Key Highlights:

- Red Rock Resorts (RRR, Financial) records unprecedented Q1 2025 results, spearheaded by Las Vegas' top performance.

- A significant upswing in customer growth with the Durango Casino & Resort adding over 95,000 new customers.

- Analysts predict a potential 22.65% upside with a solid "Outperform" recommendation.

Red Rock Resorts (RRR) has achieved a milestone with its first-quarter results for 2025, marking the highest-ever net revenue and adjusted EBITDA from its Las Vegas operations. This surge is attributed to the impressive performance of the Durango Casino & Resort, which has significantly expanded its customer base by over 95,000. Meanwhile, the company is making steady progress on a $120 million expansion project, slated for completion by late December 2025.

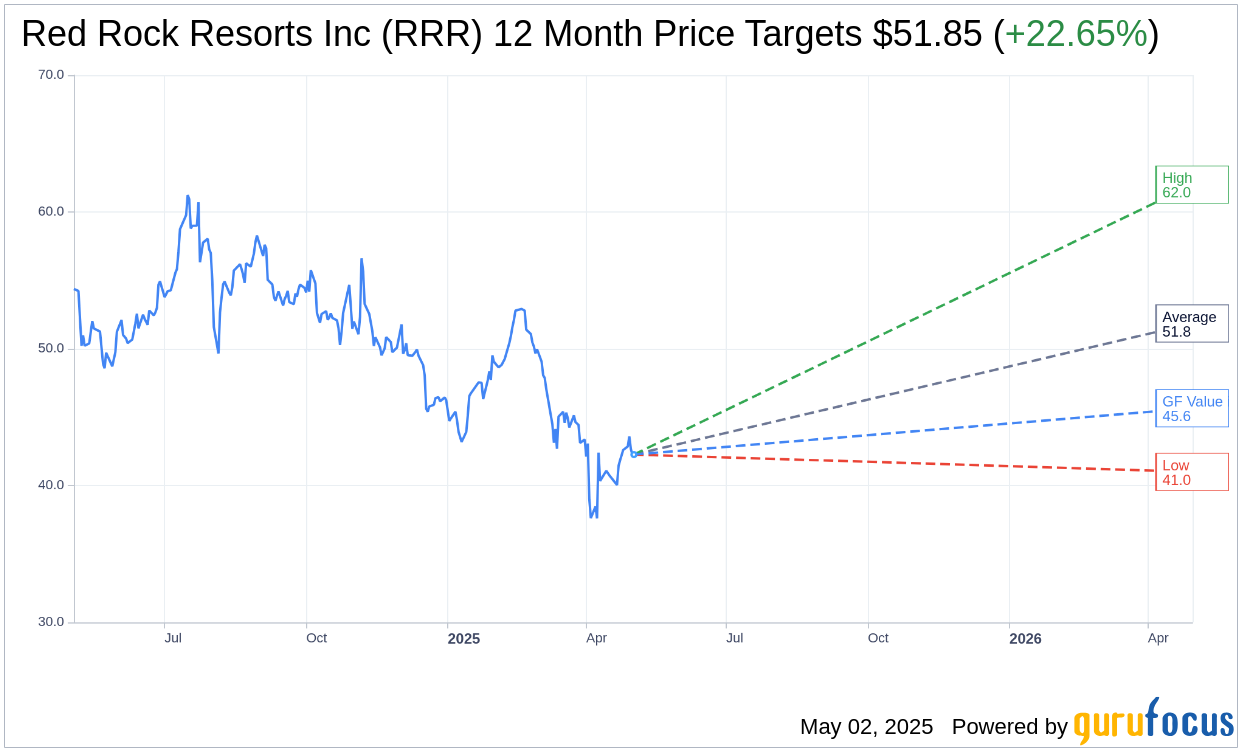

Wall Street Analysts Forecast

According to projections by 13 analysts, the average price target for Red Rock Resorts Inc (RRR, Financial) stands at $51.85, with estimates ranging from a high of $62.00 to a low of $41.00. This suggests a potential upside of 22.65% from the existing price of $42.27. For further insights into these forecasts, visit the Red Rock Resorts Inc (RRR) Forecast page.

The consensus recommendation from 13 brokerage firms positions Red Rock Resorts Inc (RRR, Financial) at an average rating of 2.5, reflecting an "Outperform" status. This rating is based on a scale from 1 to 5, where 1 indicates a Strong Buy and 5 signifies a Sell.

Additionally, GuruFocus estimates the GF Value for Red Rock Resorts Inc (RRR, Financial) over the next year to be $45.65. This presents a calculated upside of 8% from the current share price of $42.27. The GF Value is determined by analyzing historical trading multiples, previous business growth, and future performance forecasts. For a deeper analysis, refer to the Red Rock Resorts Inc (RRR) Summary page.