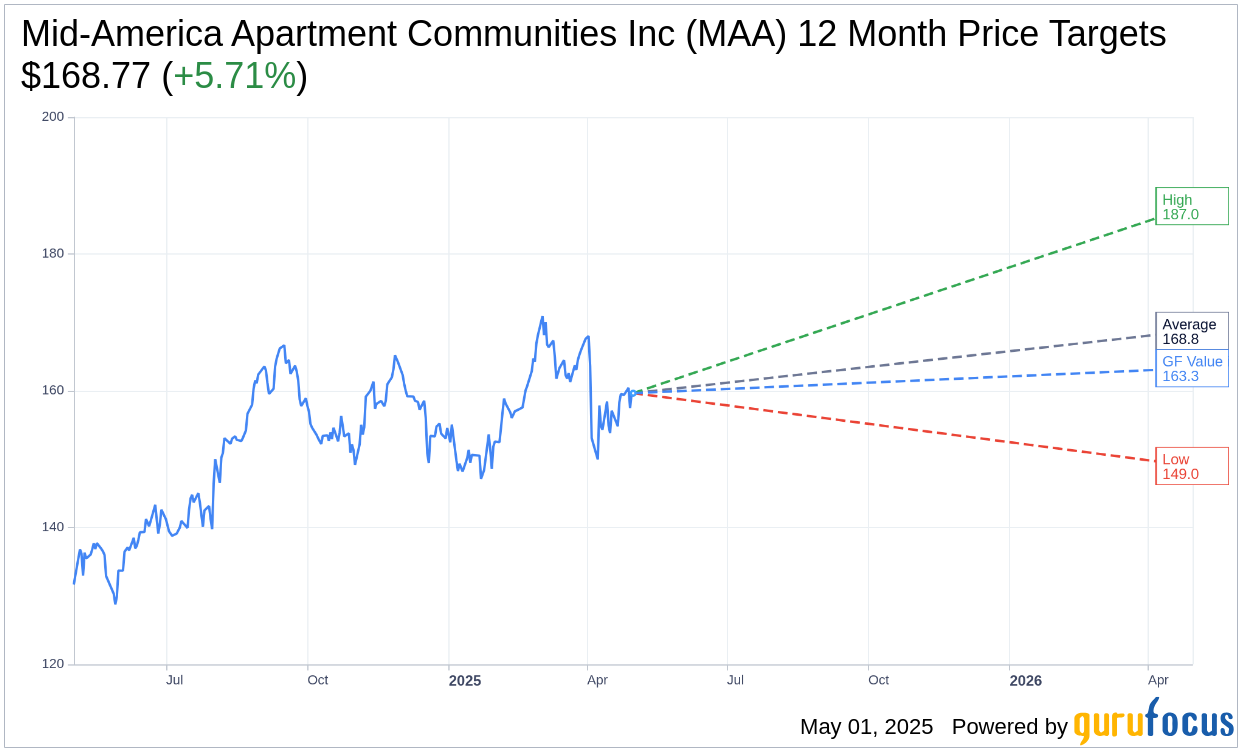

Based on the one-year price targets offered by 26 analysts, the average target price for Mid-America Apartment Communities Inc (MAA, Financial) is $168.77 with a high estimate of $187.00 and a low estimate of $149.00. The average target implies an upside of 5.71% from the current price of $159.65. More detailed estimate data can be found on the Mid-America Apartment Communities Inc (MAA) Forecast page.

Based on the consensus recommendation from 27 brokerage firms, Mid-America Apartment Communities Inc's (MAA, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Mid-America Apartment Communities Inc (MAA, Financial) in one year is $163.29, suggesting a upside of 2.28% from the current price of $159.65. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Mid-America Apartment Communities Inc (MAA) Summary page.

MAA Key Business Developments

Release Date: February 06, 2025

- Core FFO (Funds From Operations): $2.23 per share for Q4; $8.88 per share for full year 2024.

- Same Store Revenue: Down 0.2% for Q4; up 0.5% for full year 2024.

- Same Store Operating Expenses: Projected growth of 3.2% for 2025.

- Net Debt to EBITDA: 4 times.

- Occupancy: 95.6% average for Q4.

- NOI (Net Operating Income) Yields: 5.9% for acquisitions; 6.3% for developments at stabilization.

- Development Pipeline: $852 million with $374 million remaining to be funded.

- Acquisitions: 3 properties in 2024, projected NOI yields of 5.9% at stabilization.

- Dispositions: $325 million planned for 2025.

- Interest Expense: Projected to increase by approximately 13% for 2025.

- Projected Core FFO for 2025: $8.61 to $8.93 per share.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Mid-America Apartment Communities Inc (MAA, Financial) finished 2024 in line with expectations and is well-positioned for a recovery cycle in apartment leasing.

- The leadership team has a strong average tenure of 16 years, providing stability and confidence in executing the company's strategy.

- The company anticipates a significant decline in new supply deliveries starting this year, which should positively impact market rent growth.

- MAA is implementing new tech initiatives aimed at enhancing resident services and operational efficiencies, expected to increase operating margins.

- The external growth pipeline is robust, with several new projects slated for delivery and a strong balance sheet to support this growth.

Negative Points

- The company is still dealing with the impact of record high levels of new supply delivered over the past year.

- New resident lease pricing was pressured during the fourth quarter due to higher new supply and seasonal slowdown.

- Some markets, like Austin, Atlanta, and Jacksonville, continue to face challenges due to high levels of supply.

- The company expects a slight dilution to core FFO in the first half of 2025 due to the interest carrying and leasing velocity of recent acquisitions and developments.

- Projected refinancing activities in 2025 are expected to result in a three-cent dilution to core FFO compared to the prior year.