- Iron Mountain (IRM, Financial) maintains its quarterly dividend of $0.785 per share, translating to a forward yield of 3.49%.

- The company reported robust Q1 earnings, resulting in an upward revision of its 2025 guidance.

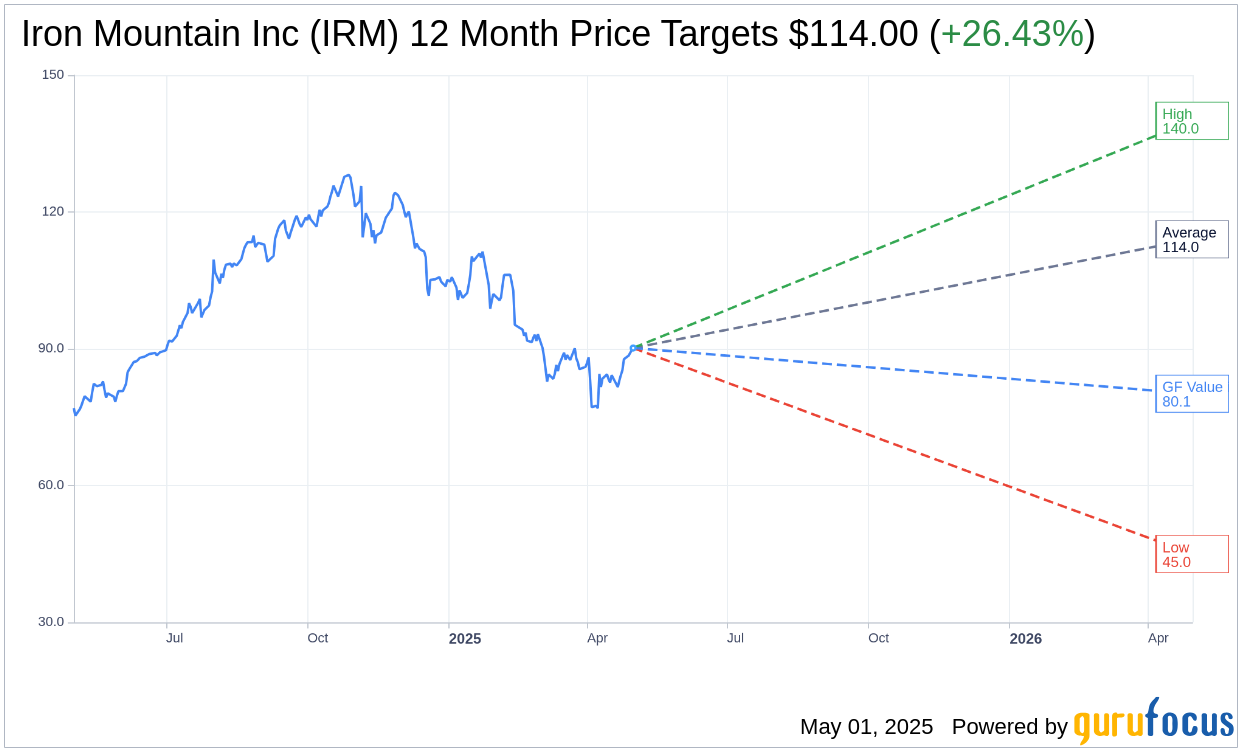

- Analysts see a potential price increase, with a consensus target suggesting a 26.43% upside from the current stock price.

Iron Mountain (IRM) has affirmed its quarterly dividend at $0.785 per share, reflecting a solid forward yield of 3.49%. Shareholders recorded by May 16 can expect the dividend payout on July 3. Following strong Q1 earnings, the company has increased its guidance for 2025, highlighting its growth potential and commitment to returning value to shareholders.

Analyst Price Targets and Recommendations

According to projections from eight analysts, Iron Mountain Inc (IRM, Financial) shows an average target price of $114.00 over the next year, with a high estimate of $140.00 and a low estimate of $45.00. This average target indicates a promising upside potential of 26.43% compared to the current price of $90.17. Investors can access more in-depth estimate information on the Iron Mountain Inc (IRM) Forecast page.

In terms of brokerage recommendations, Iron Mountain Inc (IRM, Financial) holds an average rating of 2.2 from ten brokerage firms, suggesting an "Outperform" status. The rating scale spans from 1 for Strong Buy to 5 for Sell, making IRM an attractive option for potential investors.

Evaluation of GF Value

GuruFocus estimates assign a GF Value of $80.14 to Iron Mountain Inc (IRM, Financial) for the upcoming year, implying a potential downside of 11.12% from its current trading price of $90.17. The GF Value represents GuruFocus' assessment of the fair market value for a stock, determined by its historical trading multiples, past business growth, and future performance estimates. For a more thorough analysis, visit the Iron Mountain Inc (IRM) Summary page.

Also check out: (Free Trial)