On May 1, 2025, Insight Enterprises Inc (NSIT, Financial) released its 8-K filing detailing its financial performance for the first quarter ending March 31, 2025. Insight Enterprises Inc, a Fortune IT provider, offers digital innovation, cloud/data center transformation, connected workforce, and supply chain optimization solutions across its North America, EMEA, and APAC segments, with North America being the largest revenue contributor.

Performance Overview and Challenges

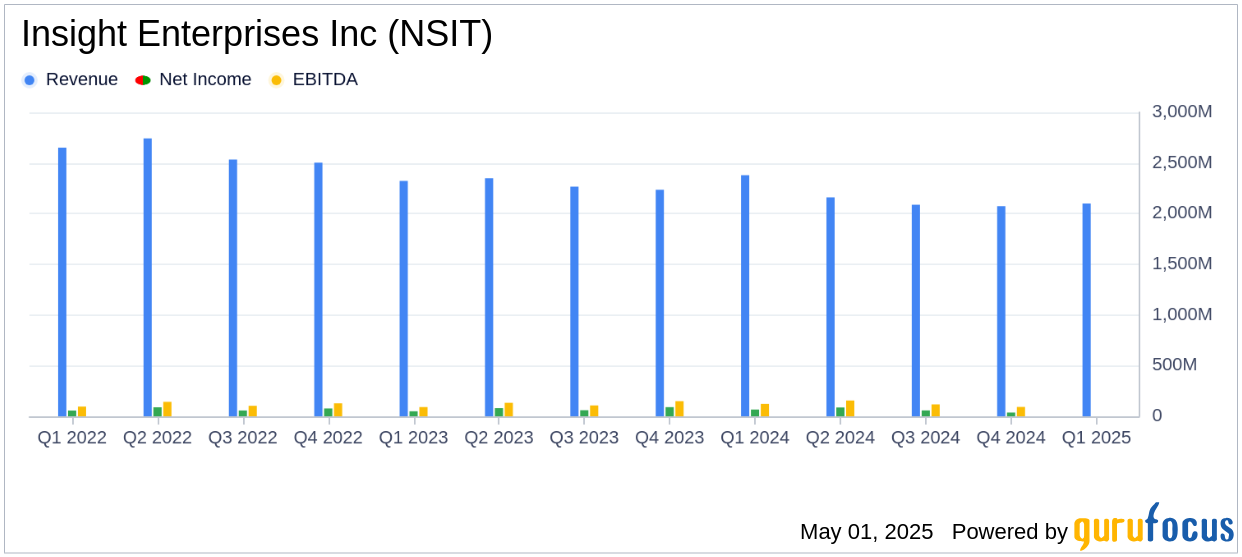

Insight Enterprises Inc reported a 12% year-over-year decline in net sales to $2.1 billion, aligning closely with the analyst estimate of $2,192.99 million. The company's gross profit also saw an 8% decrease to $406.5 million, although the gross margin improved by 80 basis points to 19.3%. This performance is crucial as it reflects the company's ability to manage costs and maintain profitability despite declining sales.

The company faced significant challenges, including an 89% drop in consolidated net earnings to $7.5 million, attributed partly to a $15.2 million loss on revaluation of earnout liability and a $25.1 million net loss from warrant settlement liabilities. These challenges highlight potential risks in financial management and market volatility.

Financial Achievements and Industry Context

Despite the decline in earnings, Insight Enterprises Inc achieved an adjusted EBITDA of $111.3 million, a 16% decrease year-over-year. The adjusted diluted earnings per share (EPS) was $2.06, surpassing the analyst estimate of $1.75. This achievement is significant in the hardware industry, where maintaining profitability amid fluctuating market conditions is critical.

Detailed Financial Metrics

The income statement revealed a 40% decrease in earnings from operations to $60.1 million. The balance sheet showed a decrease in product net sales by 13% and services net sales by 5%. Cash flows from operating activities were positive at $78.1 million, indicating effective cash management despite revenue challenges.

| Metric | Q1 2025 | Q1 2024 | Change |

|---|---|---|---|

| Net Sales | $2.1 billion | $2.38 billion | -12% |

| Gross Profit | $406.5 million | $440.9 million | -8% |

| Net Earnings | $7.5 million | $67.0 million | -89% |

| Diluted EPS | $0.22 | $1.74 | -87% |

Analysis and Commentary

Joyce Mullen, President and CEO, commented on the results, stating,

In the first quarter, we delivered Adjusted earnings from operations and Adjusted diluted earnings per share in line with our expectations. We were pleased with the continued hardware momentum, led by commercial and corporate demand, and our gross margin expansion."This commentary underscores the company's strategic focus on hardware and margin management as key drivers of performance.

Overall, Insight Enterprises Inc's Q1 results reflect a challenging environment with declining sales and earnings. However, the company's ability to exceed EPS estimates and manage gross margins effectively provides a positive outlook for value investors. The focus on hardware and operational efficiency will be crucial as the company navigates market uncertainties.

Explore the complete 8-K earnings release (here) from Insight Enterprises Inc for further details.