UBS has increased its price target for FMC (FMC, Financial) from $38 to $41, maintaining a Neutral rating on the stock. According to the analyst, the company's performance in the first half of the year met projections, and attention now shifts to anticipated developments in the second half.

Wall Street Analysts Forecast

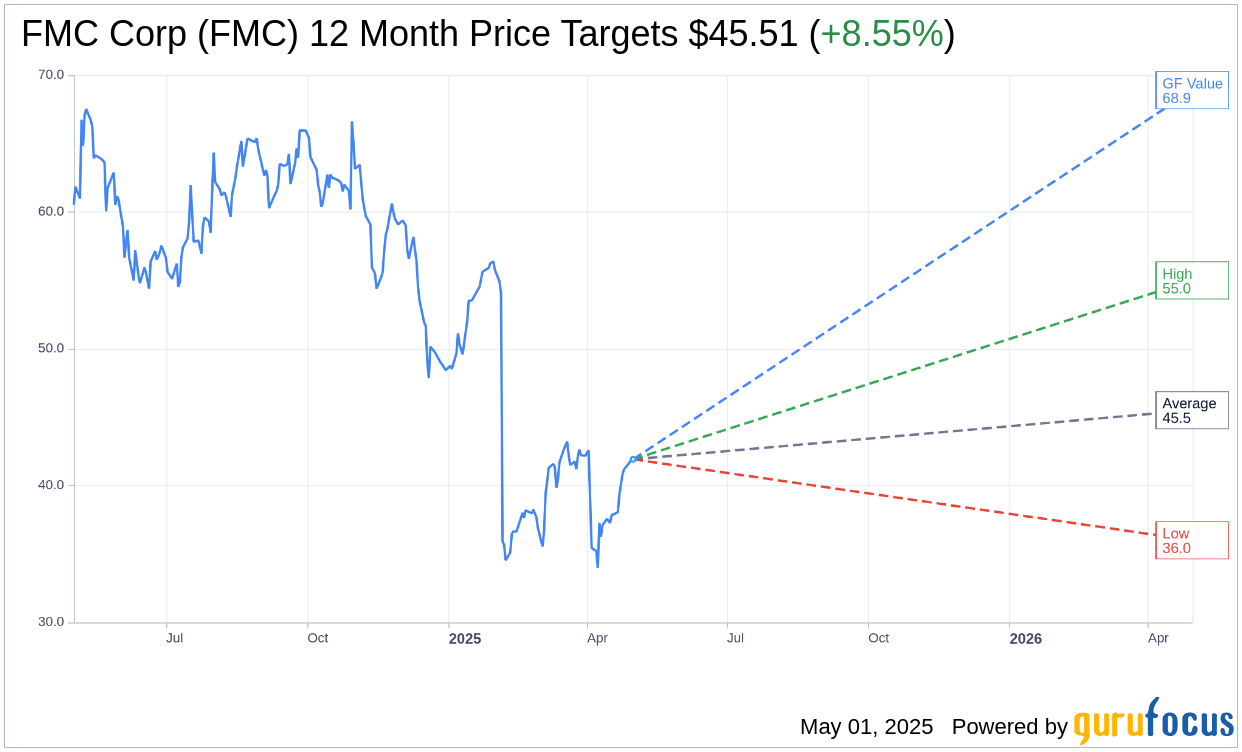

Based on the one-year price targets offered by 18 analysts, the average target price for FMC Corp (FMC, Financial) is $45.51 with a high estimate of $55.00 and a low estimate of $36.00. The average target implies an upside of 8.55% from the current price of $41.92. More detailed estimate data can be found on the FMC Corp (FMC) Forecast page.

Based on the consensus recommendation from 21 brokerage firms, FMC Corp's (FMC, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for FMC Corp (FMC, Financial) in one year is $68.91, suggesting a upside of 64.38% from the current price of $41.92. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the FMC Corp (FMC) Summary page.

FMC Key Business Developments

Release Date: February 04, 2025

- Revenue: $1.22 billion for Q4 2024, a 7% increase versus 2023.

- EBITDA: $339 million for Q4 2024, 33% higher than last year.

- EBITDA Margin: 27.7% for Q4 2024, an all-time Q4 high.

- Full Year 2024 Revenue: Declined 5% compared to the previous year.

- Full Year 2024 EBITDA: Declined 8%, with a margin of 21%.

- 2025 Revenue Guidance: $4.15 billion to $4.35 billion, flat at the midpoint compared to 2024.

- 2025 EBITDA Guidance: $870 million to $950 million, up 1% at the midpoint.

- Adjusted EPS for 2025: Expected to be between $3.26 and $3.70.

- Q1 2025 Revenue Guidance: $750 million to $800 million, a decline of 16% against prior year.

- Q1 2025 EBITDA Guidance: $105 million to $125 million, a decline of 28% at the midpoint.

- Free Cash Flow for 2024: $614 million, an increase of more than $1.1 billion versus the prior year.

- 2025 Free Cash Flow Guidance: $200 million to $400 million, a decrease of $314 million at the midpoint.

- Interest Expense for 2025: Expected to be in the range of $210 million to $230 million.

- Effective Tax Rate for 2025: Anticipated to be in the range of 13% to 15%.

- Gross Debt as of December 31, 2024: Approximately $3.4 billion, down nearly $600 million versus the prior year.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- FMC Corp (FMC, Financial) delivered two strong quarters with earnings above guidance, indicating effective management and strategic execution.

- The company is making significant progress in manufacturing cost reductions, which are critical for future growth plans.

- FMC Corp (FMC) has a well-balanced portfolio with a core portfolio expected to grow at or slightly above market rates and a growth portfolio projected to grow significantly above market rates.

- The introduction of new active ingredients, such as Isoflex and Fluinapi, is expected to drive substantial revenue growth, with sales projected to reach $600 million by 2027.

- The plant health platform is expected to grow at an annual rate in the mid-20% range through 2027, driven by biologicals and pheromones.

Negative Points

- FMC Corp (FMC) faces significant challenges with elevated channel inventories, particularly in regions like Brazil, India, and Eastern Europe.

- The company anticipates a pronounced negative impact on 2025 financial performance due to aggressive actions needed to reposition the business.

- Pricing pressures are expected due to cost-plus contracts with partners and increased competition from generic products, particularly in Asia.

- The restructuring program, while delivering savings, requires substantial investment in expanding sales organizations and exploring new routes to market.

- FMC Corp (FMC) is experiencing a shifting market structure in Latin America, requiring increased investments to adapt to new distribution channels and direct sales approaches.