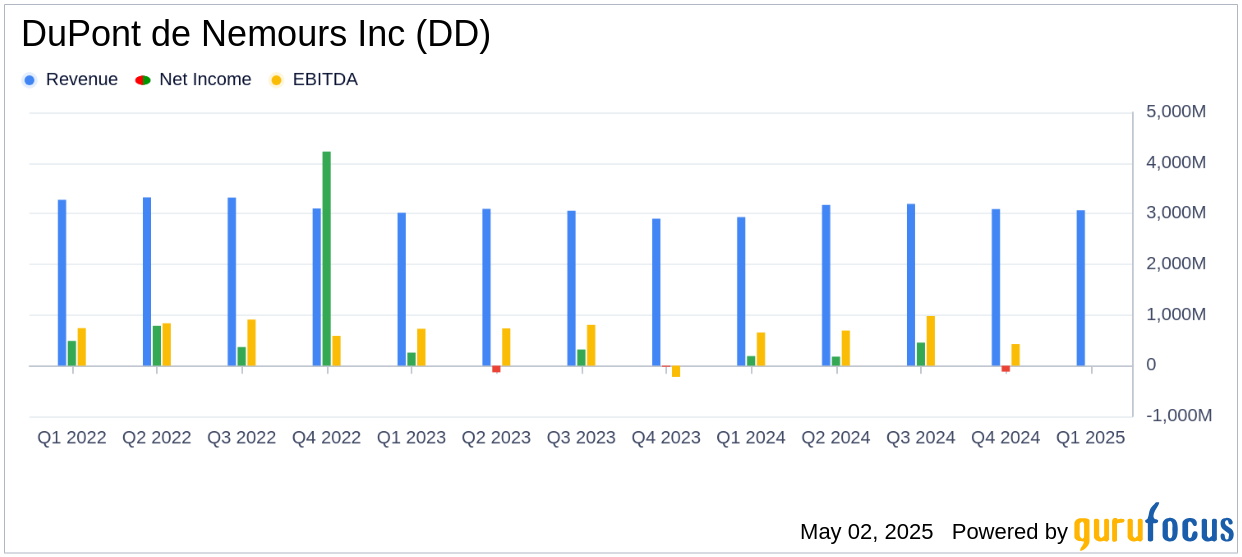

On May 2, 2025, DuPont de Nemours Inc (DD, Financial) released its 8-K filing for the first quarter of 2025, showcasing a mixed financial performance. The company reported net sales of $3.1 billion, a 5% increase from the previous year, driven by a 6% rise in organic sales. However, the quarter was marked by a GAAP loss from continuing operations of $548 million, primarily due to a $768 million non-cash goodwill impairment charge. Despite this, DuPont achieved an adjusted EPS of $1.03, surpassing the analyst estimate of $0.85.

Company Overview

DuPont de Nemours Inc (DD, Financial) is a diversified global specialty chemicals company formed in 2019 following the DowDuPont merger and subsequent separations. The company's portfolio spans specialty chemicals and downstream products serving industries such as electronics, water, construction, safety and protection, automotive, and healthcare. DuPont plans to spin off its electronics business by the end of 2025.

Performance Highlights and Challenges

DuPont's first quarter results reflect strong organic sales growth and margin expansion in its ElectronicsCo and IndustrialsCo segments. The company benefited from robust demand in electronics, healthcare, and water markets. However, the significant goodwill impairment charge related to the Aramids reporting unit, part of the 2025 Segment Realignment, impacted the overall financial performance. This realignment required specific impairment analyses, leading to the charge.

Financial Achievements and Industry Importance

Despite the challenges, DuPont's operating EBITDA increased by 16% to $788 million, highlighting the company's ability to leverage volume benefits and restructuring savings. The adjusted EPS of $1.03, a 30% increase from the previous year, underscores the company's strong segment earnings. These achievements are crucial for DuPont as they demonstrate resilience and operational efficiency in the competitive chemicals industry.

Key Financial Metrics

| Metric | 1Q25 | 1Q24 | Change |

|---|---|---|---|

| Net Sales | $3,066 million | $2,931 million | 5% |

| Operating EBITDA | $788 million | $682 million | 16% |

| GAAP EPS from Continuing Operations | $(1.33) | $0.41 | (424)% |

| Adjusted EPS | $1.03 | $0.79 | 30% |

Analysis and Outlook

DuPont's performance in the first quarter of 2025 highlights its ability to navigate complex market dynamics and internal restructuring. The company's strategic focus on high-demand sectors like electronics and healthcare positions it well for future growth. However, the goodwill impairment charge serves as a reminder of the challenges associated with large-scale corporate realignments. As DuPont progresses towards the planned spin-off of its electronics business, maintaining operational efficiency and capitalizing on market opportunities will be critical for sustained success.

“Our results reflect continued strong quarterly financial performance with year-over-year organic sales growth and margin expansion in both the ElectronicsCo and IndustrialsCo segments,” said Lori Koch, DuPont Chief Executive Officer.

Explore the complete 8-K earnings release (here) from DuPont de Nemours Inc for further details.