Key Insights:

- Broadstone Net Lease (BNL, Financial) reported significant growth in Q1 2025, with an AFFO of $71.8 million.

- Investments in industrial properties and strategic acquisitions totaled $103.9 million.

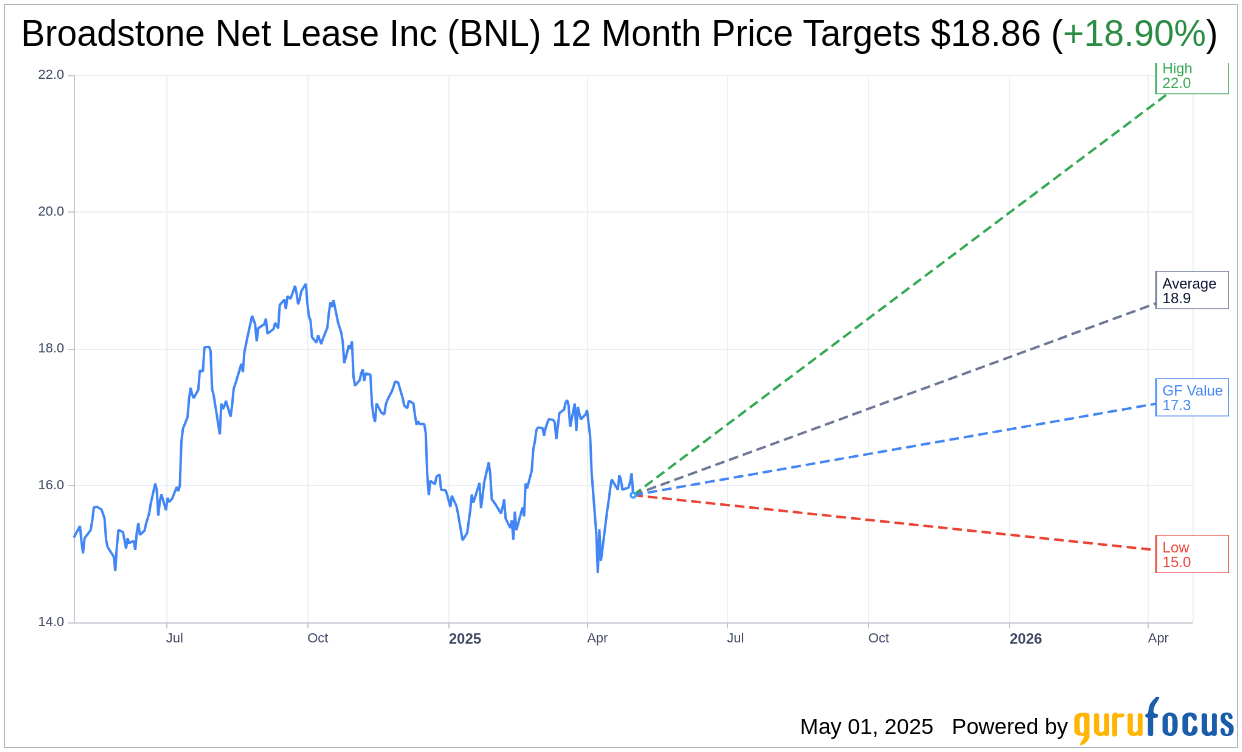

- Analysts forecast an 18.90% potential upside, with a price target ranging from $15.00 to $22.00.

Broadstone Net Lease: A Strategic Q1 2025 Performance

In the first quarter of 2025, Broadstone Net Lease (BNL) demonstrated robust financial health by reporting adjusted funds from operations (AFFO) of $71.8 million, equating to $0.36 per share. This performance underscores the company's strategic focus on expanding its portfolio through targeted acquisitions and developments, amounting to $103.9 million. A notable highlight is the $78.2 million collaboration with Prologis, aimed at strengthening future revenue streams, particularly in the industrial property sector.

Wall Street's Perspective: Analyst Price Targets

According to a consensus of seven analysts, the one-year price target for Broadstone Net Lease Inc (BNL, Financial) averages $18.86. This projection is nestled between a high of $22.00 and a low of $15.00, suggesting an 18.90% increase from its present valuation of $15.86. Investors can delve deeper into these estimates by visiting the Broadstone Net Lease Inc (BNL) Forecast page.

Furthermore, based on assessments from 10 brokerage firms, Broadstone Net Lease Inc (BNL, Financial) holds an average brokerage recommendation of 2.4, placing it in the "Outperform" category. This rating operates on a scale from 1 to 5, with 1 indicating a Strong Buy and 5 a Sell. Investors should interpret this as a positive sentiment from the brokerage community towards BNL's growth prospects.

Evaluating GF Value and Future Potential

GuruFocus has projected a one-year GF Value for Broadstone Net Lease Inc (BNL, Financial) at $17.29, indicating a potential 9.02% upside from its current trading price of $15.86. The GF Value is a critical metric that estimates a stock's fair value, taking into account historical multiples and anticipated growth trends. Investors can access detailed financial data by visiting the Broadstone Net Lease Inc (BNL) Summary page.

By leveraging strategic partnerships and focusing on high-yield assets, Broadstone Net Lease is poised to maintain its growth trajectory. The company's strategic investments and favorable analyst evaluations present a compelling case for investors considering BNL as a valuable addition to their portfolios.