Management at MTD has expressed concerns regarding uncertain market conditions that could shift swiftly. According to their current evaluation, they expect local currency sales to rise by approximately 0% to 1% for the second quarter of 2025. Regarding financial performance, the company forecasts adjusted earnings per share (EPS) to fall between $9.45 and $9.70, representing a change from a 2% decrease to a possible 1% increase. Notably, their guidance accounts for a projected negative impact of 3% on EPS growth due to increased tariff-related costs, despite efforts to counteract these challenges.

Wall Street Analysts Forecast

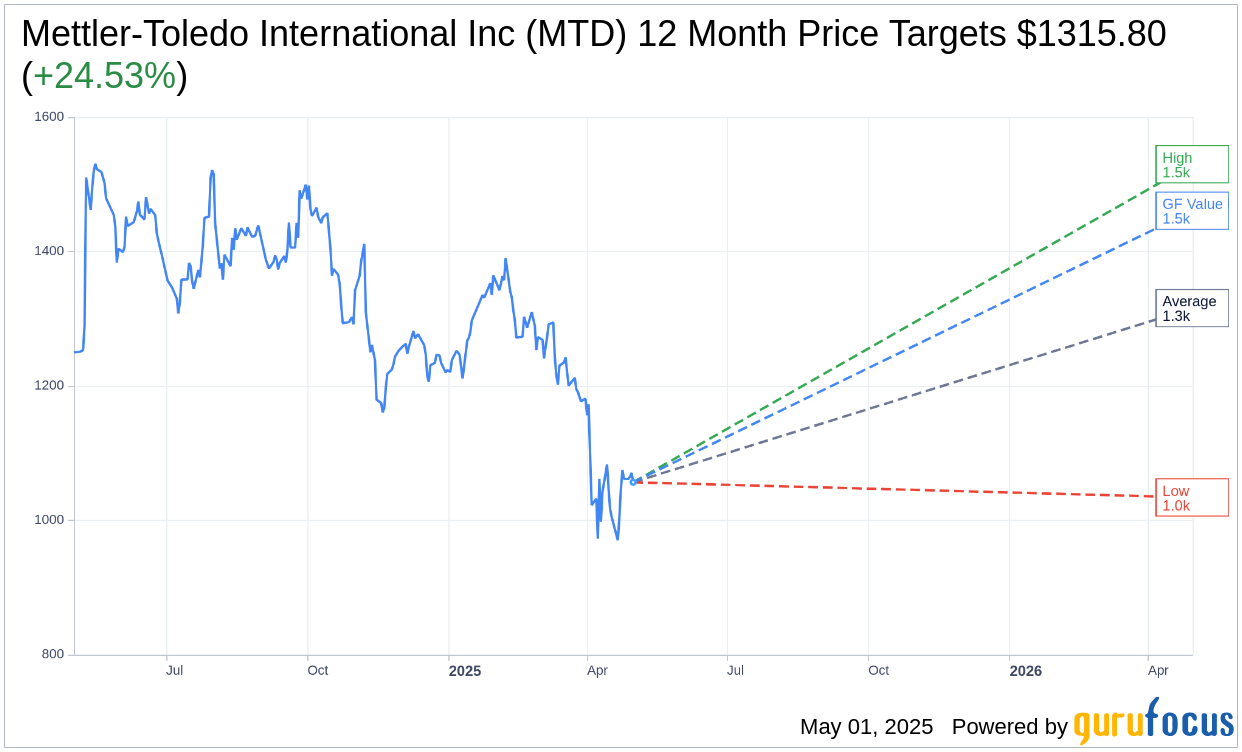

Based on the one-year price targets offered by 12 analysts, the average target price for Mettler-Toledo International Inc (MTD, Financial) is $1,315.80 with a high estimate of $1,530.00 and a low estimate of $1,034.00. The average target implies an upside of 24.53% from the current price of $1,056.58. More detailed estimate data can be found on the Mettler-Toledo International Inc (MTD) Forecast page.

Based on the consensus recommendation from 15 brokerage firms, Mettler-Toledo International Inc's (MTD, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Mettler-Toledo International Inc (MTD, Financial) in one year is $1460.80, suggesting a upside of 38.26% from the current price of $1056.58. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Mettler-Toledo International Inc (MTD) Summary page.

MTD Key Business Developments

Release Date: February 07, 2025

- Revenue: $1.045 billion for the quarter, a 12% increase in local currency and US dollars.

- Sales Growth by Region: Americas 7%, Europe 19%, Asia, Rest of World 14%, China 4% for the quarter.

- Sales Growth by Product Area: Laboratory 18%, Industrial 8%, Core Industrial 5%, Product Inspection 12%, Food Retail -14% for the quarter.

- Gross Margin: 61.2%, an increase of 220 basis points.

- R&D Expenses: $50.1 million, a 7% increase in local currency.

- SG&A Expenses: $237.3 million, a 6% increase in local currency.

- Adjusted Operating Profit: $351.9 million, up 25% from the prior year.

- Adjusted Operating Margin: 33.7%, an increase of 360 basis points.

- Adjusted EPS: $12.41, a 32% increase over the prior year.

- Free Cash Flow: $900.6 million for 2024, a 2% increase on a per-share basis from 2023.

- Effective Tax Rate: 19% for the quarter.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Mettler-Toledo International Inc (MTD, Financial) reported a strong financial performance for the fourth quarter of 2024, with sales reaching $1.045 billion, marking a 12% increase in both local currency and US dollars.

- The company experienced significant sales growth across regions, with Europe leading at 19%, followed by Asia at 14%, and the Americas at 7%.

- Laboratory products saw an impressive 18% sales increase, driven by strong demand, particularly in Europe.

- Adjusted operating profit increased by 25% year-over-year, with an adjusted operating margin of 33.7%, up 360 basis points.

- The company achieved a 32% increase in adjusted EPS for the quarter, reaching $12.41, reflecting strong execution and market demand.

Negative Points

- Mettler-Toledo International Inc (MTD) faced a 14% decline in Food Retail sales during the quarter, indicating challenges in this segment.

- Local currency sales in China decreased by 11% for the full year 2024, highlighting ongoing market difficulties.

- The company anticipates a decline in local currency sales by approximately 3% to 4% in the first quarter of 2025, reflecting continued market uncertainties.

- Geopolitical tensions and potential new tariffs pose risks to the company's future performance, which have not been fully factored into the guidance.

- The Core Industrial segment experienced modest growth due to persistent market headwinds, particularly in China, affecting overall industrial sales.