CBL Properties has unveiled a stock repurchase initiative, with its Board of Directors giving the green light for the company to buy back up to $25 million of its common stock. This strategic move, according to CEO Stephen Lebovitz, is aimed at seizing beneficial investment opportunities by purchasing shares when the stock is undervalued. This buyback, alongside the recent special dividend distributed in March and regular quarterly dividends, underscores CBL's dedication to enhancing shareholder returns and reflects the management's confidence in the company's sustained growth and value. The strong cash reserves and robust cash flow of CBL provide a solid financial foundation to back this buyback program and other strategic endeavors.

Wall Street Analysts Forecast

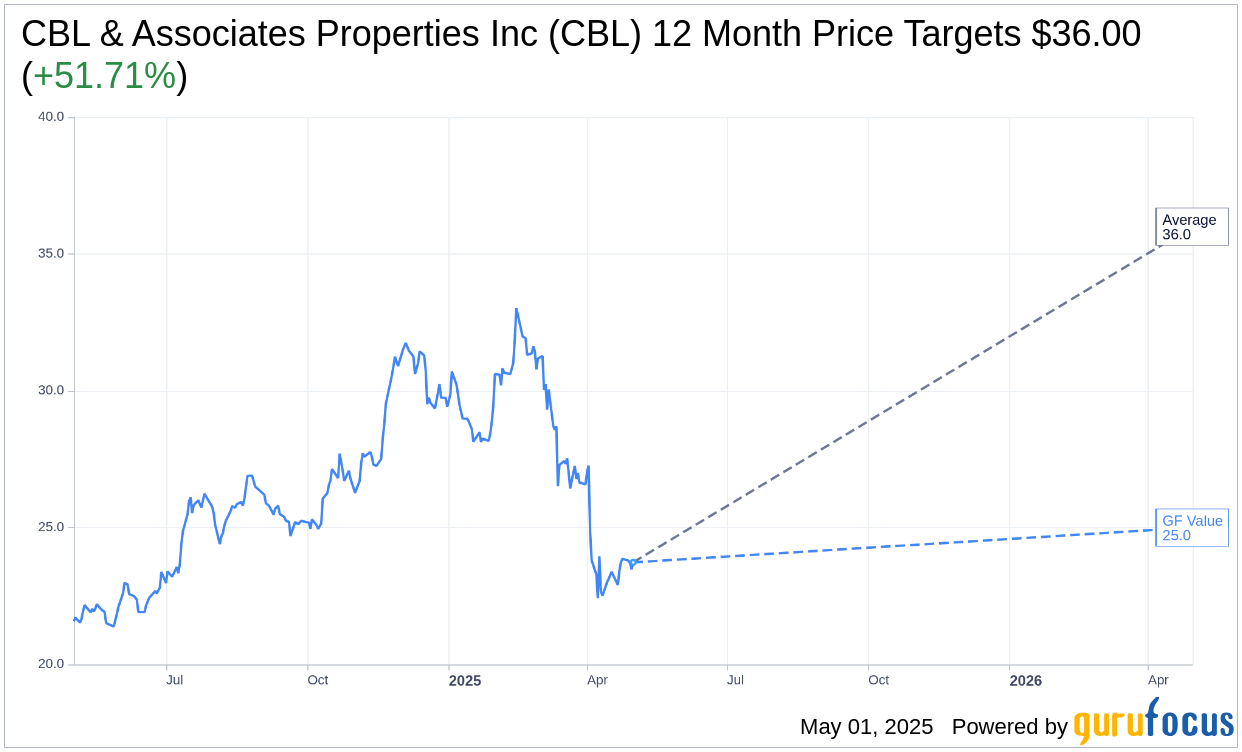

Based on the one-year price targets offered by 1 analysts, the average target price for CBL & Associates Properties Inc (CBL, Financial) is $36.00 with a high estimate of $36.00 and a low estimate of $36.00. The average target implies an upside of 51.71% from the current price of $23.73. More detailed estimate data can be found on the CBL & Associates Properties Inc (CBL) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, CBL & Associates Properties Inc's (CBL, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for CBL & Associates Properties Inc (CBL, Financial) in one year is $25.00, suggesting a upside of 5.35% from the current price of $23.73. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the CBL & Associates Properties Inc (CBL) Summary page.