On May 1, 2025, EOG Resources Inc (EOG, Financial) released its 8-K filing for the first quarter of 2025. EOG Resources, a prominent oil and gas producer with significant operations in the Permian Basin and the Eagle Ford, reported net proven reserves of 4.7 billion barrels of oil equivalent at the end of 2024. The company's net production averaged approximately 1,062 thousand barrels of oil equivalent per day in 2024, with a composition of 69% oil and natural gas liquids and 31% natural gas.

Performance Overview and Challenges

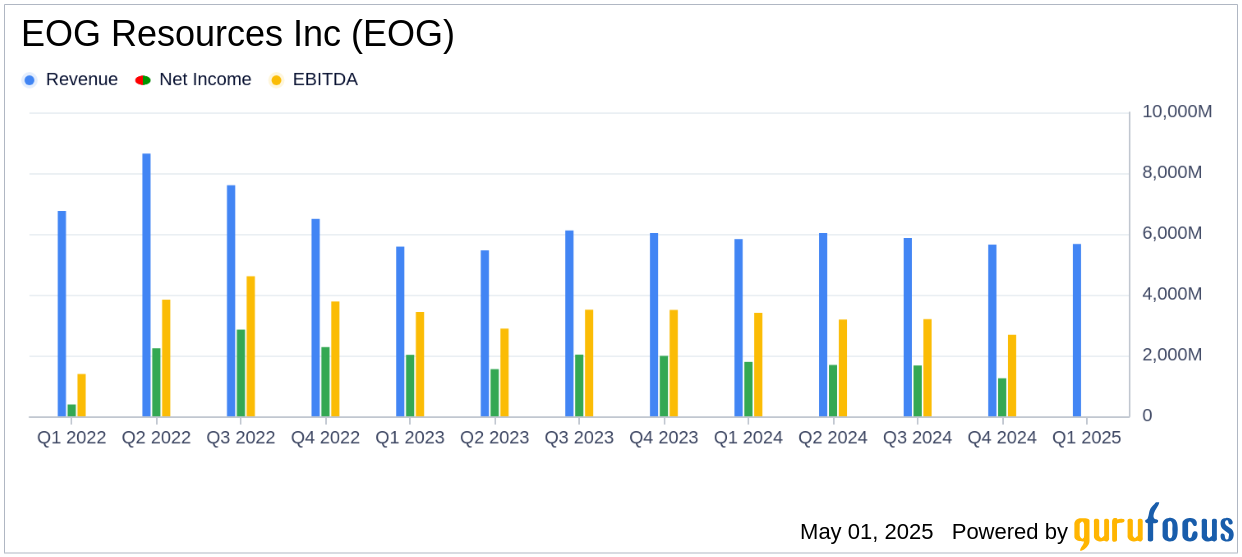

EOG Resources Inc reported operating revenues of $5,669 million for Q1 2025, which fell short of the analyst estimate of $5,878.01 million. The company's diluted earnings per share (EPS) for the quarter was $2.65, below the estimated EPS of $2.80. This performance highlights the challenges EOG faces in meeting market expectations amidst fluctuating commodity prices and operational costs.

Financial Achievements and Industry Context

Despite the revenue miss, EOG Resources Inc achieved a net income of $1,463 million for the quarter. The company's ability to maintain profitability is crucial in the volatile oil and gas industry, where market conditions can rapidly change. EOG's focus on operational efficiency and cost management remains a key factor in sustaining its financial health.

Income Statement Highlights

The income statement reveals that EOG's operating income for Q1 2025 was $1,859 million, a decrease from $2,271 million in Q1 2024. The company's total operating expenses were $3,810 million, slightly lower than the previous year's $3,852 million. This reduction in expenses reflects EOG's efforts to optimize its operations and manage costs effectively.

Balance Sheet and Cash Flow Analysis

As of March 2025, EOG Resources Inc reported total assets of $46,982 million, with cash and cash equivalents amounting to $6,599 million. The company's total liabilities stood at $17,466 million, while stockholders' equity was $29,516 million. EOG's strong balance sheet provides a solid foundation for future growth and investment opportunities.

In terms of cash flow, EOG generated $2,289 million from operating activities in Q1 2025. However, the company used $1,430 million in investing activities, primarily for additions to oil and gas properties. EOG also utilized $1,352 million in financing activities, including dividends and treasury stock purchases.

Volume and Pricing Metrics

EOG's crude oil and condensate volumes increased to 502.1 MBbld in Q1 2025, compared to 487.4 MBbld in Q1 2024. The average composite price for crude oil and condensate was $72.87 per barrel, reflecting a decrease from $78.45 per barrel in the same period last year. These metrics are vital for assessing EOG's production efficiency and market positioning.

Commentary and Analysis

EOG's focus on operational efficiency and strategic investments continues to drive its performance in a challenging market environment. The company's ability to adapt to changing conditions and maintain profitability is a testament to its robust business model." - Industry Analyst

Overall, EOG Resources Inc's Q1 2025 earnings report underscores the company's resilience in navigating market challenges while highlighting areas for improvement in meeting revenue and EPS expectations. Investors will be keen to monitor EOG's strategic initiatives and market developments in the coming quarters.

Explore the complete 8-K earnings release (here) from EOG Resources Inc for further details.