Intercontinental Exchange Inc. (ICE, Financial) posted a revenue of $2.47 billion in the first quarter, aligning with market expectations. The company marked this period as its most successful quarter, showcasing unprecedented revenues, operating income, and growth in earnings per share. Despite persistent global geopolitical and economic uncertainties, ICE's performance underscores the strength and resilience of its versatile business model. The company's wide-ranging platform is set to continue delivering value to its customers and shareholders throughout the rest of the year and into the future.

Wall Street Analysts Forecast

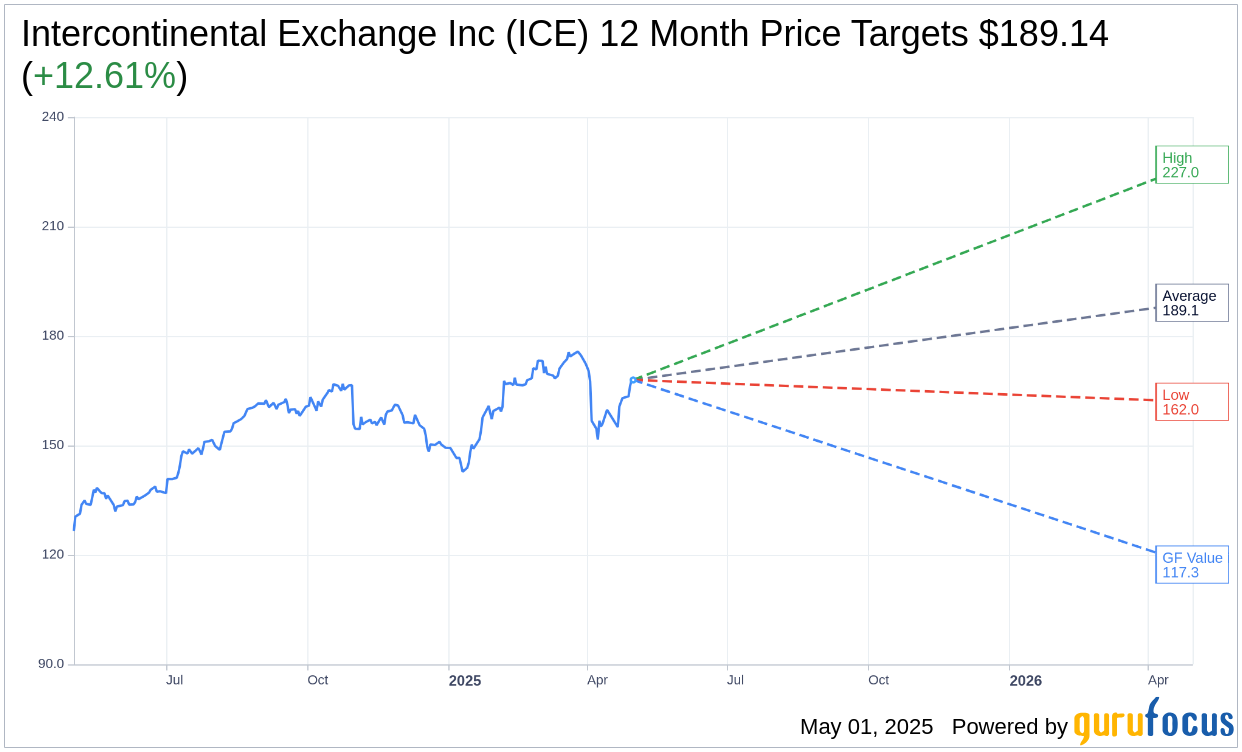

Based on the one-year price targets offered by 14 analysts, the average target price for Intercontinental Exchange Inc (ICE, Financial) is $189.14 with a high estimate of $227.00 and a low estimate of $162.00. The average target implies an upside of 12.61% from the current price of $167.97. More detailed estimate data can be found on the Intercontinental Exchange Inc (ICE) Forecast page.

Based on the consensus recommendation from 18 brokerage firms, Intercontinental Exchange Inc's (ICE, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Intercontinental Exchange Inc (ICE, Financial) in one year is $117.35, suggesting a downside of 30.14% from the current price of $167.97. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Intercontinental Exchange Inc (ICE) Summary page.

ICE Key Business Developments

Release Date: February 06, 2025

- Full Year Adjusted Earnings Per Share: $6.07, an increase of 8% year-over-year.

- Full Year Net Revenues: $9.3 billion, a record high, with a 6% increase pro forma for the acquisition of Black Knight.

- Full Year Adjusted Operating Expenses: $3.8 billion, up 1% year-over-year on a pro forma basis.

- Run Rate Expense Synergies from Black Knight: Achieved $175 million, with a target of $230 million by the end of 2025.

- Full Year Adjusted Operating Income: $5.5 billion, a 10% increase year-over-year.

- Full Year Free Cash Flow: $3.6 billion, with $1 billion returned to shareholders through dividends.

- Fourth Quarter Adjusted Earnings Per Share: $1.52, up 14% year-over-year.

- Fourth Quarter Net Revenues: $2.3 billion, a 5% increase year-over-year.

- Fourth Quarter Adjusted Operating Expenses: $973 million, below the guidance range.

- Exchange Segment Fourth Quarter Net Revenues: $1.2 billion, up 9% year-over-year.

- Energy Revenues Growth: Global energy business grew 16% year-over-year in the fourth quarter.

- Fixed Income & Data Services Fourth Quarter Revenues: $579 million, with recurring revenues at $471 million, up 5% year-over-year.

- Mortgage Technology Fourth Quarter Revenues: $508 million, with recurring revenues at $391 million.

- 2025 Adjusted Operating Expenses Guidance: Expected between $3.915 billion and $3.965 billion, a 3% increase year-over-year at the midpoint.

- 2025 Full Year CapEx Guidance: Expected between $730 million and $780 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Intercontinental Exchange Inc (ICE, Financial) reported record full-year adjusted earnings per share of $6.07, marking an 8% increase year-over-year.

- The company achieved record net revenues of $9.3 billion for the full year, with a 6% increase pro forma for the acquisition of Black Knight.

- ICE's energy markets saw significant growth, with revenues reaching a record $1.9 billion, up 25% year-over-year.

- The Fixed Income & Data Services segment reported record recurring revenues of $471 million, growing 5% year-over-year.

- ICE's Mortgage Technology segment showed signs of market stabilization, with housing inventory rising by 20% in 2024.

Negative Points

- ICE's fourth-quarter recurring revenues in the Exchange segment saw a sequential decline due to a one-time full-year true-up to tape revenues at the NYSE.

- The Mortgage Technology segment experienced a year-over-year decline in recurring revenues, despite improvements relative to the third quarter.

- There are anticipated headwinds from renewals on Encompass, particularly related to 2020 and 2021 vintages, impacting growth rates.

- The company expects some attrition from Flagstar towards the end of the year, which could impact growth by approximately 0.5 percentage points.

- ICE's guidance for 2025 anticipates only low to mid-single-digit growth in total IMT revenues, reflecting a conservative outlook on origination volumes.