- Apollo Global Management has successfully raised over $10 billion across two funds.

- Analysts forecast a promising price target, suggesting a notable upside.

- GuruFocus metrics indicate a potential downside based on their GF Value estimate.

Apollo Global Management's Remarkable Fundraising Achievement

Apollo Global Management (NYSE: APO) has recently marked a significant milestone by completing two major fundraising rounds. The Accord+ Fund II attracted an impressive $4.8 billion dedicated to high-conviction credit investments. Additionally, the Apollo S3 Equity and Hybrid Solutions Fund I exceeded expectations by securing $5.4 billion.

Wall Street Analysts Forecast: A Bullish Outlook

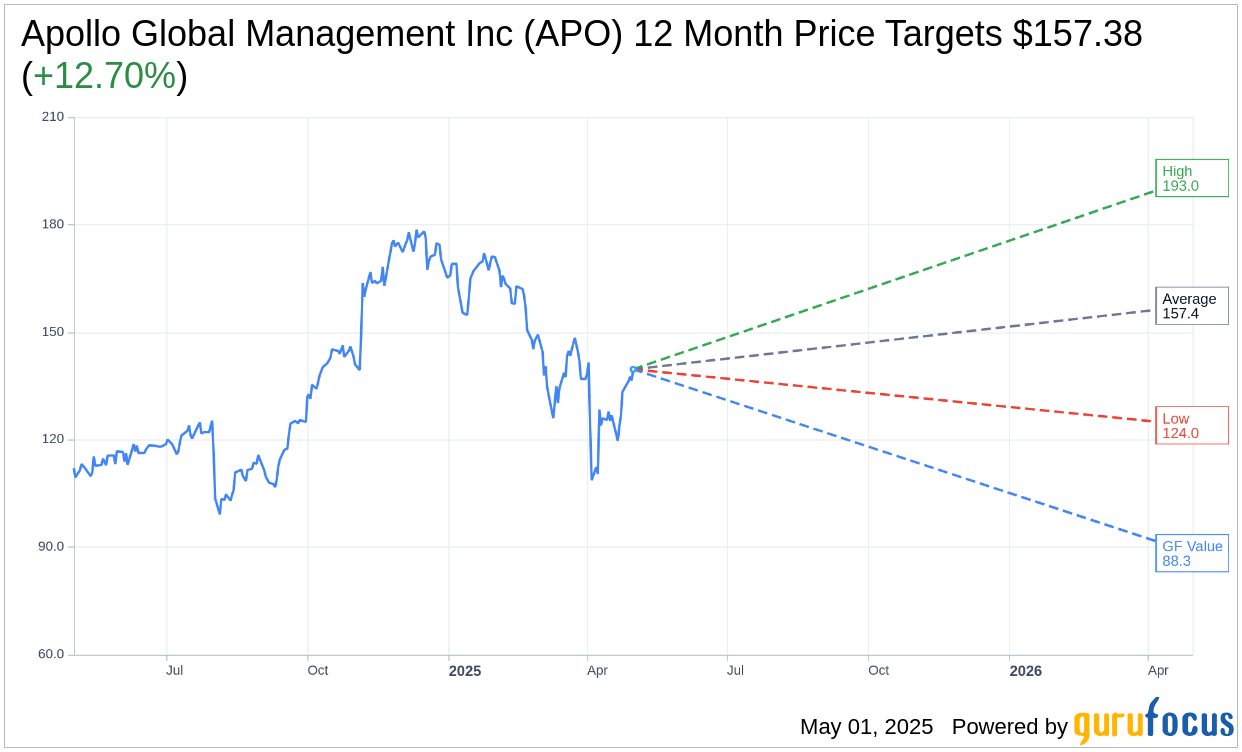

In a survey of 16 analysts, the one-year price targets for Apollo Global Management Inc (APO, Financial) reveal an average estimate of $157.38, with a ceiling of $193.00 and a floor of $124.00. This average forecast suggests a potential upside of 12.70% from the current trading price of $139.64. For more in-depth analysis, visit the Apollo Global Management Inc (APO) Forecast page.

Brokerage Firms' Consensus and Recommendations

The consensus among 21 brokerage firms positions Apollo Global Management Inc (APO, Financial) with an average brokerage recommendation of 2.0, which translates to an "Outperform" status. This recommendation scale extends from 1, indicating a 'Strong Buy,' to 5, suggesting 'Sell.'

GuruFocus Insights: A Closer Look at GF Value

According to GuruFocus estimates, the one-year GF Value for Apollo Global Management Inc (APO, Financial) stands at $88.32. This valuation implies a potential downside of 36.75% from its current price of $139.64. The GF Value is a GuruFocus proprietary metric, calculated using historical trading multiples, past business growth, and future performance projections. For comprehensive insights, refer to the Apollo Global Management Inc (APO) Summary page.