Eversource (ES, Financial) reported impressive financial results for the first quarter of 2025, with revenue reaching $4.12 billion, surpassing the expected $3.77 billion consensus. This robust start to the year underscores the company's solid operational capabilities and financial health. A significant move in Eversource’s strategy is the planned divestiture of its Aquarion water business, which is set to conclude later in 2025. This divestiture is a strategic step aimed at fortifying the company's balance sheet and positioning Eversource as a focused regulated utility company poised for growth. The company attributes part of its successful quarter to effective execution by its workforce of over 10,000 employees and favorable weather conditions, which included a mild winter storm season.

Wall Street Analysts Forecast

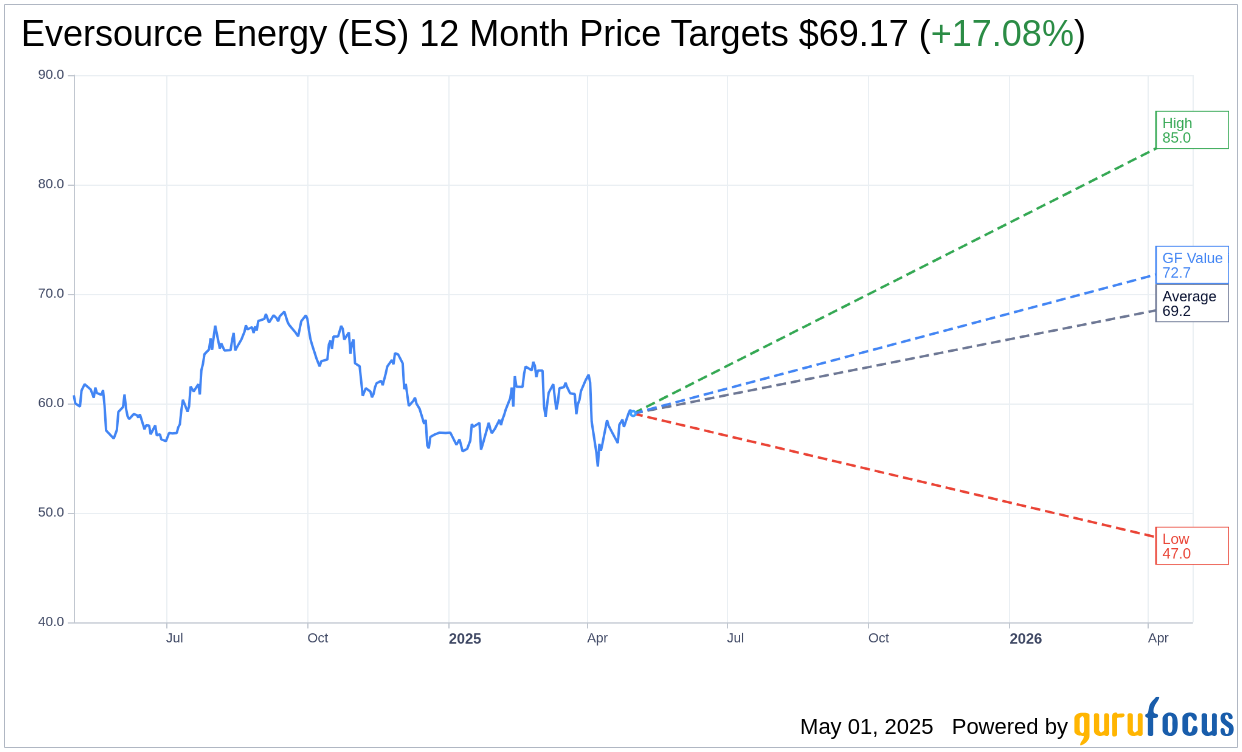

Based on the one-year price targets offered by 15 analysts, the average target price for Eversource Energy (ES, Financial) is $69.17 with a high estimate of $85.00 and a low estimate of $47.00. The average target implies an upside of 17.08% from the current price of $59.08. More detailed estimate data can be found on the Eversource Energy (ES) Forecast page.

Based on the consensus recommendation from 20 brokerage firms, Eversource Energy's (ES, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Eversource Energy (ES, Financial) in one year is $72.67, suggesting a upside of 23% from the current price of $59.08. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Eversource Energy (ES) Summary page.

ES Key Business Developments

Release Date: February 12, 2025

- Earnings Per Share (EPS): Up 5.3% year-over-year, with non-GAAP EPS at $4.57 for 2024.

- GAAP Earnings: $2.27 per share for 2024 compared to a GAAP loss of $1.26 per share in 2023.

- Electric Transmission Earnings: $2.03 per share in 2024, up from $1.84 per share in 2023.

- Electric Distribution Earnings: $1.77 per share in 2024, compared to $1.74 per share in 2023.

- Natural Gas Distribution Earnings: $0.81 per share in 2024, up from $0.64 per share in 2023.

- Water Distribution Earnings: $0.12 per share in 2024, excluding the loss on the pending sale of Aquarion.

- 2025 EPS Guidance: Projected in the range of $4.67 to $4.82.

- Capital Investment Plan: $24.2 billion planned for 2025-2029, a 10% increase from the previous plan.

- Rate Base Growth: 8% growth from 2023 through 2029.

- Dividend Increase: First quarter 2025 dividend increased by 5.2% on an annualized basis.

- Aquarion Sale: Aggregate enterprise value of approximately $2.4 billion, including $1.6 billion in cash.

- Cash Flow Improvement: Nearly 50% increase in cash flows from operations expected in 2025 compared to 2024.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Eversource Energy (ES, Financial) reported a 5.3% year-over-year increase in earnings per share, exceeding the midpoint of their revised guidance.

- The company successfully issued $1 billion of equity through their ATM program, strengthening their balance sheet.

- Eversource Energy (ES) was recognized by Newsweek as one of America's most responsible companies for the sixth consecutive year.

- The company announced the sale of Aquarion Water at an attractive multiple of 1.7 times rate base, which will help reduce debt and reinvest in regulated utilities.

- Eversource Energy (ES) has a new five-year capital investment plan that increases investment by nearly 10%, focusing on transmission investments to address aging infrastructure needs.

Negative Points

- The company faced headwinds in 2024, including higher interest expenses and the absence of prior year net benefits from asset sales.

- Eversource Energy (ES) is dealing with regulatory challenges, particularly in Connecticut, where they are seeking to improve the regulatory environment.

- The sale of Aquarion Water, while financially beneficial, will result in a loss of $0.83 per share in earnings.

- The company's 2025 earnings guidance is below the long-term growth target of 5% to 7%, partly due to the dilutive effect of equity issued in 2024.

- Eversource Energy (ES) is facing pressure to maintain a healthy FFO to debt ratio, with Moody's currently having them on a negative outlook.