Key Highlights:

- Duolingo's Q1 GAAP EPS of $0.72 beats estimates by $0.20.

- Revenue surged 37.7% year-over-year, reaching $230.74 million.

- Paid subscriber base expanded by 40%, totaling 10.3 million.

Duolingo's Outstanding Q1 Performance

Duolingo (NASDAQ: DUOL) has reported an impressive first-quarter performance, achieving a GAAP EPS of $0.72. This result exceeded market expectations by $0.20, demonstrating the strength of the company's financial health. Additionally, Duolingo's revenue soared to $230.74 million, marking a 37.7% increase from the same period last year and surpassing analyst forecasts by $7.63 million. A significant 40% rise in paid subscribers further underscores the company's robust growth, now boasting 10.3 million subscribers by the quarter's end.

Wall Street Analysts' Outlook

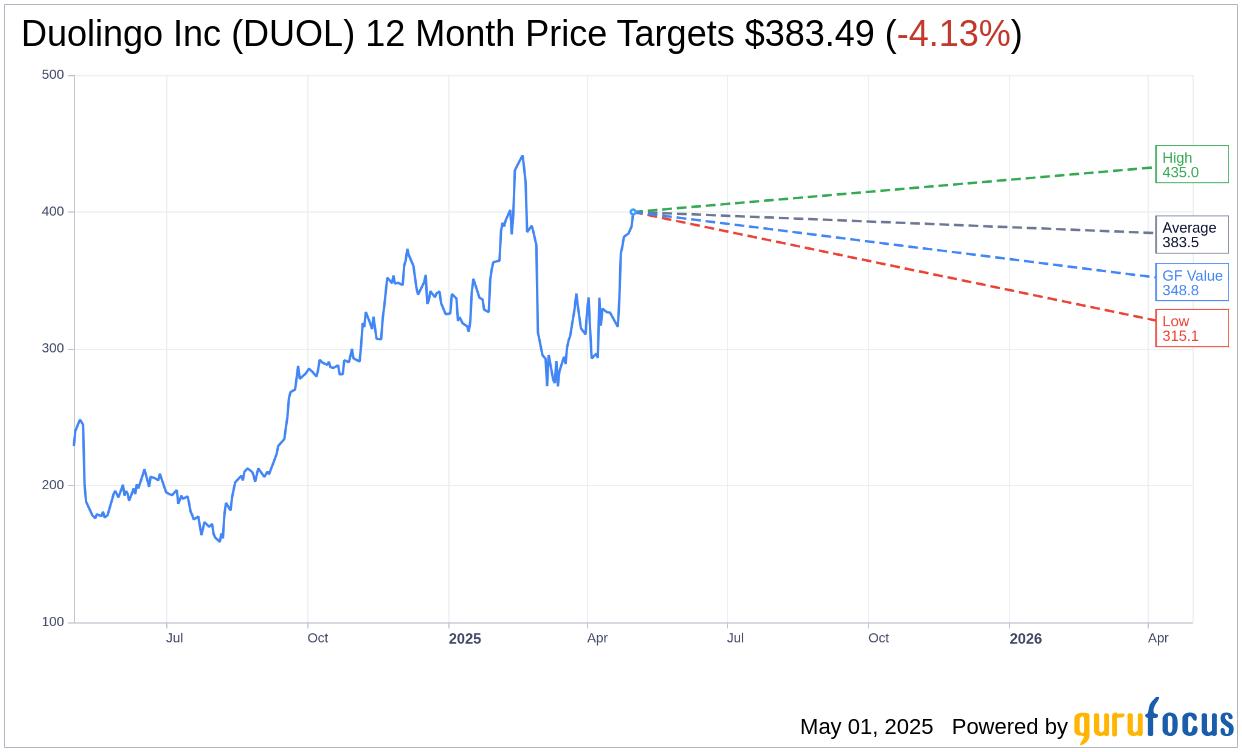

Analysts are closely watching Duolingo, with 17 analysts projecting an average one-year price target of $383.49. This target reflects a potential downside of 4.13% from the current trading price of $400.00. Expectations range from a high of $435.00 to a low of $315.12. For a more comprehensive view of these predictions, visit the Duolingo Inc (DUOL, Financial) Forecast page.

The consensus from 23 brokerage firms categorizes Duolingo Inc.'s stock as "Outperform," with an average recommendation score of 2.3 on a scale of 1 to 5, where 1 indicates a "Strong Buy" and 5 signals a "Sell."

GuruFocus GF Value Assessment

According to GuruFocus estimates, Duolingo Inc (DUOL, Financial) has a projected GF Value of $348.79 in one year, suggesting a potential downside of 12.8% from the current price. The GF Value metric represents GuruFocus' appraisal of the stock's fair trading value, derived from historical trading multiples, past business growth, and future performance projections. Investors seeking further insights can explore the Duolingo Inc (DUOL) Summary page.