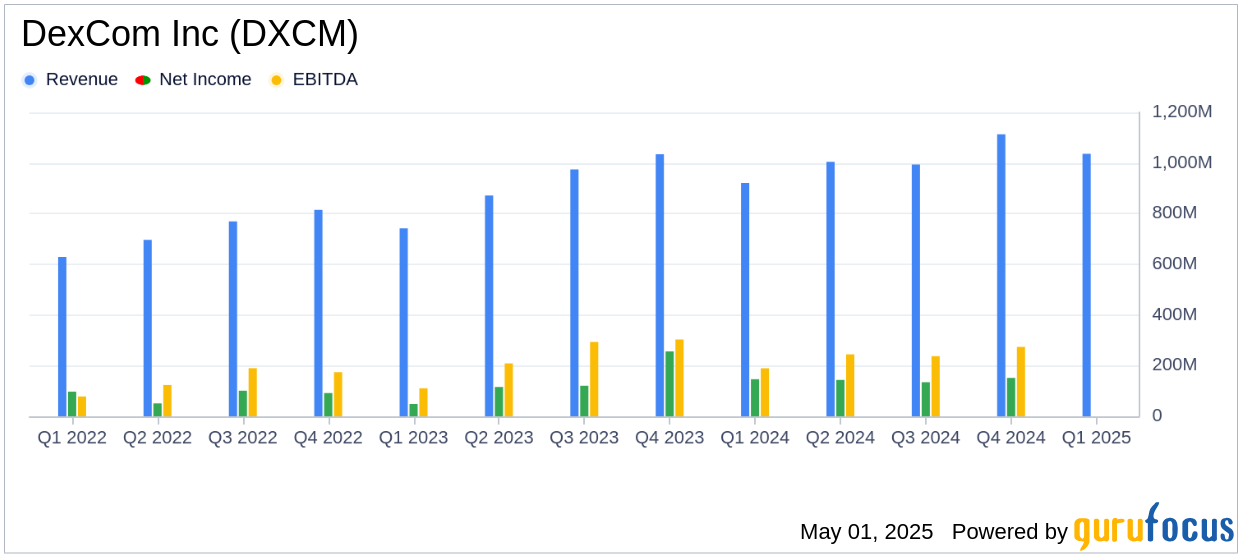

On May 1, 2025, DexCom Inc (DXCM, Financial) released its 8-K filing detailing its financial performance for the first quarter of 2025. DexCom, a leader in continuous glucose monitoring (CGM) systems, reported a 12% year-over-year increase in revenue, reaching $1.036 billion, surpassing the analyst estimate of $1.01738 billion. However, the company's GAAP diluted earnings per share (EPS) of $0.27 fell short of the estimated $0.31.

Company Overview

DexCom Inc (DXCM, Financial) specializes in designing and commercializing continuous glucose monitoring systems for diabetic patients. These systems offer an alternative to traditional blood glucose meters and are integrated with insulin pumps from Insulet and Tandem for automatic insulin delivery.

Performance and Strategic Highlights

DexCom's revenue growth was driven by a 15% increase in U.S. revenue and a 7% rise in international revenue. The company also achieved broader coverage in the U.S. with two of the three largest pharmacy benefit managers (PBMs) now covering Dexcom CGM for all diabetes patients. Additionally, DexCom expanded its distribution footprint by launching on Amazon and received FDA clearance for its Dexcom G7 15 Day System shortly after the quarter ended.

Financial Achievements and Challenges

The company's GAAP operating income increased to $133.7 million, representing 12.9% of revenue, up from 11.0% in the previous year. However, the non-GAAP operating income margin decreased by 140 basis points to 13.8%. Despite these achievements, DexCom faced challenges with its gross profit margin, which declined to 56.9% from 61.0% a year earlier, primarily due to incremental costs related to supply dynamics.

Key Financial Metrics

DexCom's net income for the quarter was $105.4 million, or $0.27 per diluted share, compared to $146.4 million, or $0.36 per diluted share, in the first quarter of 2024. The non-GAAP net income was $127.7 million, or $0.32 per diluted share, consistent with the previous year's $0.32 per share.

| Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Revenue | $1.036 billion | $921.0 million |

| GAAP Net Income | $105.4 million | $146.4 million |

| GAAP EPS | $0.27 | $0.36 |

| Non-GAAP EPS | $0.32 | $0.32 |

Analysis and Outlook

DexCom's strong revenue growth highlights its successful market expansion and product innovation. However, the decline in gross profit margin and EPS indicates challenges in managing costs and maintaining profitability. The company's strategic initiatives, including the launch of the Dexcom G7 15 Day System and expanded market access, are expected to drive future growth. Additionally, the announcement of a $750 million share repurchase program reflects confidence in its long-term prospects.

“To start the year, Dexcom delivered a quarter of strong revenue results and unlocked significant new type 2 coverage,” said Kevin Sayer, Dexcom’s chairman, president and CEO.

DexCom's financial flexibility, with $2.70 billion in cash and marketable securities, positions it well to capitalize on new market opportunities and expand production capacity. As the company continues to innovate and expand its product offerings, it remains a key player in the medical devices and instruments industry.

Explore the complete 8-K earnings release (here) from DexCom Inc for further details.