Key Highlights:

- Riot Platforms (RIOT, Financial) shows a 594% increase over five years despite a recent decline.

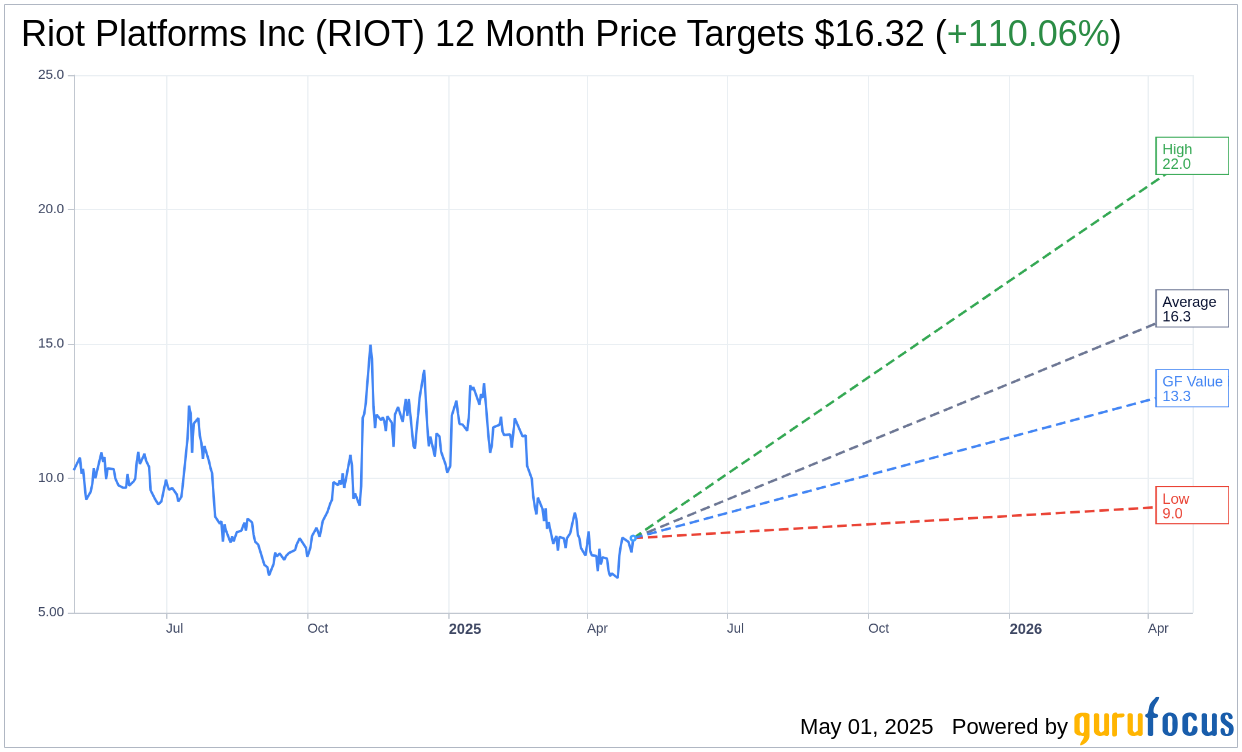

- Analysts anticipate a potential 110.06% upside in the stock's price.

- GuruFocus estimates suggest a significant rise with a 71.81% upside.

Riot Platforms (NASDAQ: RIOT) has encountered a challenging quarter with its stock dropping by 29%. However, its long-term trajectory remains notable, marking an impressive surge of 594% over the past five years. This robust growth invites investors to delve deeper into the company's fundamentals and assess its future potential beyond the immediate volatility.

Wall Street Analysts' Projections

According to a consensus of 14 analysts, Riot Platforms Inc (RIOT, Financial) has an average one-year price target of $16.32. This forecast ranges from a high of $22.00 to a low of $9.00, collectively indicating a potential upside of 110.06% from its current price of $7.77. For more detailed projections, visit the Riot Platforms Inc (RIOT) Forecast page.

Brokerage Recommendations

The consensus from 16 brokerage firms places Riot Platforms Inc's (RIOT, Financial) average recommendation at 1.9, aligning with an "Outperform" rating. The scale, ranging from 1 (Strong Buy) to 5 (Sell), highlights analysts' favorable outlook for the stock.

GuruFocus Valuation Insight

According to GuruFocus, the projected GF Value for Riot Platforms Inc (RIOT, Financial) over the next year stands at $13.35, indicating a potential upside of 71.81% from its current market price of $7.77. This estimate reflects an in-depth analysis based on historical trading multiples, business growth patterns, and forward-looking performance indicators. For more insights, visit the Riot Platforms Inc (RIOT) Summary page.