Motorola Solutions (MSI, Financial) announced first-quarter revenue of $2.5 billion, slightly below the expected $2.52 billion. Despite this, the company witnessed a remarkable start to the year, achieving record levels in first-quarter sales, operating earnings, and cash flow. Leadership at MSI attributes this success to a sustained focus from clients on enhancing safety and security measures. This emphasis is anticipated to continue fueling robust growth in the company's revenue, earnings, and cash flow throughout the year, according to CEO Greg Brown.

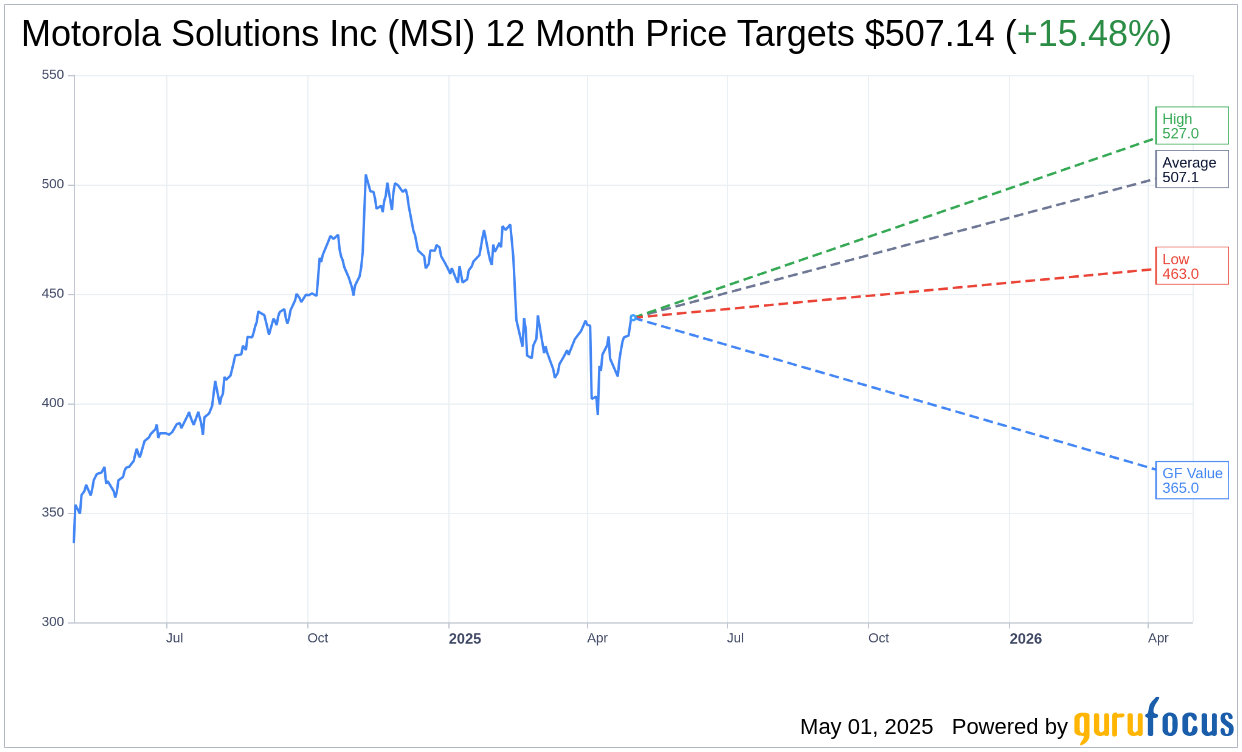

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for Motorola Solutions Inc (MSI, Financial) is $507.14 with a high estimate of $527.00 and a low estimate of $462.99. The average target implies an upside of 15.48% from the current price of $439.16. More detailed estimate data can be found on the Motorola Solutions Inc (MSI) Forecast page.

Based on the consensus recommendation from 13 brokerage firms, Motorola Solutions Inc's (MSI, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Motorola Solutions Inc (MSI, Financial) in one year is $364.98, suggesting a downside of 16.89% from the current price of $439.16. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Motorola Solutions Inc (MSI) Summary page.

MSI Key Business Developments

Release Date: February 13, 2025

- Q4 Revenue Growth: 6% growth, above guidance, with contributions from both segments and all three technologies.

- Q4 GAAP Operating Earnings: $814 million, 27% of sales, up from 25.9% in the previous year.

- Q4 Non-GAAP Operating Earnings: $916 million, 30.4% margin, slightly down from 30.5% last year.

- Q4 GAAP EPS: $3.56, up from $3.47 in the previous year.

- Q4 Non-GAAP EPS: $4.04, up 4% from $3.90 last year.

- Q4 Operating Expenses: $652 million, up $55 million year-over-year.

- Full-Year 2024 Revenue: $10.8 billion, up 8%.

- Full-Year GAAP Operating Earnings: $2.7 billion, 24.8% of sales, up from 23% last year.

- Full-Year Non-GAAP Operating Earnings: $3.1 billion, 29% margin, up from 27.9% last year.

- Full-Year GAAP EPS: $9.23, down from $9.93 last year.

- Full-Year Non-GAAP EPS: $13.84, up 16% from $11.95 last year.

- Full-Year Operating Cash Flow: $2.4 billion, up 17% year-over-year.

- Q4 Products & SI Sales: Up 3%, driven by LMR and Video growth.

- Q4 Software & Services Revenue: Up 11%, with growth in all three technologies.

- Q4 North America Revenue: $2.2 billion, up 9%.

- Q4 International Revenue: $807 million, down 3% year-over-year.

- Ending Backlog: $14.7 billion, up $438 million year-over-year.

- 2025 Revenue Growth Outlook: Approximately 5.5% growth expected.

- 2025 Non-GAAP EPS Outlook: Between $14.64 and $14.74 per share.

- 2025 Operating Cash Flow Outlook: Expected to be $2.7 billion.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Motorola Solutions Inc (MSI, Financial) achieved record revenue in both segments and all three technologies, with double-digit growth in Video and Command Center.

- The company ended the year with a record backlog of $14.7 billion, despite unfavorable currency rates.

- Full-year revenue was up 8%, with strong growth in both segments and across all three technologies.

- Motorola Solutions Inc (MSI) increased its dividend by 11%, marking the fourteenth consecutive year of double-digit increases.

- The company expects another year of strong revenue, earnings per share, and cash flow growth in 2025, supported by robust demand and a healthy balance sheet.

Negative Points

- GAAP earnings per share decreased from $9.93 to $9.23 due to a pre-tax loss related to the settlement of the Silver Lake convertible notes.

- Operating expenses increased by $197 million for the full year, driven by higher employee incentives, acquisition expenses, and legal costs.

- International revenue declined by 2% for the full year, primarily due to lower revenue from Ukraine and the exit from ESN.

- The Software & Services segment saw a decline in operating margins by 310 basis points due to the Airwave Charge Control and higher expenses from acquisitions.

- The company faces $120 million in foreign exchange headwinds for the full year 2025, impacting revenue growth expectations.