H.C. Wainwright has significantly increased its price target for X4 Pharmaceuticals (XFOR, Financial), moving it from $1.50 to $7, while maintaining a Buy rating on the stock. The adjustment follows the company's first-quarter report, which highlights its ongoing progress. X4 Pharmaceuticals is set to complete patient enrollment for the Phase 3 4WARD study by the fourth quarter. This study focuses on evaluating the effectiveness of mavorixafor, both alone and combined with stable doses of G-CSF, in treating congenital, idiopathic, and autoimmune chronic neutropenia.

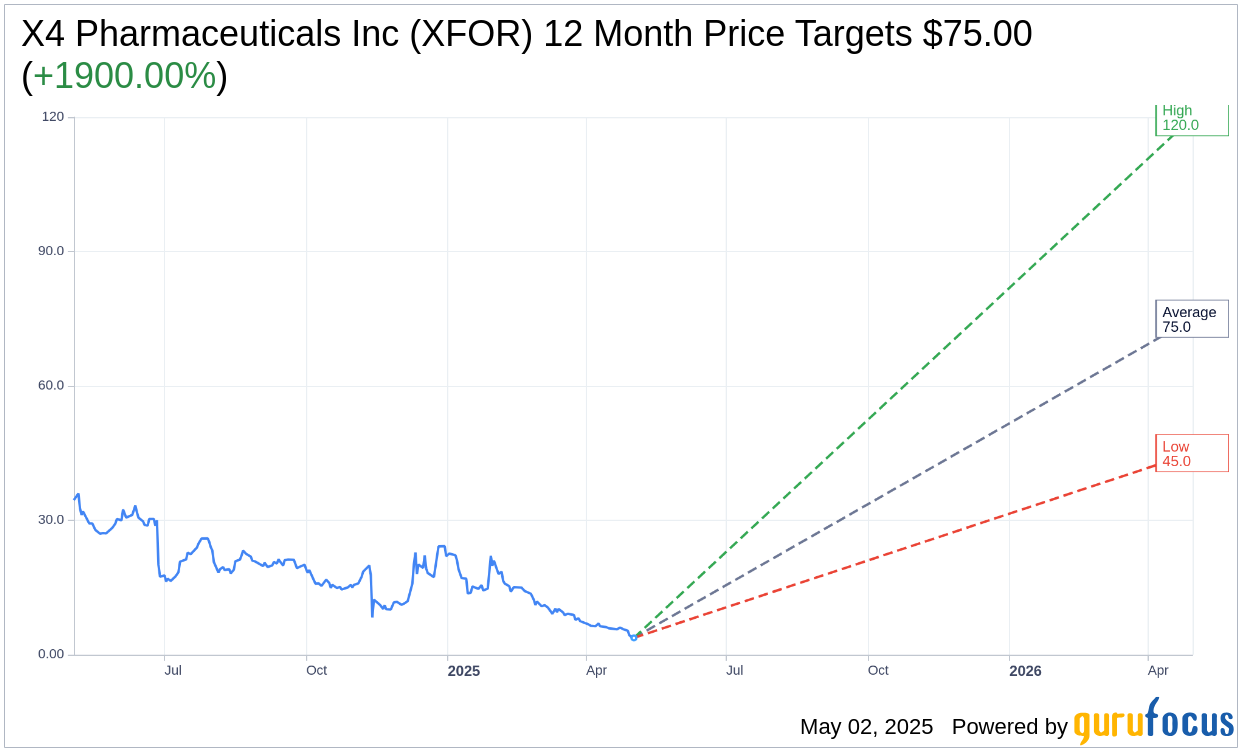

Wall Street Analysts Forecast

Based on the one-year price targets offered by 6 analysts, the average target price for X4 Pharmaceuticals Inc (XFOR, Financial) is $75.00 with a high estimate of $120.00 and a low estimate of $45.00. The average target implies an upside of 1,900.00% from the current price of $3.75. More detailed estimate data can be found on the X4 Pharmaceuticals Inc (XFOR) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, X4 Pharmaceuticals Inc's (XFOR, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

XFOR Key Business Developments

Release Date: May 01, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- X4 Pharmaceuticals Inc (XFOR, Financial) has made significant progress in the development of Maverick 4 for chronic neutropenia, with over 90% of global trial sites activated.

- The company has received a notice of allowance from the US Patent Office for Maverick 4, with the patent expected to expire in March 2041.

- X4 Pharmaceuticals Inc (XFOR) reported cumulative sales of $3.5 million for Zoremby since its launch, indicating growing demand.

- The company has secured international partnerships to expand the reach of Maverick 4 in Europe, Australia, New Zealand, and the MENA region.

- X4 Pharmaceuticals Inc (XFOR) ended the first quarter of 2025 with nearly $90 million in cash, providing financial stability into the first half of 2026.

Negative Points

- Sales for the first quarter were slightly lower than the previous quarter due to fluctuations in inventory resupply.

- The company is still in the early stages of commercialization for Zoremby, with some sales volatility expected.

- X4 Pharmaceuticals Inc (XFOR) had significant R&D and SG&A expenses, totaling $18.5 million and $15 million respectively for the first quarter.

- The company had to implement a 1 for 30 reverse stock split to address NASDAQ listing rule deficiencies.

- There is a high unmet need in the chronic neutropenia market, with approximately 15,000 individuals in the US still experiencing health challenges despite available treatments.