Scotiabank's analyst Meny Grauman has revised the price target for Sun Life Financial (SLF, Financial), reducing it from C$94 to C$90. Despite this adjustment, Grauman continues to rate the company's shares as Outperform, indicating a positive outlook for SLF.

Wall Street Analysts Forecast

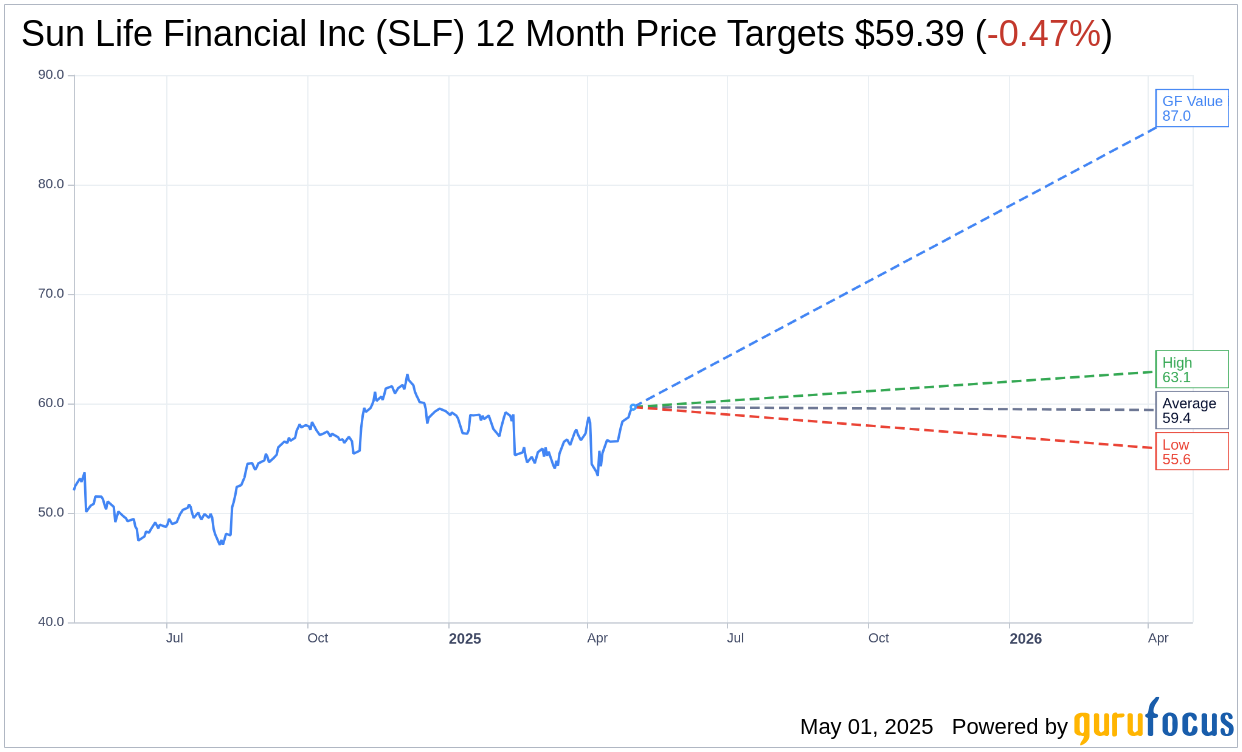

Based on the one-year price targets offered by 2 analysts, the average target price for Sun Life Financial Inc (SLF, Financial) is $59.39 with a high estimate of $63.13 and a low estimate of $55.65. The average target implies an downside of 0.47% from the current price of $59.67. More detailed estimate data can be found on the Sun Life Financial Inc (SLF) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Sun Life Financial Inc's (SLF, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Sun Life Financial Inc (SLF, Financial) in one year is $86.99, suggesting a upside of 45.79% from the current price of $59.67. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Sun Life Financial Inc (SLF) Summary page.

SLF Key Business Developments

Release Date: February 13, 2025

- Underlying Net Income: $965 million for Q4 2024, down 2% year over year; $3.9 billion for the full year, up 3% year over year.

- Underlying Earnings Per Share: $1.68 for Q4 2024, flat year over year; $6.66 for the full year, up 5% year over year.

- Underlying Return on Equity (ROE): 16.5% for Q4 2024; 17.2% for the full year.

- LICAT Ratio: 152% at SLF, indicating a strong capital position.

- Total Assets Under Management (AUM): $1.54 trillion, a new milestone.

- Group Benefits Revenue (Canada): Up 11% year over year.

- Group Benefits Revenue (US): Up 6% year over year.

- Individual Protection Sales (Asia): Up, driven by strong sales in Asia.

- Wealth Sales and Asset Management Gross Flows: Up 33%.

- MFS Assets Under Management: $606 billion, up 1% year over year.

- SLC Management Capital Raising: Record $10 billion for Q4 2024; $24 billion for the full year.

- Book Value Per Share: Increased by 11% year over year.

- Employee Engagement Index: Average score of 88%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Sun Life Financial Inc (SLF, Financial) reported strong capital raising in asset management, with SLC Management achieving a record $10 billion in the quarter.

- The company maintained a robust capital position with a LICAT ratio of 152%, allowing for continued share buybacks.

- Sun Life Financial Inc (SLF) saw significant growth in Asia, with underlying net income up 17% year over year, driven by strong protection sales.

- The company's digital initiatives, such as virtual care services in Canada and the Advisor Buddy tool in the Philippines, demonstrate a commitment to innovation and client impact.

- Sun Life Financial Inc (SLF) achieved record underlying net income in Canada, supported by solid results across all business segments.

Negative Points

- The US segment experienced lower results due to adverse morbidity experience in the medical stop-loss business, driven by higher claims severity.

- Reported net income was significantly impacted by market-related factors and one-time items, including a tax-related loss and an impairment charge in Vietnam.

- Group protection sales were down, reflecting fewer large cases and pricing discipline, leading to a decline in group sales.

- The company faced challenges in the US dental business, with a one-time provision for administrative services only clients.

- MFS experienced net outflows due to large institutional mandate redemptions and retail outflows, reflecting a preference for high-growth tech stocks and interest-bearing products.