- Howmet Aerospace (HWM, Financial) exceeds earnings predictions with a strong quarterly performance.

- Analyst forecasts indicate a potential downside based on current price levels.

- GF Value suggests significant overvaluation relative to historical metrics.

Howmet Aerospace (HWM) recently unveiled its first-quarter financial results, showcasing a robust performance with adjusted earnings per share at $0.86, outpacing expectations by $0.08. Revenue climbed to $1.94 billion, marking a solid 6.6% increase from the previous year. The company also achieved a commendable $134 million in free cash flow, while providing forward guidance that considers the anticipated impacts of tariffs.

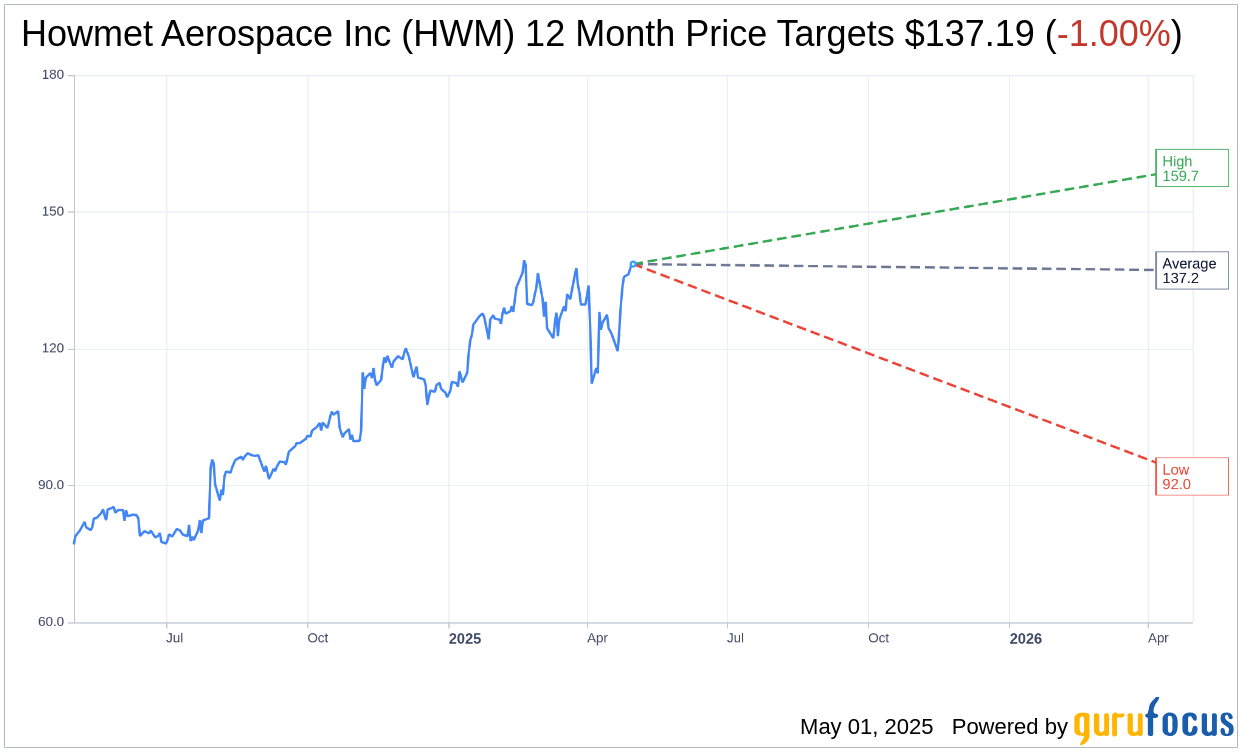

Wall Street Analysts' Forecast

According to projections by 22 analysts, the average price target for Howmet Aerospace Inc (HWM, Financial) stands at $137.19. Expected price targets range from a high of $159.65 to a low of $92.00. Currently priced at $138.58, this average target implies a potential downside of 1.00%. For more granular insights, visit the Howmet Aerospace Inc (HWM) Forecast page.

Brokerage Firm Consensus

The consensus recommendation from 26 brokerage firms rates Howmet Aerospace Inc (HWM, Financial) at an average of 2.0, which equates to an "Outperform" status. This rating uses a scale where 1 represents a Strong Buy and 5 denotes a Sell.

GF Value Assessment

GuruFocus' estimates suggest that the GF Value for Howmet Aerospace Inc (HWM, Financial) in one year is projected at $66.93. This indicates a significant downside of 51.7% from the current price of $138.58. The GF Value is GuruFocus' appraisal of the fair value the stock should command in the market, calculated considering historical trading multiples, past growth, and future performance projections. For a deeper analysis, visit the Howmet Aerospace Inc (HWM) Summary page.