Key Highlights:

- NNN REIT (NNN, Financial) exceeds earnings estimates with a strong Q1 FFO of $0.86.

- Revenue increases by 7.2% year-over-year, reaching $230.85 million.

- Maintains high occupancy rate and sets a 2025 acquisition target of $500-$600 million.

NNN REIT (NNN) has delivered a robust performance in the first quarter, reporting funds from operations (FFO) of $0.86, which surpasses analysts' expectations by $0.04. In an impressive year-over-year growth, the company's revenue soared to $230.85 million, marking a 7.2% increase. These figures underscore NNN REIT's strategic investment of $232.4 million, contributing to its maintained high occupancy rate of 97.7%. Looking ahead, the company aims for a 2025 acquisition target between $500-$600 million, further solidifying its growth trajectory.

Wall Street Analysts Forecast

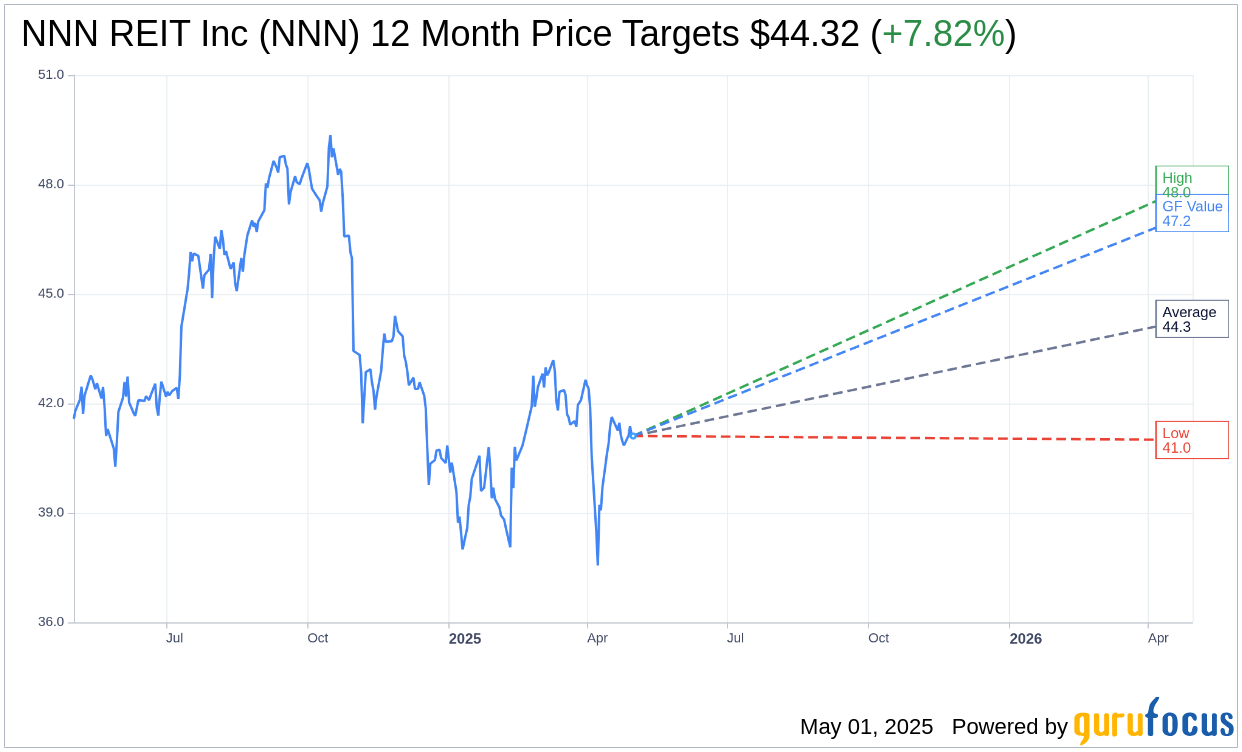

Turning to Wall Street projections, 17 analysts have provided one-year price targets for NNN REIT Inc (NNN, Financial), resulting in an average target price of $44.32. These estimates range from a high of $48.00 to a low of $41.00, suggesting a potential upside of 7.82% from the current share price of $41.11. For a more in-depth analysis, investors can visit the NNN REIT Inc (NNN) Forecast page.

The consensus among 19 brokerage firms positions NNN REIT Inc (NNN, Financial) with an average brokerage recommendation of 2.8, which aligns with a "Hold" status. This rating is based on a scale from 1 to 5, where 1 represents a Strong Buy, and 5 indicates a Sell recommendation.

According to GuruFocus estimates, the calculated GF Value for NNN REIT Inc (NNN, Financial) in one year stands at $47.22. This implies a potential upside of 14.86% from the current price of $41.11. The GF Value is GuruFocus' estimate of the stock's fair trading value, derived from historical trading multiples, past business growth, and future performance projections. For further details, investors can explore the NNN REIT Inc (NNN) Summary page.