Monolithic Power Systems (MPWR, Financial) reported first-quarter revenue of $637.6 million, surpassing the anticipated $633.43 million. The company remains committed to its strategic growth plan, evolving from a mere semiconductor supplier to a comprehensive provider of silicon-based solutions. CEO and founder Michael Hsing emphasized the firm's ongoing transformation and dedication to this long-term vision.

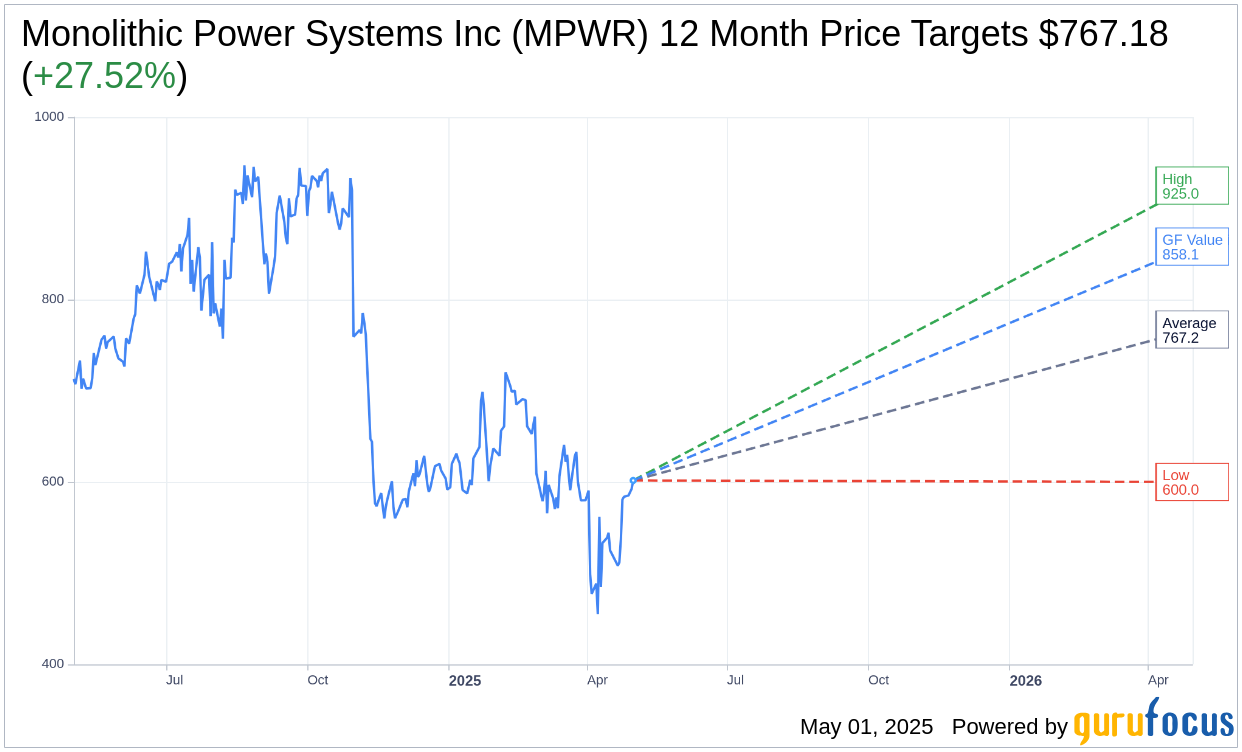

Wall Street Analysts Forecast

Based on the one-year price targets offered by 13 analysts, the average target price for Monolithic Power Systems Inc (MPWR, Financial) is $767.18 with a high estimate of $925.00 and a low estimate of $600.00. The average target implies an upside of 27.52% from the current price of $601.63. More detailed estimate data can be found on the Monolithic Power Systems Inc (MPWR) Forecast page.

Based on the consensus recommendation from 18 brokerage firms, Monolithic Power Systems Inc's (MPWR, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Monolithic Power Systems Inc (MPWR, Financial) in one year is $858.12, suggesting a upside of 42.63% from the current price of $601.63. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Monolithic Power Systems Inc (MPWR) Summary page.

MPWR Key Business Developments

Release Date: February 06, 2025

- Full Year Revenue: $2.2 billion, up 21% from 2023.

- Q4 2024 Revenue: $621.7 million, 37% higher than Q4 2023.

- Quarterly Dividend: Increased by 25% to $1.56 per share.

- Share Repurchase Program: Completed under a $640 million authorization; new $500 million three-year program authorized.

- Free Cash Flow Return: 86% returned to shareholders through share repurchases and dividends over the past three years.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Monolithic Power Systems Inc (MPWR, Financial) achieved its 13th consecutive year of growth, with full-year revenue reaching $2.2 billion, a 21% increase from 2023.

- The company reported record quarterly revenue of $621.7 million for Q4 2024, marking a 37% increase compared to Q4 2023.

- Monolithic Power Systems Inc (MPWR) introduced innovative products such as the silicon carbide inverter for high-powered clean energy applications and a family of automotive audio products utilizing DSP technology.

- The company announced a 25% increase in its quarterly dividend to $1.56 per share and completed share repurchases under a $640 million authorization.

- Monolithic Power Systems Inc (MPWR) continues to focus on innovation and diversification, investing in new technology and expanding into new markets to capture future growth opportunities.

Negative Points

- The enterprise data segment is expected to have a flattish year, with growth weighted towards the second half of 2025.

- There is uncertainty regarding the timing of product ramps, particularly in the automotive and communications sectors, which could affect revenue projections.

- The company faces challenges in predicting the exact timing and magnitude of revenue from hyperscale projects due to customer launch delays.

- Monolithic Power Systems Inc (MPWR) has limited visibility into the separation of CPU and GPU market dynamics, making it difficult to offer precise commentary on enterprise data components.

- The company acknowledges the volatility in the AI side of enterprise data, which could impact revenue patterns throughout 2025.