The U.S. Army has rated Palantir's (PLTR, Financial) innovative $178 million mobile intelligence-gathering vehicle, known as the Titan system, as one of its leading programs, according to an April report. The Titan system is slated to enter an important phase of operational testing under combat-like conditions. This is expected to pave the way for decisions regarding full-scale production and to begin initial deployment between 2027 and 2028.

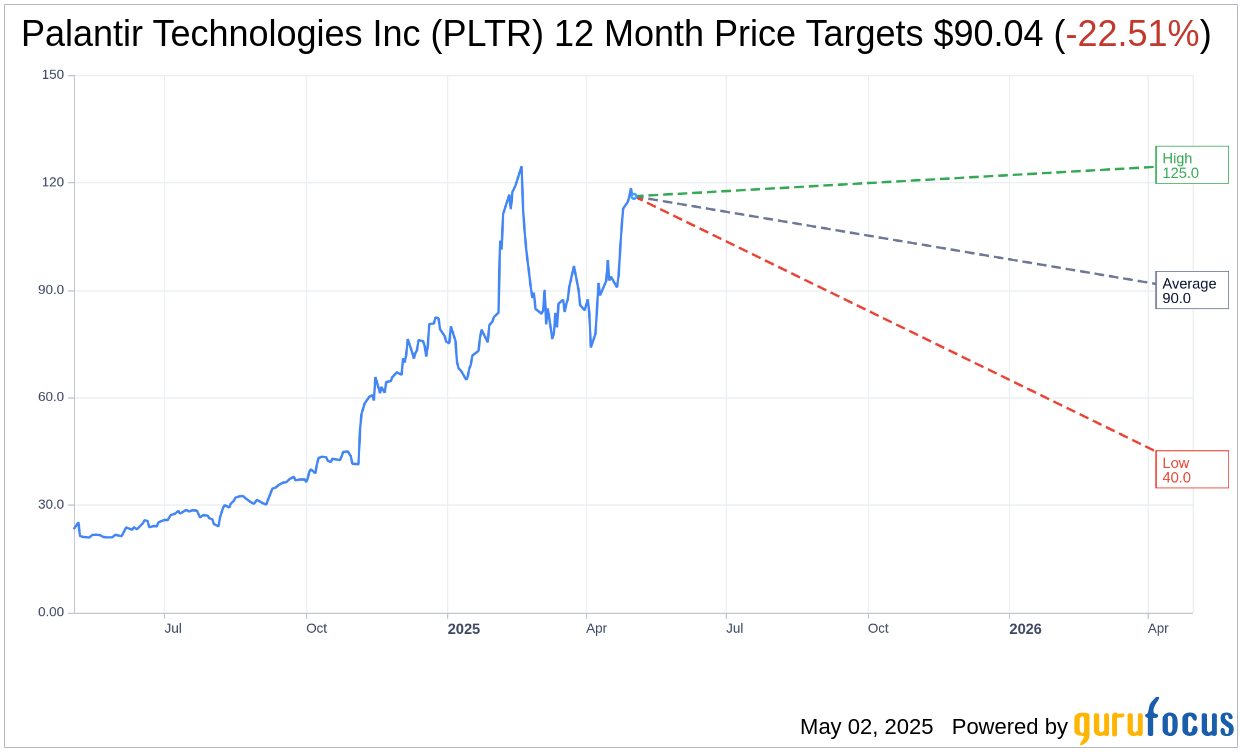

Wall Street Analysts Forecast

Based on the one-year price targets offered by 20 analysts, the average target price for Palantir Technologies Inc (PLTR, Financial) is $90.04 with a high estimate of $125.00 and a low estimate of $40.00. The average target implies an downside of 22.51% from the current price of $116.20. More detailed estimate data can be found on the Palantir Technologies Inc (PLTR) Forecast page.

Based on the consensus recommendation from 24 brokerage firms, Palantir Technologies Inc's (PLTR, Financial) average brokerage recommendation is currently 2.9, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Palantir Technologies Inc (PLTR, Financial) in one year is $27.12, suggesting a downside of 76.66% from the current price of $116.2. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Palantir Technologies Inc (PLTR) Summary page.

PLTR Key Business Developments

Release Date: February 03, 2025

- Revenue Growth: 36% year over year in Q4; 29% for the full year 2024.

- US Business Revenue Growth: 52% year over year in Q4.

- US Commercial Revenue Growth: 64% year over year in Q4; 54% for the full year.

- US Government Revenue Growth: 45% year over year in Q4.

- Adjusted Operating Margin: 45% in Q4, the strongest in company history.

- Adjusted Free Cash Flow: $517 million in Q4; $1.25 billion for the full year, representing a 44% margin.

- Customer Count Growth: 43% year over year to 711 customers.

- Top 20 Customers Revenue: $65 million per customer, a 18% year over year increase.

- Commercial TCV Booked: $995 million in Q4, a 42% year over year growth.

- US Commercial TCV Booked: $803 million in Q4, a 134% year over year growth.

- International Government Revenue Growth: 28% year over year in Q4.

- Net Dollar Retention: 120%, an increase of 200 basis points from last quarter.

- Total Remaining Deal Value: $5.43 billion, a 40% year over year increase.

- Adjusted Gross Margin: 83% for Q4 and the full year.

- GAAP Net Income: $79 million in Q4; $462 million for the full year.

- GAAP Earnings Per Share: $0.03 in Q4; $0.19 for the full year.

- Adjusted Earnings Per Share: $0.14 in Q4; $0.41 for the full year.

- Cash and Equivalents: $5.2 billion at the end of Q4.

- Q1 2025 Revenue Guidance: $858 million to $862 million.

- Full Year 2025 Revenue Guidance: $3.741 billion to $3.757 billion.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Palantir Technologies Inc (PLTR, Financial) reported a 36% year-over-year revenue growth in Q4 2024, exceeding prior guidance by over 900 basis points.

- The US business showed significant strength, with a 52% year-over-year growth in Q4, driven by both commercial and government sectors.

- Palantir Technologies Inc (PLTR) achieved a Rule of 40 score of 81 in Q4, indicating strong revenue growth combined with profitability.

- The company closed $1.8 billion in total contract value (TCV) in Q4, marking a 56% increase year over year.

- Palantir Technologies Inc (PLTR) reported an exceptional cash flow quarter with adjusted free cash flow of $517 million, representing a margin of 63%.

Negative Points

- International commercial revenue growth was relatively modest at 3% year over year in Q4.

- Revenue from strategic commercial contracts is expected to decline significantly in Q1 2025.

- The European market showed slower growth, with only 4% growth on 13% of the company's business.

- Palantir Technologies Inc (PLTR) faces challenges in expanding its presence in Europe due to cultural and strategic differences.

- The company anticipates a more significant increase in expenses in 2025 as it invests in technical hires and product pipeline.