Science Applications International Corp. (SAIC, Financial) has landed a significant contract worth $55 million with the Space Development Agency (SDA) for the Proliferated Warfighter Space Architecture (PWSA) Tranche 3 Program Integration. This contract, with a performance duration of five years, is slated to commence on May 1, 2025.

The PWSA initiative involves a constellation of space vehicles contributed by various vendors that aim to enhance the Transport, Tracking, and Custody Layers, alongside an integrated ground system. This system is focused on addressing key Department of Defense challenges, particularly in executing precise and rapid kill chains. The Tranche 3 layers are designed to offer global multi-band communication, consistent encrypted connections for military missions, comprehensive missile defense, improved Position, Navigation, and Timing capabilities, and continuous surveillance of critical targets regardless of weather conditions.

Under this new agreement, SAIC (SAIC, Financial) will be responsible for managing enterprise requirements and overseeing schedules, engineering processes, technical assessments, and risk management, thereby tackling the complexities of integrating various space and ground segments along with operational users in the Tranche 3 space layers.

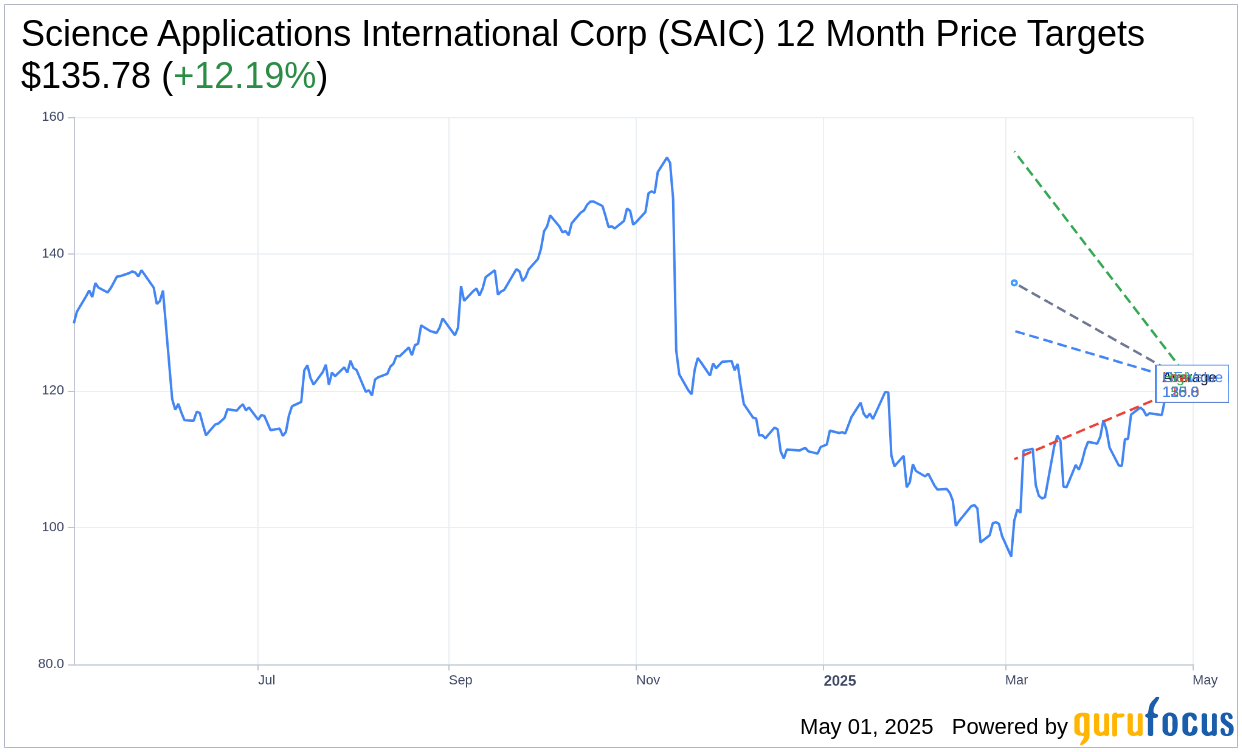

Wall Street Analysts Forecast

Based on the one-year price targets offered by 9 analysts, the average target price for Science Applications International Corp (SAIC, Financial) is $135.78 with a high estimate of $155.00 and a low estimate of $110.00. The average target implies an upside of 12.19% from the current price of $121.03. More detailed estimate data can be found on the Science Applications International Corp (SAIC) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Science Applications International Corp's (SAIC, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Science Applications International Corp (SAIC, Financial) in one year is $128.75, suggesting a upside of 6.38% from the current price of $121.03. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Science Applications International Corp (SAIC) Summary page.

SAIC Key Business Developments

Release Date: March 17, 2025

- Fourth Quarter Revenue: $1.84 billion, a 6% increase year-over-year.

- Full Year Revenue: $7.48 billion, representing 2.1% organic growth.

- Fourth Quarter Adjusted EBITDA: $177 million, with a margin of 9.6%.

- Full Year Adjusted EBITDA: $710 million, with a margin of 9.5%.

- Fourth Quarter Adjusted Diluted EPS: $2.57.

- Full Year Adjusted Diluted EPS: $9.13.

- Fourth Quarter Free Cash Flow: $236 million.

- Full Year Free Cash Flow: $507 million, translating to over $10 per share.

- Net Bookings: $1.3 billion in Q4 and $6.6 billion for FY25, with a book-to-bill ratio of 0.9.

- FY26 Revenue Guidance: $7.6 billion to $7.75 billion, approximately 3% organic growth at the midpoint.

- FY26 EBITDA Margin Guidance: 9.4% to 9.6%.

- FY26 Adjusted Diluted EPS Guidance: $9.10 to $9.30.

- FY26 Free Cash Flow Guidance: $510 million to $530 million, approximately $11 per share.

- Share Repurchase Plan: $350 million to $400 million in FY26 and FY27.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- SAIC reported a 6% year-over-year increase in fourth-quarter revenue, driven by new program wins and on-contract growth.

- The company achieved a full-year revenue of $7.48 billion, representing 2.1% organic growth, which was at the high end of their guidance.

- SAIC's adjusted EBITDA margin for the full year was 9.5%, exceeding guidance by 20 basis points due to strong program performance.

- The company delivered free cash flow of $507 million for the year, translating to over $10 per share, with a target of $11 per share in fiscal year '26.

- SAIC's commercial operating sector revenue increased significantly from less than $1 million in fiscal year '22 to approximately $45 million in fiscal year '25, with a goal of $100 million by fiscal year '28.

Negative Points

- SAIC's book-to-bill ratio was 0.9 for fiscal year '25, indicating challenges in securing new contracts relative to revenue.

- The company faces a roughly $200 million headwind related to low-margin Air Force Cloud One compute and store revenue, which they chose not to bid on.

- SAIC is experiencing procurement delays, which could impact the timing of bookings and revenue recognition.

- The company is preparing for potential revenue pressures due to government efficiency initiatives, which could affect their financial performance.

- SAIC's recompete win rates are not yet at the desired high 80% to 90% range, indicating room for improvement in retaining existing contracts.