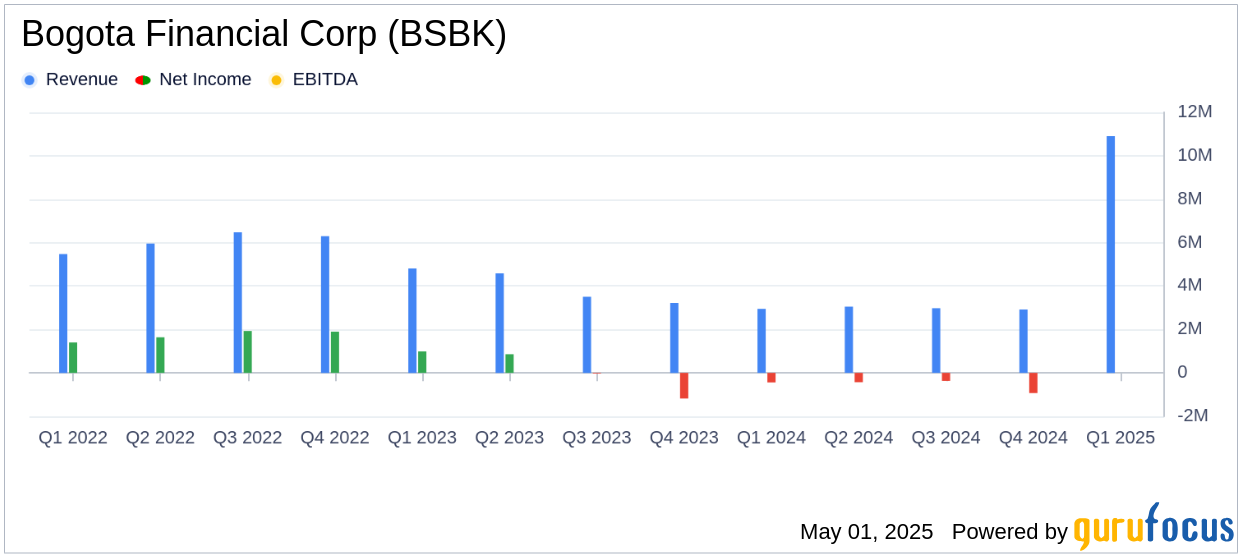

Bogota Financial Corp (BSBK, Financial) released its 8-K filing on April 30, 2025, reporting a significant turnaround in its financial performance for the first quarter ended March 31, 2025. The New Jersey-based bank, which offers a range of personal and business banking services, reported a net income of $731,000, or $0.06 per share, compared to a net loss of $441,000, or $0.03 per share, in the same period last year.

Performance and Challenges

The improvement in net income was primarily driven by a $942,000 increase in net interest income, attributed to a decrease in deposit costs and higher yields on loans and securities. Additionally, a one-time death benefit accrual of approximately $543,000 from a bank-owned life insurance policy contributed to the positive results. However, the company faced challenges with a decrease in total assets, which fell by $41.3 million, or 4.3%, to $930.2 million due to reductions in cash, loans, and securities.

Financial Achievements

Bogota Financial Corp's strategic restructuring at the end of 2024 has shown immediate benefits, as reflected in the financials. The bank's net interest margin increased by 48 basis points to 1.66%, and the net interest rate spread improved by 44 basis points to 1.12%. These metrics are crucial for banks as they indicate the profitability of lending activities relative to the cost of funds.

Income Statement Highlights

Interest income rose by $862,000, or 8.6%, to $10.9 million, driven by higher yields on interest-earning assets despite a decrease in their volume. Non-interest income surged by $590,000, or 197.4%, to $889,000, largely due to the aforementioned life insurance benefit. However, non-interest expenses increased by $217,000, primarily due to higher occupancy and equipment costs following a sale-leaseback transaction.

Balance Sheet and Cash Flow

The bank's balance sheet showed a decrease in cash and cash equivalents by $26.6 million, or 51.0%, as excess funds were used to pay down borrowings. Net loans decreased by $10.2 million, reflecting reduced demand for residential and construction loans. Total deposits fell by $9.2 million, with a notable decrease in certificates of deposit, although this was partially offset by increases in NOW and savings accounts.

CEO Commentary

Kevin Pace, President and CEO, stated, "We continue to have a positive outlook on achieving the long-term goals we have set. We have also experienced immediate improvements from the balance sheet restructuring completed at the end of 2024. The current market turmoil has created uncertainty around rates. We remain very mindful of this as we project our growth and look to improve our net interest margin."

Analysis and Outlook

Bogota Financial Corp's strategic initiatives and focus on improving net interest margins have yielded positive results in the first quarter of 2025. The bank's ability to navigate market challenges and enhance its financial metrics is a positive sign for value investors. However, the decrease in total assets and deposits highlights ongoing challenges in the current economic environment. The company's focus on credit quality and asset diversification remains a priority as it seeks to sustain growth and profitability.

Explore the complete 8-K earnings release (here) from Bogota Financial Corp for further details.