- Motorola Solutions (MSI, Financial) achieves a 6% revenue growth driven by Software and Services.

- Analyst average price target suggests a potential upside of 15.48%.

- The company's strategic acquisitions and innovations enhance its growth prospects.

Motorola Solutions (MSI) recently reported outstanding first-quarter results, marking significant achievements in its financial performance. The company's revenue surged by 6%, largely influenced by a notable 9% increase in Software and Services sales and a 4% rise in Products and SI. These factors contributed to an improved non-GAAP operating margin of 28.3%. Additionally, the non-GAAP EPS was elevated by 13% to $3.18, reflecting strong operational efficiency. The introduction of cutting-edge technologies such as SVX and Assist, alongside strategic acquisitions like RapidDeploy and Theatro, have further reinforced its market position.

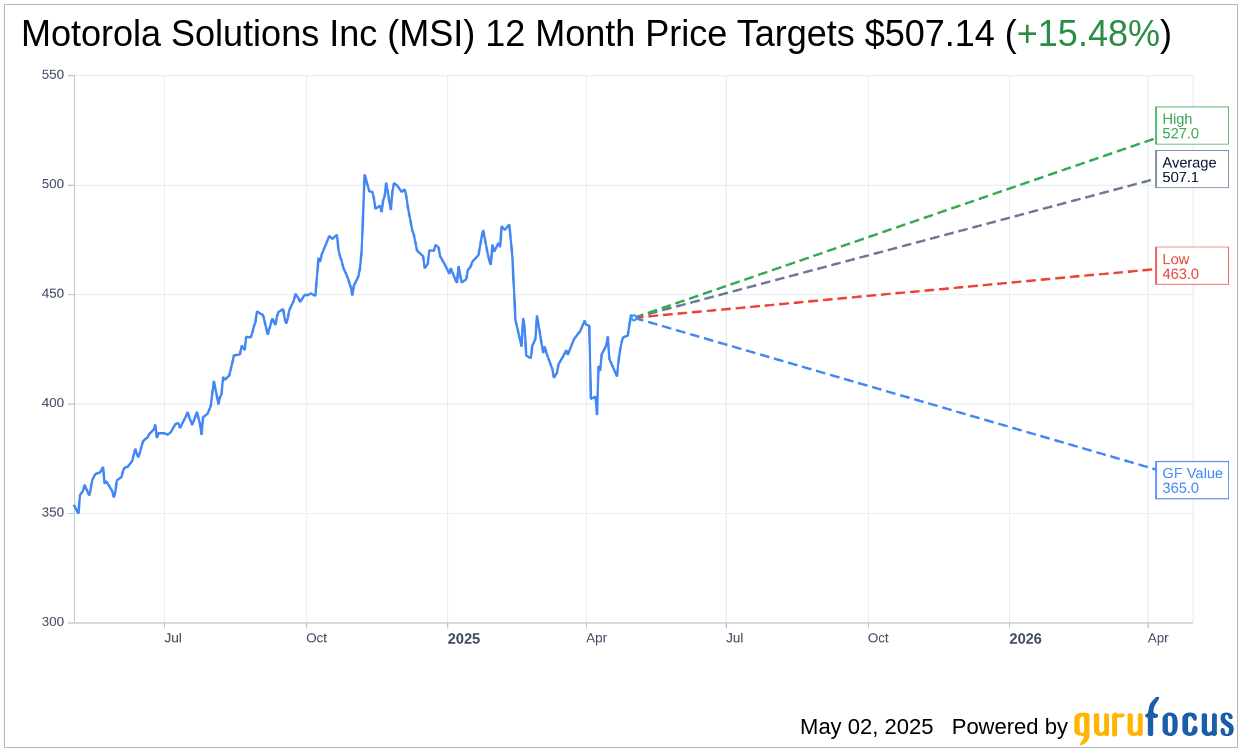

Wall Street Analysts Forecast

Forecasts by seven analysts suggest a promising future for Motorola Solutions Inc (MSI, Financial), with an average price target of $507.14. This projection includes a high estimate of $527.00 and a low forecast of $462.99. The average target price indicates a potential upside of 15.48% from the current trading price of $439.16, suggesting investor optimism. For a deeper analysis, explore the Motorola Solutions Inc (MSI) Forecast page.

The analysis from 13 brokerage firms places Motorola Solutions Inc (MSI, Financial) in an "Outperform" category, with an average recommendation of 1.8. The rating scale ranges from 1 (Strong Buy) to 5 (Sell), demonstrating general bullish sentiment towards the stock's potential.

While the market outlook appears positive, GuruFocus provides a contrasting GF Value estimation of $364.98 for Motorola Solutions Inc (MSI, Financial) over the next year. This estimate suggests a potential downside of 16.89% from the current price of $439.16. The GF Value is a comprehensive calculation based on historical price multiples, prior business growth, and projected future performance. For further insight, visit the Motorola Solutions Inc (MSI) Summary page.