Lake Street's analyst Eric Martinuzzi has revised the price target for Extreme Networks (EXTR, Financial), reducing it from $16 to $15 while maintaining a Hold rating on the stock. Despite a satisfactory quarterly performance and guidance, the unchanged FY26 projections and shrinking industry multiples have prompted this adjustment.

Wall Street Analysts Forecast

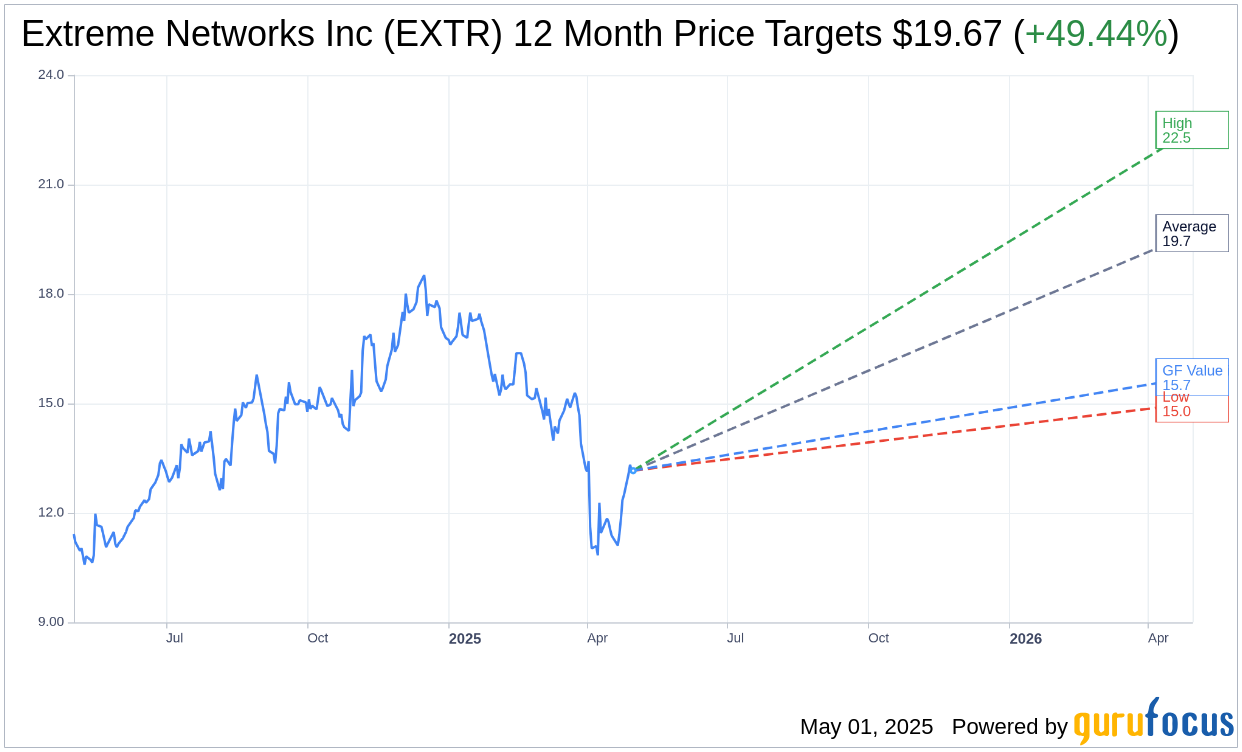

Based on the one-year price targets offered by 6 analysts, the average target price for Extreme Networks Inc (EXTR, Financial) is $19.67 with a high estimate of $22.50 and a low estimate of $15.00. The average target implies an upside of 49.44% from the current price of $13.16. More detailed estimate data can be found on the Extreme Networks Inc (EXTR) Forecast page.

Based on the consensus recommendation from 7 brokerage firms, Extreme Networks Inc's (EXTR, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Extreme Networks Inc (EXTR, Financial) in one year is $15.72, suggesting a upside of 19.45% from the current price of $13.16. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Extreme Networks Inc (EXTR) Summary page.

EXTR Key Business Developments

Release Date: April 30, 2025

- Revenue: $284.5 million, up 35% year over year and 2% sequentially.

- Product Revenue: $178.1 million, up 67% year over year and 3% quarter over quarter.

- Gross Margin: 62.3%, up 470 basis points year over year.

- Earnings Per Share (EPS): $0.21, exceeding the high end of guidance.

- SaaS Annual Recurring Revenue: $184 million, up 13.4% year over year.

- Total Deferred Recurring Revenue: $578 million, up 7% year over year.

- Operating Income: $40 million, representing a 14.1% operating margin.

- Operating Expenses: $137.3 million.

- Operating Cash Flow: $30 million for the quarter.

- Net Cash Position: $3 million as of March 31.

- Guidance for Q4 Revenue: $295 million to $305 million.

- Guidance for Q4 Gross Margin: 61.8% to 62.8%.

- Guidance for Q4 EPS: $0.21 to $0.25.

- Full Year Fiscal '25 Revenue Guidance: $1,128 million to $1,138 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Revenue for the quarter reached $284.5 million, representing a 35% increase year over year, with strong growth in the Americas and EMEA regions.

- Extreme Networks Inc (EXTR, Financial) achieved its best quarter of product bookings in six quarters, with 40 customers generating over $1 million in bookings.

- The company is successfully displacing major competitors like Cisco, HPE, and Juniper due to its differentiated campus fabric solution and flexible licensing.

- SaaS annual recurring revenue grew by 13.4% year over year, reaching $184 million, indicating strong momentum in the subscription business.

- Extreme Networks Inc (EXTR) has improved its financial position, transitioning to a net cash position of $3 million and generating robust operating cash flow of $30 million during the quarter.

Negative Points

- The company faces potential tariff impacts, with an estimated $1.5 million hit to gross margin in the fourth quarter, which could continue into the next fiscal year.

- Gross margin decreased by 110 basis points sequentially, although it was up year over year.

- Operating expenses are expected to increase to a range of $143 million to $145 million in the fourth quarter, partly due to higher commissions and marketing events.

- The federal business remains immaterial, representing a growth opportunity rather than a current revenue driver.

- The data center business, which constitutes 10% to 15% of overall business, may not grow as fast as other segments, as the company's focus is more on campus-oriented solutions.