Key Highlights:

- Cooper-Standard (CPS, Financial) reports a non-GAAP earnings per share of $0.19, with a revenue of $667.1 million.

- The adjusted EBITDA improved significantly to $58.7 million compared to the previous year.

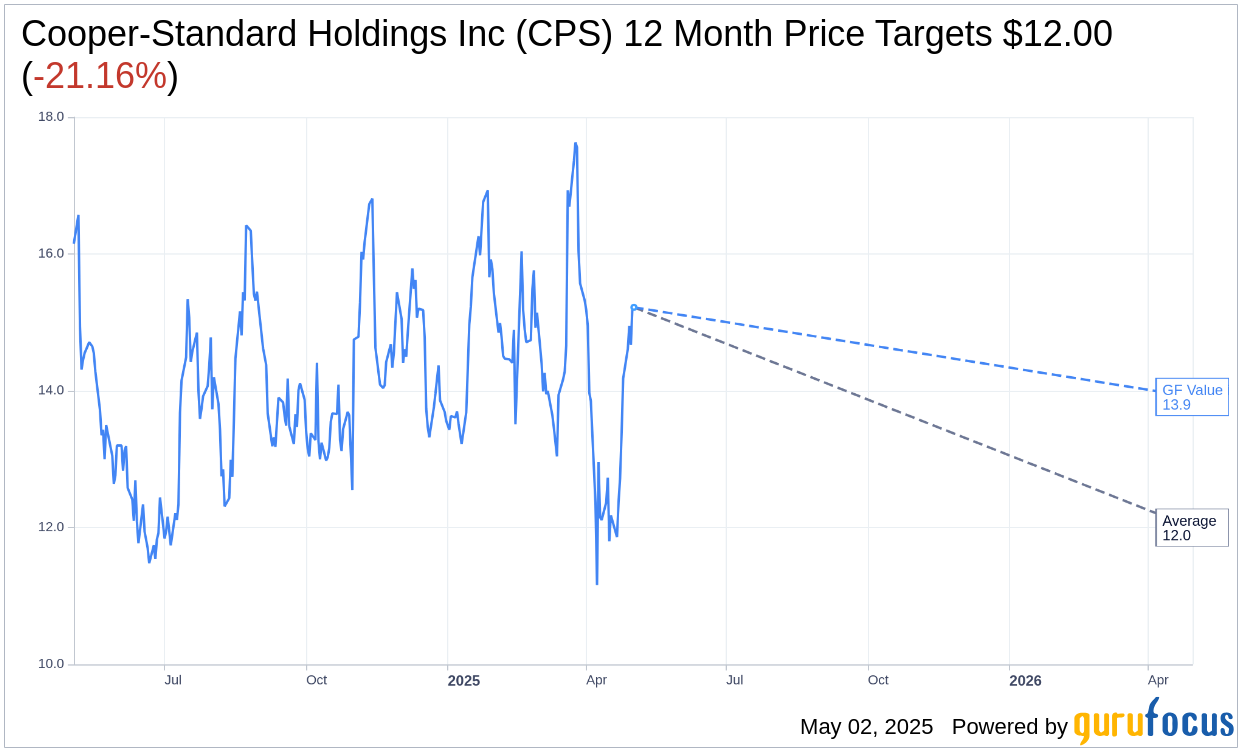

- Analysts predict an average target price of $12.00, suggesting a potential downside of 21.16% from the current price.

Quarterly Performance Insights

Cooper-Standard (CPS) recently announced its first-quarter financial results, showcasing a non-GAAP earnings per share of $0.19. Despite a slight year-over-year revenue decline to $667.1 million, the company impressively achieved an adjusted EBITDA of $58.7 million, reflecting notable growth from the previous year. This performance highlights the company's resilience in optimizing its operations amidst challenging market conditions.

Analyst Projections and Market Expectations

According to analysis from one financial expert, the average target price for Cooper-Standard Holdings Inc (CPS, Financial) stands at $12.00, with both the high and low estimates coinciding at $12.00. This projection suggests a potential downside of 21.16% from the current trading price of $15.22. Investors seeking more detailed insights into these estimates can explore the CPS Forecast page.

Brokerage Recommendations

The consensus rating from one brokerage firm indicates a "Hold" status for Cooper-Standard Holdings Inc (CPS, Financial), with an average recommendation score of 3.0. The rating scale spans from 1, representing a Strong Buy, to 5, indicating a Sell. This suggests that while there may be caution in the current market outlook, there remains potential value for long-term stakeholders.

Evaluating GF Value Estimates

GuruFocus' proprietary GF Value estimation suggests a one-year fair value of $13.91 for Cooper-Standard Holdings Inc (CPS, Financial), implying a downside of 8.61% from the current price of $15.22. The GF Value is determined by analyzing historical trading multiples and anticipated business performance, offering investors a comprehensive view of the stock's potential. For a more thorough analysis, visit the CPS Summary page.

This comprehensive overview aims to equip investors with a deeper understanding of Cooper-Standard's financial health and market positioning, providing clarity for informed investment decisions.