SPX Technologies (SPXC, Financial) announced its first-quarter revenue of $482.6 million, surpassing the anticipated $481.18 million. CEO Gene Lowe expressed satisfaction with the company's robust beginning to 2025, highlighting noteworthy improvements in core profitability metrics and strong margin performance across divisions. The firm concentrated on effective operational execution to navigate diverse economic conditions. Furthermore, SPX Technologies advanced its value creation strategies through new product launches and ongoing enhancements.

In a strategic move to bolster its HVAC segment, the company acquired Sigma & Omega in April. This acquisition, which focuses on vertical stack heat pumps and commercial self-contained units, complements SPXC's existing heating and cooling offerings. This strategic integration is expected to unlock additional growth avenues by leveraging combined distribution channels. SPX Technologies remains committed to enhancing its market position and exploring new growth opportunities.

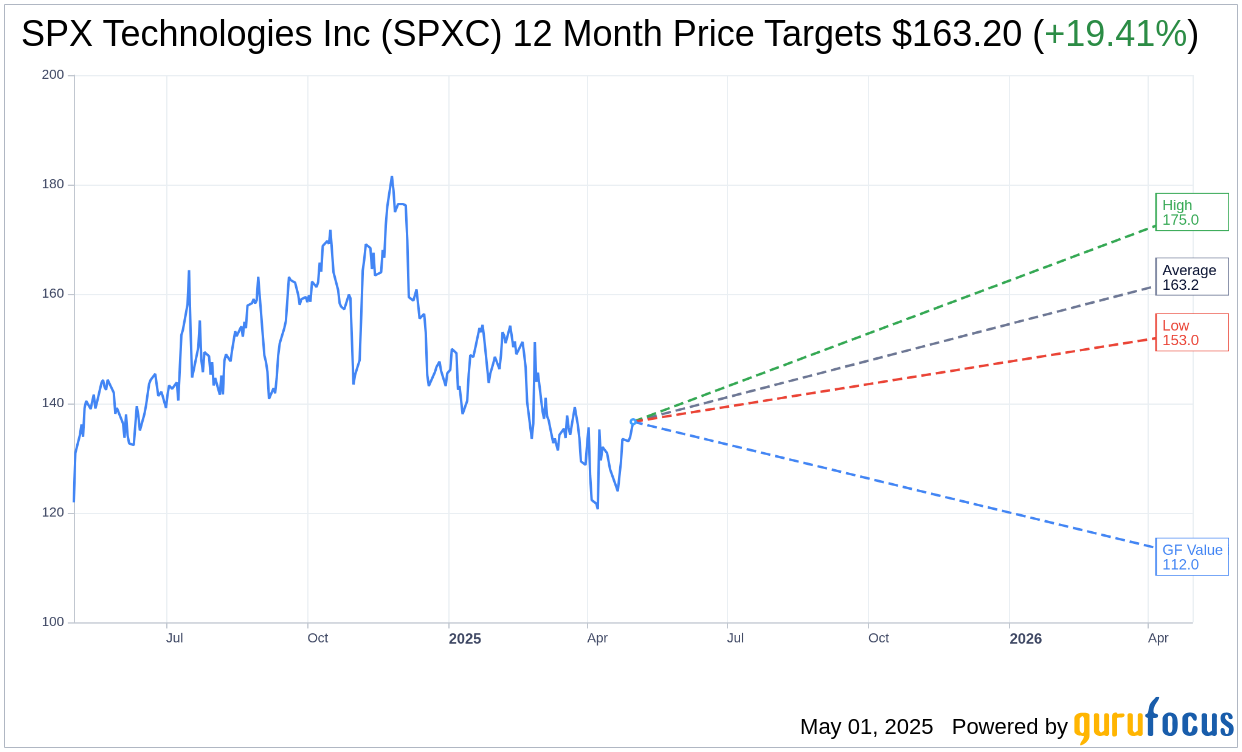

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for SPX Technologies Inc (SPXC, Financial) is $163.20 with a high estimate of $175.00 and a low estimate of $153.00. The average target implies an upside of 19.41% from the current price of $136.67. More detailed estimate data can be found on the SPX Technologies Inc (SPXC) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, SPX Technologies Inc's (SPXC, Financial) average brokerage recommendation is currently 1.5, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for SPX Technologies Inc (SPXC, Financial) in one year is $112.00, suggesting a downside of 18.05% from the current price of $136.67. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the SPX Technologies Inc (SPXC) Summary page.

SPXC Key Business Developments

Release Date: February 25, 2025

- Revenue Growth: Increased by 13.7% year-on-year for the fourth quarter.

- Adjusted EBITDA: Grew by 28.1% year-on-year with a 250 basis points margin expansion.

- Adjusted EPS: Increased by 21% to $1.51 for the fourth quarter; full year adjusted EPS grew 29% to $5.58.

- HVAC Segment Revenue: Grew 18.6% year-on-year, with organic growth of 12.8% and a 6% contribution from the Ingénia acquisition.

- Detection & Measurement Segment Revenue: Organic growth of 4.2% year-on-year.

- Segment Income: Increased by $26.6 million or 25.9% to $129.4 million, with a 230 basis points margin increase.

- Cash and Debt: Ended Q4 with $161 million in cash and $615 million in total debt.

- Leverage Ratio: 1x, increasing to 1.7x post-KTS acquisition.

- Adjusted Free Cash Flow: Approximately $284 million, reflecting 108% conversion of adjusted net income.

- 2025 Revenue Guidance: $2.13 billion to $2.19 billion.

- 2025 Adjusted EBITDA Guidance: $460 million to $490 million, reflecting 13% growth at the midpoint.

- 2025 Adjusted EPS Guidance: $6 to $6.25, reflecting approximately 10% growth at the midpoint.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- SPX Technologies Inc (SPXC, Financial) reported a 36% increase in full-year adjusted EBITDA, showcasing strong financial performance.

- The company delivered adjusted EPS near the upper end of its guidance range, indicating effective financial management.

- SPX Technologies Inc (SPXC) achieved a 13.7% revenue growth in the fourth quarter, with significant contributions from both segments.

- The acquisition of Kranze Technology Solutions (KTS) enhances the company's Detection & Measurement segment, positioning it for further growth.

- The company introduced several innovative products in 2024, enhancing customer efficiency and sustainability, particularly in the HVAC segment.

Negative Points

- The HVAC segment faced challenges with heating product sales due to warmer weather conditions in the fourth quarter.

- There is potential uncertainty regarding the impact of tariffs and geopolitical factors on future operations.

- The Detection & Measurement segment anticipates flat organic revenue growth in 2025, with some project deliveries delayed to 2026 and beyond.

- Higher interest costs are expected due to the acquisition of KTS, which may impact financial performance in the short term.

- The company faces capacity constraints in meeting demand for certain products, particularly in the Engineered Air Movement business.