VICI Properties (VICI, Financial) is making strategic financial moves with the announcement of a significant partnership and updated financial forecasts.

- Announced a $510 million loan with Red Rock Resorts for a California tribal casino.

- Increased 2025 AFFO guidance due to strong dividend yields.

- Analysts predict a potential 14.37% upside in stock price.

Strengthening Financial Position

VICI Properties Inc. has bolstered its financial health through a new strategic partnership with Red Rock Resorts, which involves a substantial $510 million loan for a tribal casino project in California. This venture underscores VICI's commitment to enhancing its investment portfolio and optimizing operational efficiencies. Additionally, the company has raised its guidance for adjusted funds from operations (AFFO) for 2025, citing strong dividend yields as a key contributing factor.

Wall Street Outlook

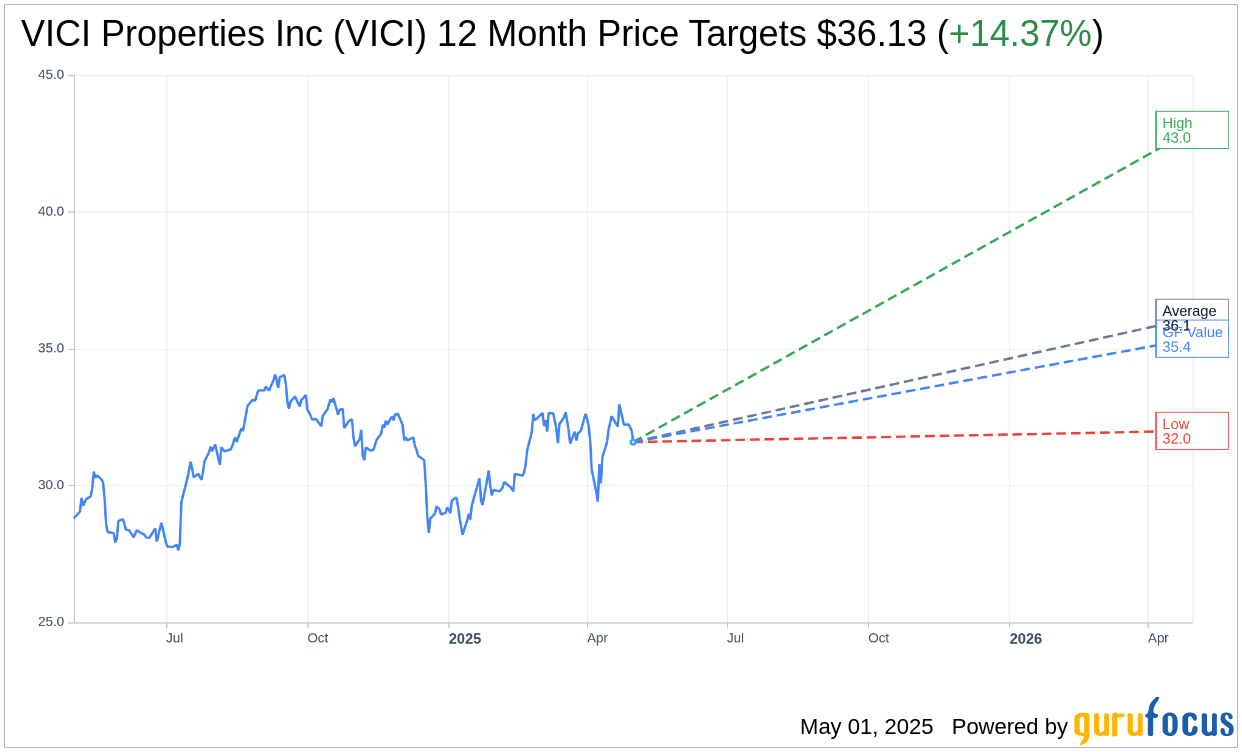

According to 22 analysts, VICI Properties Inc. is projected to reach an average target price of $36.13 over the next year, with estimates ranging from $32.00 to $43.00. This forecast suggests a potential upside of 14.37% from its current trading price of $31.59. For more in-depth information, investors can visit the VICI Properties Inc (VICI, Financial) Forecast page.

Analyst Recommendations

The consensus among 25 brokerage firms positions VICI Properties Inc. with an average recommendation rating of 1.8, indicating an "Outperform" status. This rating is derived from a scale where 1 represents a Strong Buy, and 5 suggests a Sell. Investors might find these insights valuable when considering stock performance and market positioning.

Assessing GF Value

The estimated GF Value for VICI Properties Inc. in one year is pegged at $35.37, hinting at an 11.98% upside from its current price of $31.585. GuruFocus' GF Value is determined by analyzing historical multiples, past business growth, and future performance projections. Detailed data and insights are available on the VICI Properties Inc (VICI, Financial) Summary page.