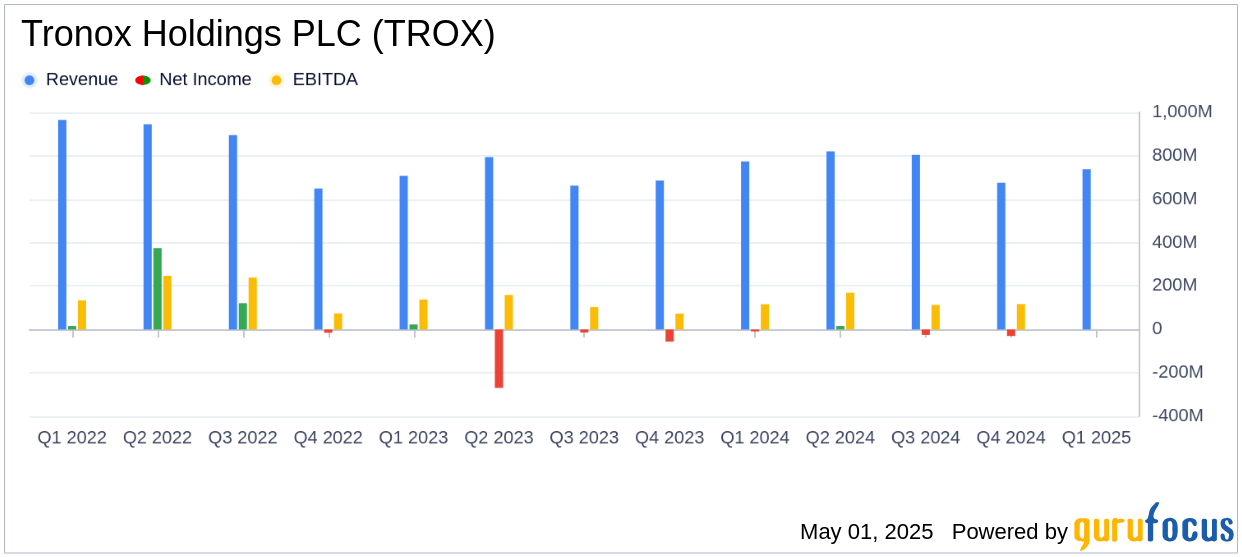

On May 1, 2025, Tronox Holdings PLC (TROX, Financial) released its 8-K filing detailing its financial performance for the first quarter of 2025. The company, a leading vertically integrated manufacturer of titanium dioxide (TiO2) pigment, reported a revenue of $738 million, falling short of the analyst estimate of $748.76 million. The GAAP diluted loss per share was $0.70, significantly below the estimated earnings per share of -0.02.

Company Overview

Tronox Holdings PLC is a prominent player in the chemicals industry, specializing in the production of TiO2 pigment. The company operates titanium-bearing mineral sand mines and beneficiation and smelting operations in Australia and South Africa. These operations produce feedstock materials that are processed into TiO2 for various applications, including paints, coatings, plastics, paper, and printing ink. Tronox has three pigment production facilities in the United States, the Netherlands, and Western Australia, along with three mining operations in Western Australia and South Africa. The majority of its revenue is generated from the Europe, Middle East, and Africa regions.

Financial Performance and Challenges

Tronox Holdings PLC reported a net loss of $111 million for the first quarter, which includes $87 million in restructuring and other charges related to the idling of the Botlek pigment plant. The adjusted net loss was $24 million, or $0.15 per diluted share. The company's revenue of $738 million represents a 9% increase compared to the previous quarter but a 5% decrease compared to the same period last year. This decline was primarily driven by lower zircon sales volumes and reduced average selling prices for zircon and TiO2.

Key Financial Achievements

Despite the challenges, Tronox achieved an adjusted EBITDA of $112 million, with an adjusted EBITDA margin of 15.2%. The company maintained its guidance for 2025, expecting revenue between $3.0 billion and $3.4 billion and adjusted EBITDA between $525 million and $625 million. Tronox's strategic actions, including the idling of the Botlek plant, are anticipated to improve free cash flow and result in cost improvements from 2026 onwards.

Income Statement and Balance Sheet Highlights

Tronox's revenue from TiO2 sales was $584 million, a 3% decline year-over-year, while zircon revenue decreased by 22% to $69 million. The company's selling, general, and administrative expenses were reduced by 6% to $74 million. Tronox ended the quarter with $3.0 billion in total debt and $2.8 billion in net debt, with a net leverage ratio of 5.2x. Available liquidity totaled $443 million, including $138 million in cash and cash equivalents.

CEO's Commentary

Chief Executive Officer John D. Romano commented, “Tronox realized stronger than normal seasonable demand uplift in TiO2, sequentially. Europe led this growth bolstered by the finalization of anti-dumping duties in January, with sales volumes recovering to levels not seen since Q2 2021. Despite increased competitive dynamics across all products, pricing for the quarter came in as anticipated. Our production costs in the first quarter were higher than expected, primarily due to lower operating rates at Botlek and increases in direct material prices. Our focus on cost reduction drove SG&A lower in the quarter.”

Analysis and Outlook

Tronox Holdings PLC faces significant challenges, including competitive pressures and higher production costs. However, the company's strategic initiatives, such as cost reduction programs and the idling of the Botlek plant, are expected to enhance operational efficiency and improve cash flow. The company's focus on maintaining its vertical integration cost advantage and completing key capital projects in South Africa is crucial for sustaining its market position. As Tronox navigates macroeconomic uncertainties, its commitment to operational efficiency and strategic actions is vital for creating sustainable value for stakeholders.

Explore the complete 8-K earnings release (here) from Tronox Holdings PLC for further details.