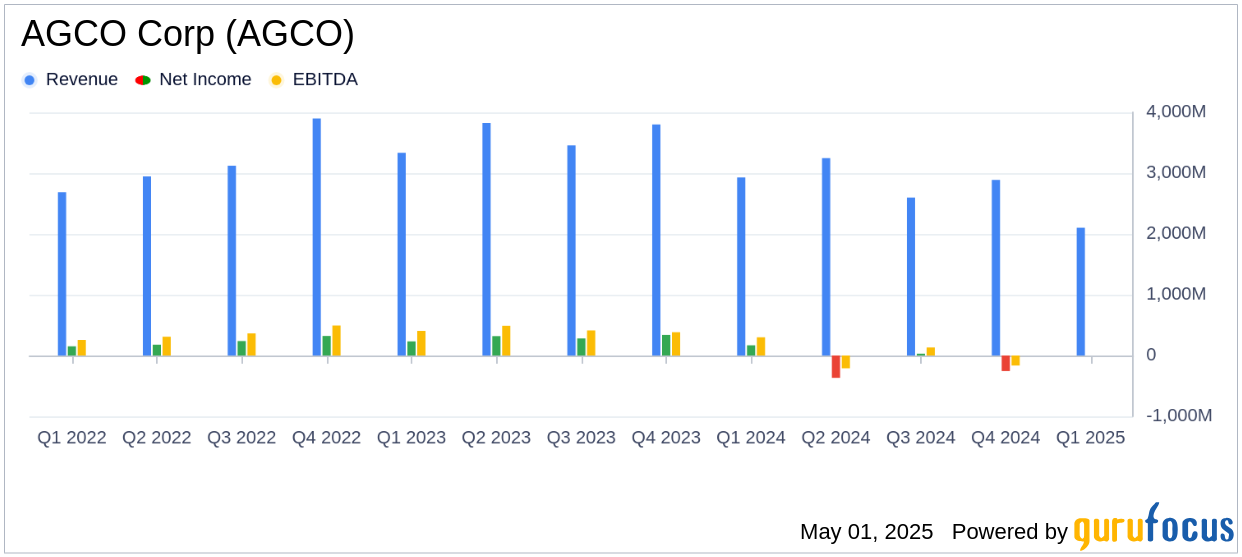

On May 1, 2025, AGCO Corp (AGCO, Financial) released its 8-K filing for the first quarter ended March 31, 2025. The company reported net sales of $2.1 billion, marking a significant 30.0% decrease compared to the same period in 2024. Despite this decline, AGCO achieved a reported earnings per share (EPS) of $0.14 and an adjusted EPS of $0.41, both surpassing the analyst estimate of -$0.09 per share. The company also reaffirmed its full-year guidance.

Company Overview

AGCO Corp (AGCO, Financial) is a global manufacturer of agricultural equipment, known for its prominent brands such as Fendt, Massey Ferguson, and Valtra. The company has been focusing on precision agriculture through its PTx initiative. While AGCO operates globally, its sales are predominantly concentrated in the Europe/Middle East region, accounting for 50%-60% of sales and a larger share of operating profits. The company is actively working to expand its presence in the North and South American markets, leveraging a vast dealer network that spans over 140 countries.

Performance and Challenges

AGCO's first-quarter performance reflects a challenging environment, with net sales declining by 30.0% year-over-year. The decrease was primarily driven by weaker industry demand and global trade uncertainties. The company faced significant sales declines across all regions, with North America experiencing a 34.2% drop and Asia/Pacific/Africa seeing a 36.0% decrease. Despite these challenges, AGCO's cost reduction efforts and inventory management strategies have positioned it to better navigate these uncertainties.

Financial Achievements

AGCO's ability to exceed EPS estimates is a notable achievement, especially in the Farm & Heavy Construction Machinery industry, where market volatility and fluctuating demand are common. The company's focus on cost control and operational efficiency has contributed to its financial resilience. AGCO's adjusted EPS of $0.41 is a testament to its strategic initiatives aimed at maintaining profitability amidst declining sales.

Key Financial Metrics

AGCO's income statement reveals a gross profit of $520.6 million, down from $769.8 million in the previous year. Operating expenses were reduced, with selling, general, and administrative expenses decreasing to $325.8 million. The company's balance sheet shows total assets of $11,480.8 million, with a notable increase in inventories to $2,958.0 million. Cash and cash equivalents stood at $562.6 million, reflecting a decrease from the end of 2024.

| Region | Net Sales (2025) | Net Sales (2024) | % Change |

|---|---|---|---|

| North America | $395.6 million | $601.1 million | (34.2)% |

| South America | $229.9 million | $273.0 million | (15.8)% |

| Europe/Middle East | $1,330.5 million | $1,706.9 million | (22.1)% |

| Asia/Pacific/Africa | $94.5 million | $147.6 million | (36.0)% |

Analysis and Outlook

AGCO's performance in the first quarter underscores the challenges faced by the agricultural equipment industry, including volatile market conditions and trade uncertainties. The company's strategic focus on cost reduction and inventory management has been crucial in mitigating the impact of declining sales. AGCO's reaffirmation of its full-year guidance indicates confidence in its ability to navigate these challenges and capitalize on emerging opportunities in the global market.

“AGCO performed well in the first quarter, which better positions us to navigate global trade uncertainties and continued weak industry demand,” said Eric Hansotia, AGCO’s Chairman, President and Chief Executive Officer.

AGCO's strategic initiatives, including its focus on precision agriculture and expansion in North and South America, are expected to drive future growth. However, the company must remain agile in responding to market dynamics and geopolitical developments that could impact its operations and financial performance.

Explore the complete 8-K earnings release (here) from AGCO Corp for further details.