Arrow Electronics (ARW, Financial) reported impressive financial results for the first quarter, with revenue reaching $6.81 billion, significantly higher than the anticipated $6.32 billion. The company's strong performance was largely attributed to growth in the Europe, Middle East, and Africa (EMEA) regions across all segments. In addition to this geographical momentum, Arrow's value-added services and robust performance in their Enterprise Computing Solutions (ECS) division contributed significantly to the revenue beat.

Sean Kerins, the president and CEO of Arrow, expressed satisfaction with the company's ability to exceed its projected revenue and earnings per share targets. This achievement underscores Arrow’s effective strategies and operational execution in the competitive electronics market.

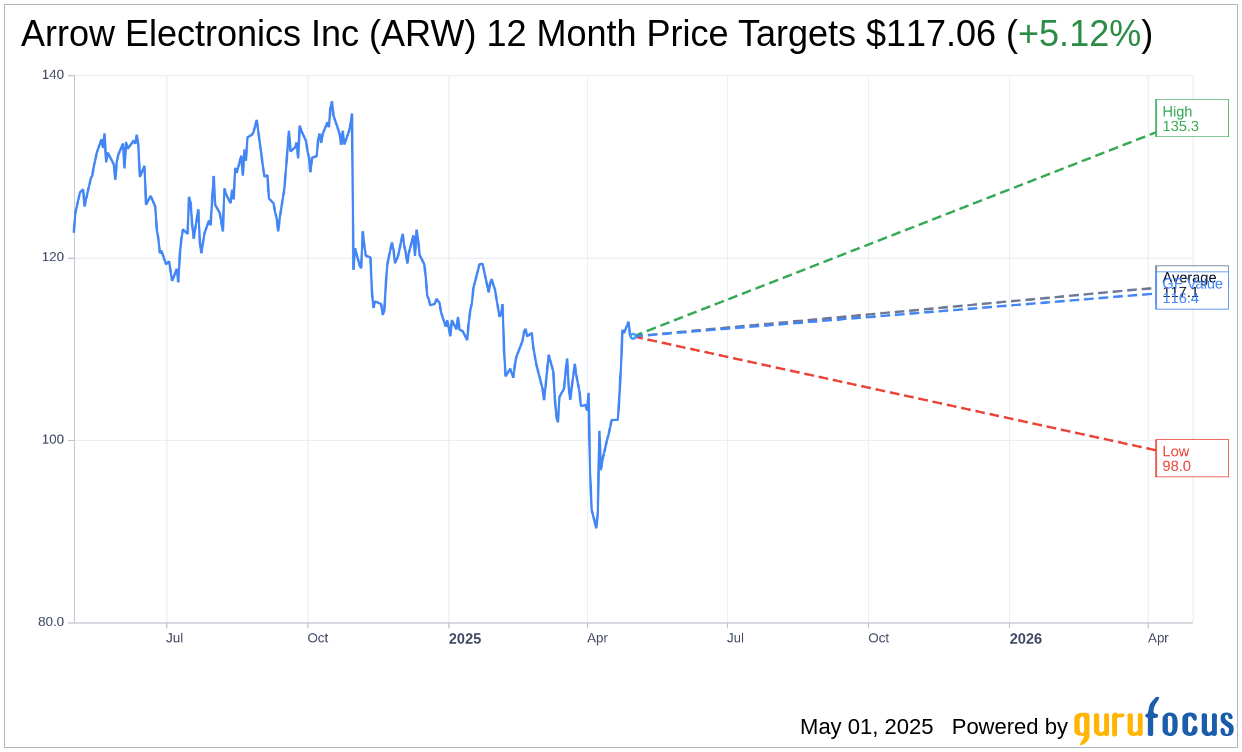

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Arrow Electronics Inc (ARW, Financial) is $117.06 with a high estimate of $135.30 and a low estimate of $98.00. The average target implies an upside of 5.12% from the current price of $111.36. More detailed estimate data can be found on the Arrow Electronics Inc (ARW) Forecast page.

Based on the consensus recommendation from 7 brokerage firms, Arrow Electronics Inc's (ARW, Financial) average brokerage recommendation is currently 3.1, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Arrow Electronics Inc (ARW, Financial) in one year is $116.39, suggesting a upside of 4.52% from the current price of $111.36. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Arrow Electronics Inc (ARW) Summary page.

ARW Key Business Developments

Release Date: February 06, 2025

- Total Sales: $7.3 billion, surpassing the high-end of guided ranges.

- Non-GAAP Earnings Per Share: $2.97, above guided range.

- Global Component Sales: $4.8 billion, down 3% versus prior quarter.

- Enterprise Computing Solutions Sales: $2.5 billion, 12% higher versus prior year.

- Non-GAAP Gross Margin: 11.7%, down 90 basis points year-over-year.

- Global Components Gross Margin: 11.4% (non-GAAP).

- Enterprise Computing Solutions Gross Margin: 12.4% (non-GAAP).

- Non-GAAP Operating Income: $274 million, 3.8% of sales.

- Interest and Other Expense: $60 million.

- Non-GAAP Effective Tax Rate: 24.9%.

- Cash Flow from Operations: $326 million in Q4, $1.1 billion for the full year.

- Inventory: $4.7 billion, reduced by $1.1 billion from peak levels.

- Gross Balance Sheet Debt: $3.1 billion.

- Share Repurchase: $50 million in Q4, $250 million for the full year.

- Q1 Sales Guidance: $5.98 billion to $6.58 billion.

- Q1 Non-GAAP Diluted EPS Guidance: $1.30 to $1.50.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Arrow Electronics Inc (ARW, Financial) exceeded its fourth-quarter sales expectations, generating $7.3 billion in total sales.

- The company achieved a non-GAAP earnings per share of $2.97, surpassing the high-end of its guided range.

- Arrow Electronics Inc (ARW) saw sequential improvement in its industrial markets, particularly in Asia and the Americas.

- The enterprise computing solutions segment delivered year-over-year growth in billings, gross profit, and operating income.

- The company successfully reduced its inventory by $1.1 billion from peak levels, indicating effective inventory management.

Negative Points

- Consolidated sales for the fourth quarter were down 7% compared to the prior year.

- Global component sales decreased by 3% versus the prior quarter.

- The company faced softness in consumer, compute, and communications segments in Asia.

- The automotive sector in the Americas experienced softness, impacting overall performance.

- Arrow Electronics Inc (ARW) anticipates a challenging macro environment in Europe, with sub-seasonal outlooks.