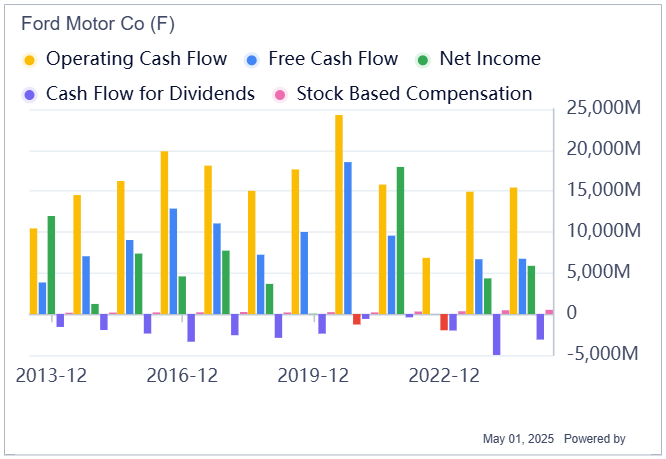

Ford (F, Financial) is hitting turbulence—and fast. While the automaker touts its status as a top U.S. producer and net exporter, a closer look under the hood tells a different story. Free cash flow has been negative for over a decade, meaning Ford has consistently spent more than it brings in after capex. The chart confirms the trend: operating cash flow remains solid, but free cash flow lags, and net income is anything but stable. Add in aggressive dividend payouts and rising stock-based compensation, and it's clear Ford is stretching its capital thin in all directions.

Trump's new executive order offers short-term breathing room by cutting back on “stacked” tariffs, but the 25% levy on auto parts is still set to hit by May 3. CEO Jim Farley didn't mince words—Ford has zero financial cushion to absorb that blow in its 2025 forecast. And while domestic final assembly will qualify for partial tariff reimbursements, the company's heavy dependence on cross-border supply chains (especially with Mexico) puts it in the line of fire. Analysts are already pulling back, downgrading the stock on fears that tariff costs, EV losses, and a slowing global auto cycle could compress margins further.

In short: Ford's playing defense, and the scoreboard's not in its favor. With ballooning costs, shaky profitability, and no free cash flow safety net, investors face a stark decision. Ride out the volatility—or shift gears before the next pothole hits.