Key Takeaways:

- ServiceNow (NOW, Financial) receives an upgrade to 'Buy' from Truist Securities, highlighting its robust platform and AI strengths.

- Analysts forecast potential growth, with an average price target suggesting nearly a 10% upside.

- ServiceNow is positioned for durable growth through IT stack consolidation and product expansion.

ServiceNow Inc. (NOW) experienced a 2.7% increase in premarket trading, following an upgrade from Truist Securities to a Buy rating. The upgrade underscores the company's strong platform and AI capabilities. Analyst Joel Fishbein set a new price target of $1,200, emphasizing the potential for sustained growth via enterprise IT stack consolidation and product expansion.

Wall Street Analysts' Forecast

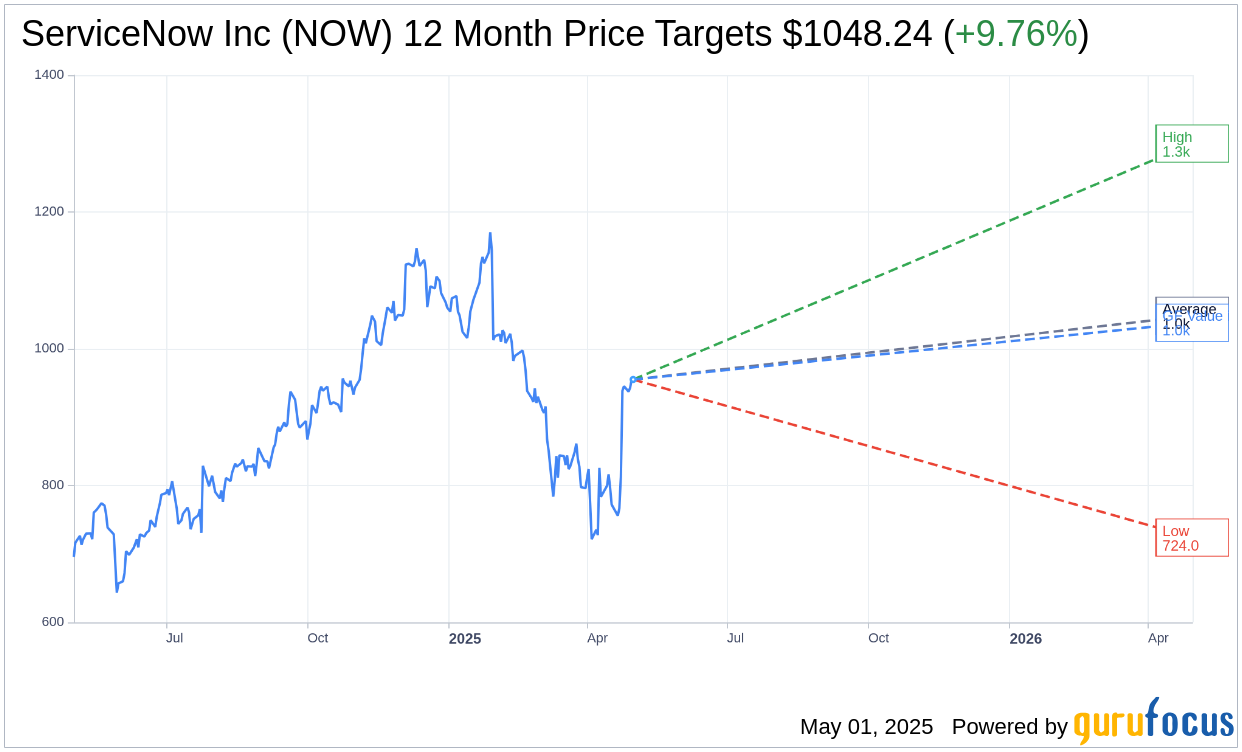

According to projections from 40 analysts, the average price target for ServiceNow Inc (NOW, Financial) over the next year stands at $1,048.24. These forecasts range from a high of $1,300.00 to a low of $724.00. With the current stock price at $955.01, this average target indicates a potential upside of 9.76%. For more detailed forecasts, visit the ServiceNow Inc (NOW) Forecast page.

The consensus recommendation from 47 brokerage firms rates ServiceNow Inc (NOW, Financial) at 1.9, which is an "Outperform" rating. This rating is part of a scale where 1 represents a Strong Buy and 5 signifies a Sell.

In terms of GuruFocus metrics, the estimated GF Value for ServiceNow Inc (NOW, Financial) in the next year is $1,038.12, suggesting an 8.7% increase from the current price of $955.01. The GF Value signifies the fair trading value of the stock, calculated from historical trading multiples, past business growth, and future business performance estimates. For more details, see the ServiceNow Inc (NOW) Summary page.