Key Highlights:

- Lumen Technologies collaborates with Google Cloud aiming at significant cost reduction by 2025.

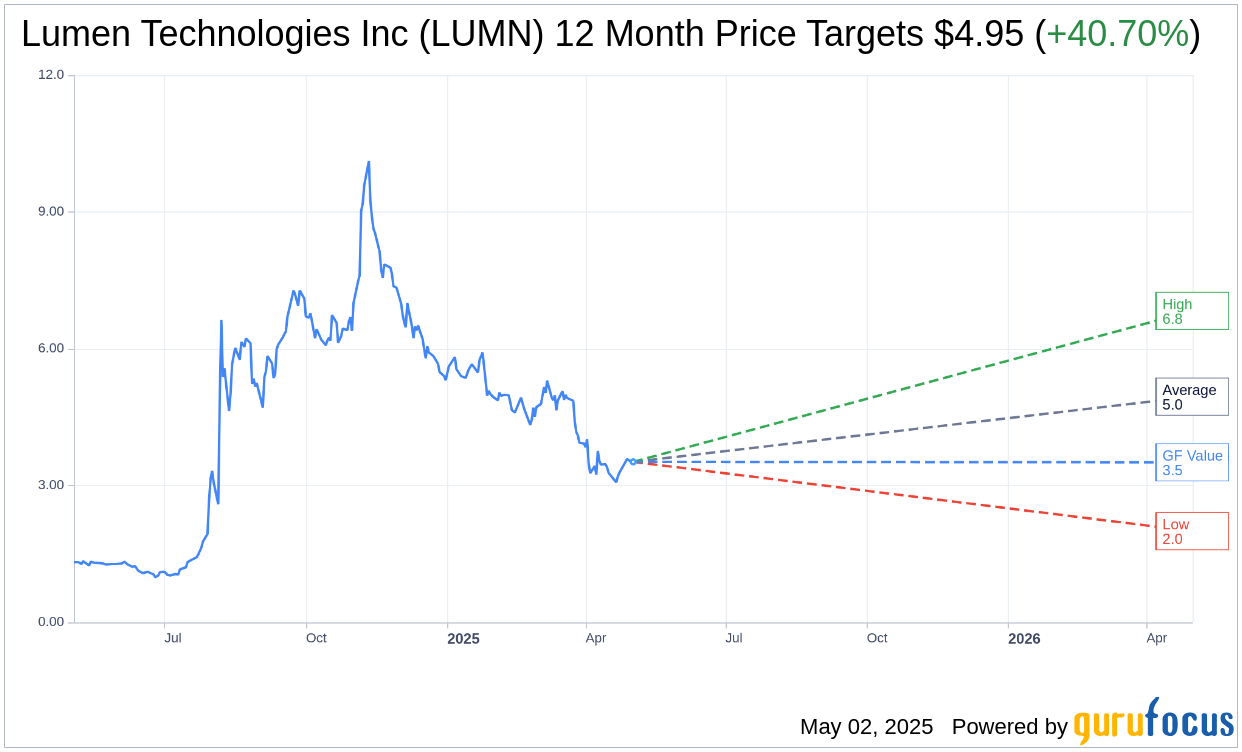

- Projected revenue growth with a target price increase of 40.70% according to analysts.

- Current "Hold" recommendation from brokerage firms amidst ongoing strategic shifts.

Lumen Technologies' Strategic Shift: AI and Telecom Modernization

Lumen Technologies (LUMN, Financial) is advancing its strategic initiatives, focusing on integrating artificial intelligence and telecom modernization to drive its future growth. During the first quarter of 2025 earnings call, Lumen highlighted its pivotal partnership with Google Cloud, a move directed towards achieving an ambitious $250 million in cost savings by 2025. In this period, the company reported a quarterly revenue of $3.182 billion and a free cash flow of $354 million, demonstrating solid financial footing as it embarks on this transformation.

Wall Street Analysts' Forecast and Price Targets

Lumen Technologies Inc (LUMN, Financial) has captured the attention of 11 Wall Street analysts, who have projected a one-year price target for the stock with an average target price of $4.95. This range spans a high of $6.83 to a low of $2.00, indicating a potential upside of 40.70% from the current share price of $3.52. For a deeper dive into these projections, investors can visit the Lumen Technologies Inc (LUMN) Forecast page.

Brokerage Firms' Consensus and Recommendations

Thirteen brokerage firms have weighed in on Lumen Technologies Inc (LUMN, Financial), collectively assigning an average recommendation rating of 2.9, which suggests a "Hold" status. This rating operates on a scale from 1 to 5, where 1 represents a Strong Buy and 5 signifies a Sell, indicating a cautious but stable outlook among analysts as Lumen continues its strategic evolution.

Estimating Lumen's GF Value and Market Position

According to GuruFocus metrics, Lumen Technologies Inc (LUMN, Financial) carries an estimated GF Value of $3.51 for the coming year, suggesting a modest downside of 0.28% from its current price of $3.52. This valuation metric reflects the fair value based on historical trading multiples, past business growth, and future performance estimates. More comprehensive information is accessible on the Lumen Technologies Inc (LUMN) Summary page.