Highlights:

- MYR Group reported a 2.2% revenue growth in Q1, outperforming Wall Street expectations.

- GAAP earnings per share reached $1.45, exceeding consensus estimates by 23.5%.

- Analysts suggest a slight potential downside based on current price targets.

MYR Group Inc. (MYRG, Financial) has showcased impressive financial results for the first quarter, with revenue climbing by 2.2% year-over-year to a notable $833.6 million. The company also reported GAAP earnings of $1.45 per share, a significant 23.5% above analyst expectations, underscoring MYR Group's robust financial health and strategic execution.

Wall Street Analysts Forecast

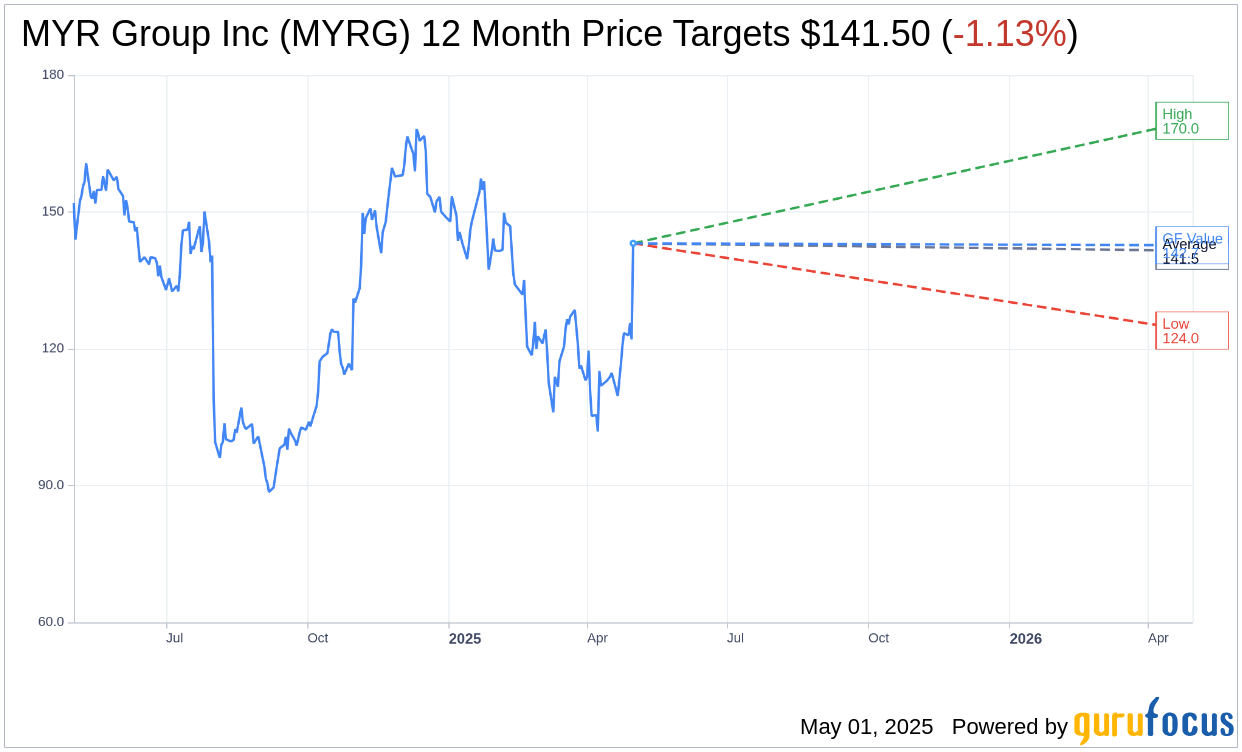

Examining the insights from six analysts, the average price target for MYR Group Inc. (MYRG, Financial) over the next year stands at $141.50, with projections ranging from a high of $170.00 to a low of $124.00. This average target indicates a modest downside of 1.13% from the current trading price of $143.12. Investors can explore more detailed predictions on the MYR Group Inc (MYRG) Forecast page.

The current brokerage consensus places MYR Group Inc. (MYRG, Financial) at an average recommendation of 1.7, which translates to an "Outperform" rating. This rating is based on a scale where 1 is a Strong Buy and 5 is a Sell, demonstrating confidence in the company's potential to exceed overall market performance.

According to GuruFocus' proprietary metrics, MYR Group Inc (MYRG, Financial) has an estimated GF Value of $142.70 within one year, indicating a marginal downside of 0.29% relative to the current price of $143.12. The GF Value is derived from historical trading multiples, past growth trends, and expected future performance. More comprehensive data is available on the MYR Group Inc (MYRG) Summary page.