- Uber Technologies teams up with May Mobility to launch self-driving cars in Arlington, Texas by 2025.

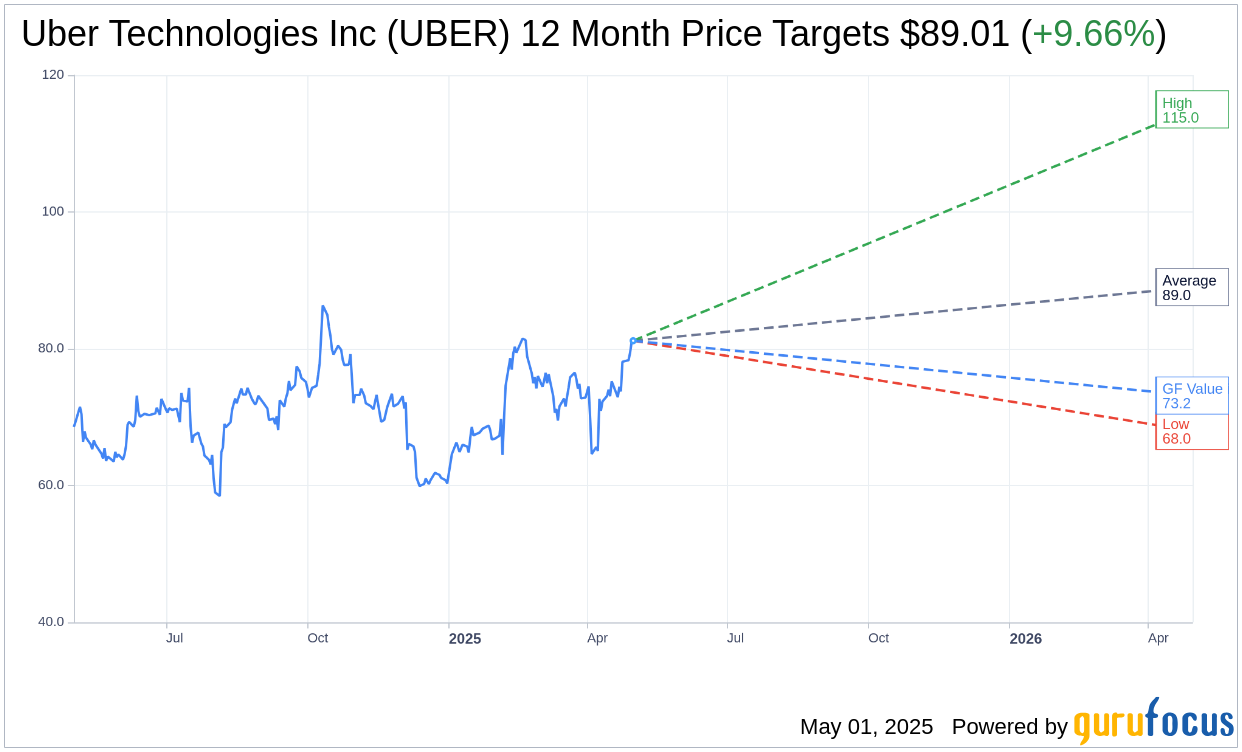

- Analysts project a notable upside potential for Uber stock, with price targets as high as $115.00.

- Current market estimates suggest Uber's fair value may see a slight decrease.

Uber Technologies (UBER, Financial) is accelerating its innovation by partnering with May Mobility, aiming to integrate cutting-edge autonomous vehicles into its ride-hailing service. This forward-thinking collaboration will debut in Arlington, Texas, by late 2025, with an expansion planned for additional U.S. markets in 2026. Uber's move underscores its commitment to enhancing customer experience with AI-driven vehicles.

Wall Street Analysts' Forecast

Wall Street's sentiment about Uber Technologies Inc (UBER, Financial) reflects optimism, with 41 analysts suggesting an average price target of $89.01. High-end estimates reach $115.00, while the low sits at $68.00, indicating a potential upside of 9.66% from the current stock price of $81.17. For further details, visit the Uber Technologies Inc (UBER) Forecast page.

Brokerage Firms' Recommendations

The consensus from 53 brokerage firms places Uber Technologies Inc (UBER, Financial) with an average rating of 1.9, translating to an "Outperform" recommendation. This rating operates on a 1-to-5 scale, where 1 represents a Strong Buy and 5 indicates a Sell, highlighting the positive outlook that analysts currently hold for Uber.

GuruFocus Valuation Insights

According to GuruFocus estimates, the projected GF Value for Uber Technologies Inc (UBER, Financial) in one year is $73.16. This valuation suggests a potential downside of 9.86% from the present price of $81.165. The GF Value encapsulates an estimate of what the stock's fair trading value should be, calculated by considering historical trading multiples, past business growth, and future performance projections. More in-depth information can be explored on the Uber Technologies Inc (UBER) Summary page.