Summary:

- Roblox's first-quarter results reveal varied performance.

- Analysts predict a moderate downside based on current stock prices.

- GuruFocus suggests a potential upside, indicating possible stock undervaluation.

Roblox's First-Quarter Performance and Future Plans

Roblox (RBLX, Financial) has unveiled its first-quarter results, which present a blend of outcomes for investors. As the company gears up for its second-quarter initiatives, it has also updated its fiscal outlook for 2025. A key factor for investors to monitor will be the evolving growth rates in daily active users (DAU), which are crucial for the company's long-term success.

Wall Street Analysts' Predictions

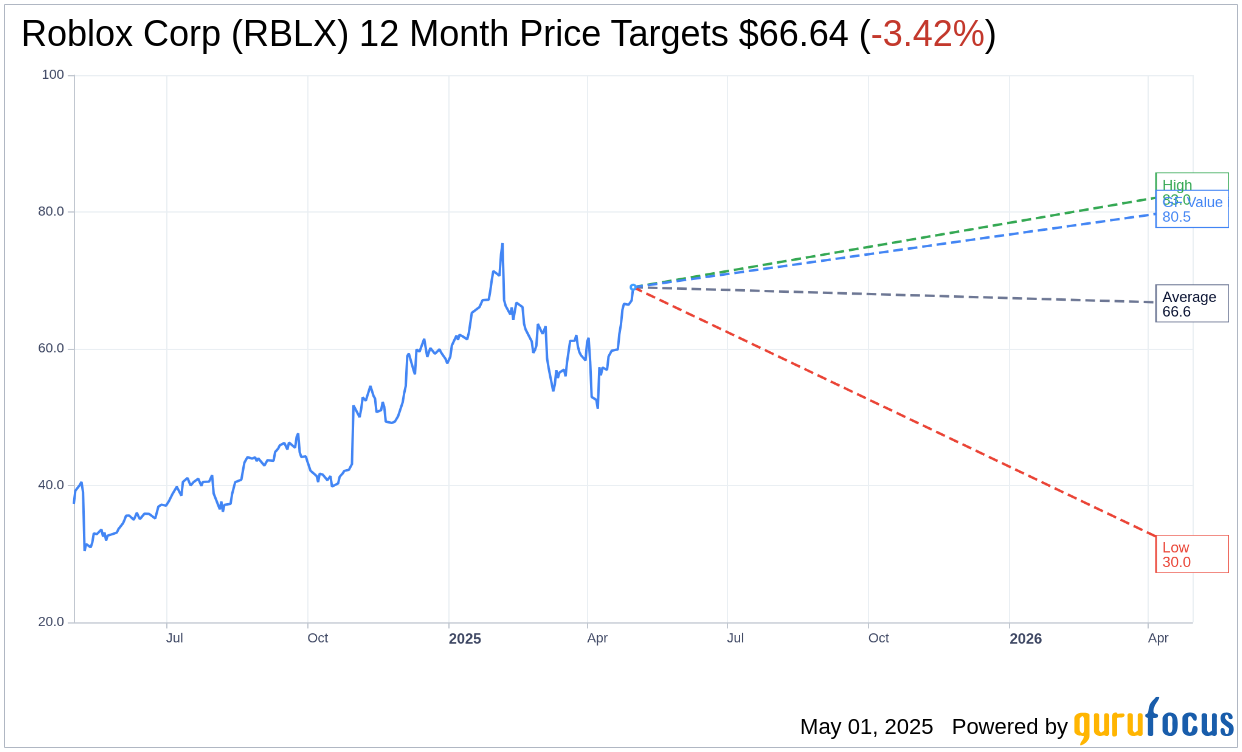

According to one-year price targets from 30 analysts, Roblox Corp (RBLX, Financial) has an average target price of $66.64, with projections ranging from a high of $83.00 to a low of $30.00. This average target reflects a potential downside of 3.42% from its current price of $69.00. For more in-depth estimate data, visit the Roblox Corp (RBLX) Forecast page.

Additionally, based on consensus recommendations from 33 brokerage firms, Roblox Corp's (RBLX, Financial) average brokerage recommendation stands at 2.3, which indicates an "Outperform" status. This rating is on a scale where 1 signifies Strong Buy, and 5 denotes Sell, reflecting a generally positive outlook towards the stock.

GuruFocus Valuation Insights

Based on GuruFocus estimates, Roblox Corp's (RBLX, Financial) projected GF Value in one year is $80.46, suggesting a potential upside of 16.61% from the current price of $69. GF Value represents GuruFocus' estimation of the stock's fair trading value, derived from historical trading multiples, past business growth, and future business performance projections. For detailed valuation data, refer to the Roblox Corp (RBLX) Summary page.