Cantor Fitzgerald has revised its price target for Udemy (UDMY, Financial), adjusting it from $11 to $9 while maintaining an Overweight rating on the stock. As 2025 kicks off, Udemy is experiencing a promising start with the ongoing CEO transition proceeding seamlessly. The company has outlined a strategic plan to revitalize its operations, according to an analyst's update to investors.

Wall Street Analysts Forecast

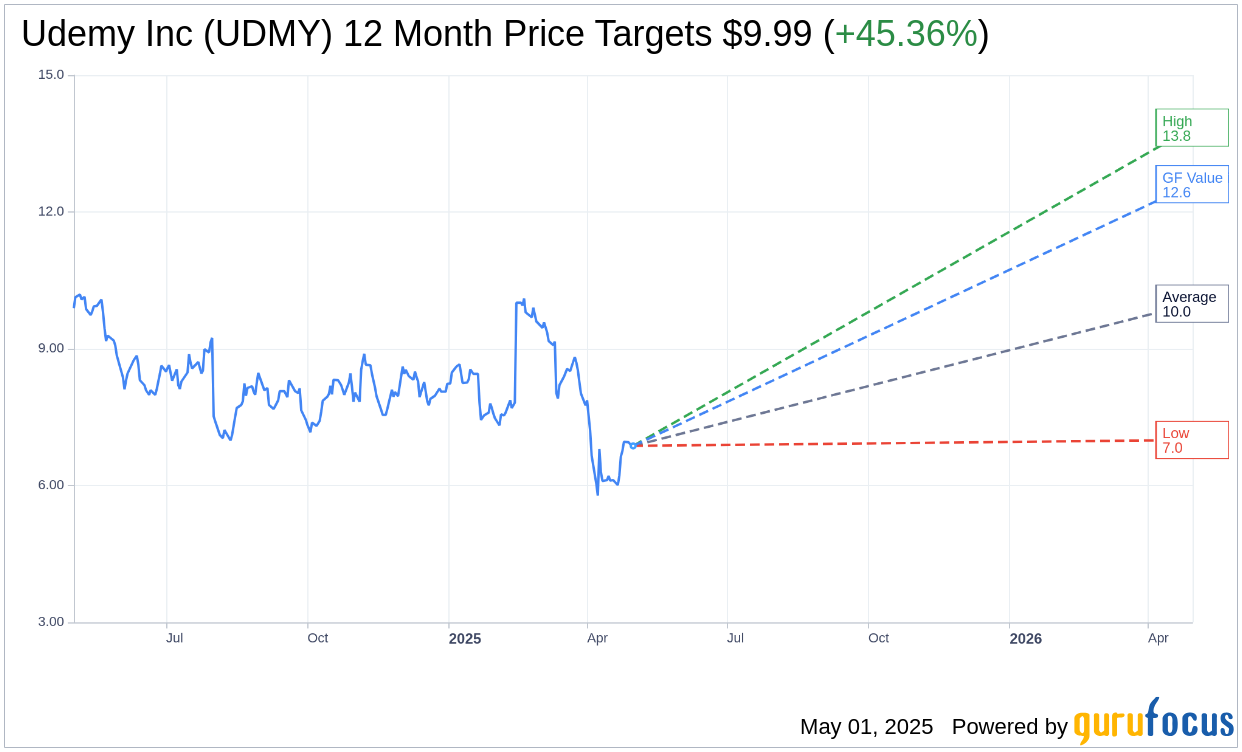

Based on the one-year price targets offered by 11 analysts, the average target price for Udemy Inc (UDMY, Financial) is $9.99 with a high estimate of $13.85 and a low estimate of $7.00. The average target implies an upside of 45.36% from the current price of $6.87. More detailed estimate data can be found on the Udemy Inc (UDMY) Forecast page.

Based on the consensus recommendation from 13 brokerage firms, Udemy Inc's (UDMY, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Udemy Inc (UDMY, Financial) in one year is $12.61, suggesting a upside of 83.55% from the current price of $6.87. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Udemy Inc (UDMY) Summary page.

UDMY Key Business Developments

Release Date: April 30, 2025

- Quarterly Revenue: Surpassed $200 million for the first time.

- Adjusted EBITDA: Exceeded expectations, approximately $21 million or 11% of revenue.

- Udemy Business ARR: $519 million, up 8% year-over-year.

- Udemy Business Revenue: $128 million, an increase of 9% year-over-year.

- Consumer Segment Revenue: $73 million, down 8% year-over-year.

- Gross Margin: Total company gross margin was 65%, a 300 basis point improvement from Q1 2024.

- Net Income: Approximately $18 million.

- Cash and Cash Equivalents: $358 million at the end of the quarter.

- Free Cash Flow: $7 million for the quarter.

- Subscription Revenue: Accounts for 68% of total revenue, a 500 basis point expansion year-over-year.

- Net Dollar Retention: 96% overall, 100% for large customers.

- Q2 Revenue Guidance: Expected to be between $195 million and $199 million.

- Full Year 2025 Revenue Guidance: Expected to be in the range of $772 million to $794 million.

- Full Year 2025 Adjusted EBITDA Guidance: Expected to be $77 million to $87 million, approximately 10% of revenue at the midpoint.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Udemy Inc (UDMY, Financial) exceeded the high end of its guidance for both revenue and adjusted EBITDA in Q1 2025.

- The company is seeing strong customer traction, including a multiyear enterprise-wide expansion deal with a large professional service firm.

- Udemy Inc (UDMY) is focusing on increasing consumer subscriptions, which saw a nearly 40% year-over-year revenue rise in Q1.

- The company is implementing a comprehensive global market activation strategy to enhance its international presence.

- Udemy Inc (UDMY) is leveraging AI to enhance its platform, offering personalized learning experiences and AI-driven learning paths.

Negative Points

- There is increased uncertainty in the market, leading to a more conservative outlook for the second half of the year.

- The company is experiencing pressure on top-line growth due to restructuring and reduced sales capacity.

- Consumer segment performance is softer than expected, impacting overall revenue projections.

- There is a noted decrease in net dollar retention, particularly among large customers, due to changes in the sales organization.

- Udemy Inc (UDMY) faces challenges in effectively marketing and packaging its AI capabilities to fully capture market opportunities.