- Universal Display Corp (OLED, Financial) faces a projected 5.8% decline in revenue.

- Analysts provide a price target of $172.44, suggesting a potential 19.24% upside.

- Current "Outperform" rating with a GF Value suggesting a 21.56% upside.

Universal Display Corp (OLED) is poised to release its latest earnings report, with analysts forecasting a 5.8% reduction in revenue, bringing the expected figure to $155.6 million compared to the previous year. While the company has recently exceeded revenue expectations, it has not met earnings per share forecasts, resulting in a decline in share prices.

Wall Street Analysts' Price Projections

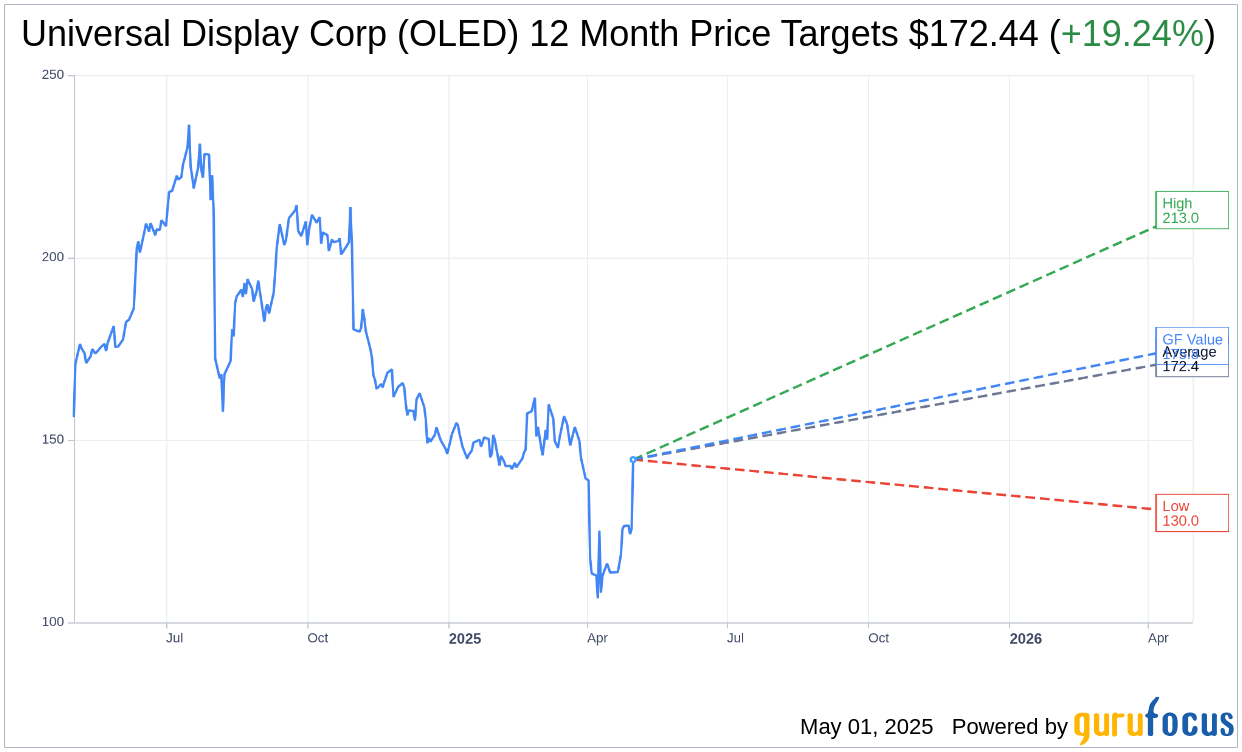

Wall Street's expectations for Universal Display Corp are clear. Among 11 analysts covering the stock, the consensus one-year price target averages $172.44. This target includes a high estimate of $213.00 and a low of $130.00. Currently trading at $144.62, this average target suggests a significant potential upside of 19.24%. Investors can explore more detailed estimates on the Universal Display Corp (OLED, Financial) Forecast page.

Brokerage Recommendations and GF Value Assessment

With 12 brokerage firms weighing in, Universal Display Corp carries an average brokerage recommendation of 2.2, aligning it with an "Outperform" stance. This rating is part of a scale from 1 to 5, where 1 is a Strong Buy and 5 is a Sell.

Further supporting the investment thesis, GuruFocus estimates the GF Value of Universal Display Corp to be $175.80 within the next year, which represents a 21.56% increase from the current trading price of $144.62. The GF Value is derived from historical trading multiples, the company's past growth, and predictions about its future performance. Additional insights are available on the Universal Display Corp (OLED, Financial) Summary page.