Canaccord's analyst, William Plovanic, has revised the price target for iRhythm Technologies (IRTC, Financial), reducing it from $152 to $139. Despite the adjustment, Plovanic maintains a Buy rating on the stock. The company surpassed market predictions and continues to make progress on its regulatory plans. iRhythm reiterated its goal to submit the Zio Monitor in the third quarter and is committed to resolving compliance issues related to the Warning Letter and 483 observations by the end of 2025.

Wall Street Analysts Forecast

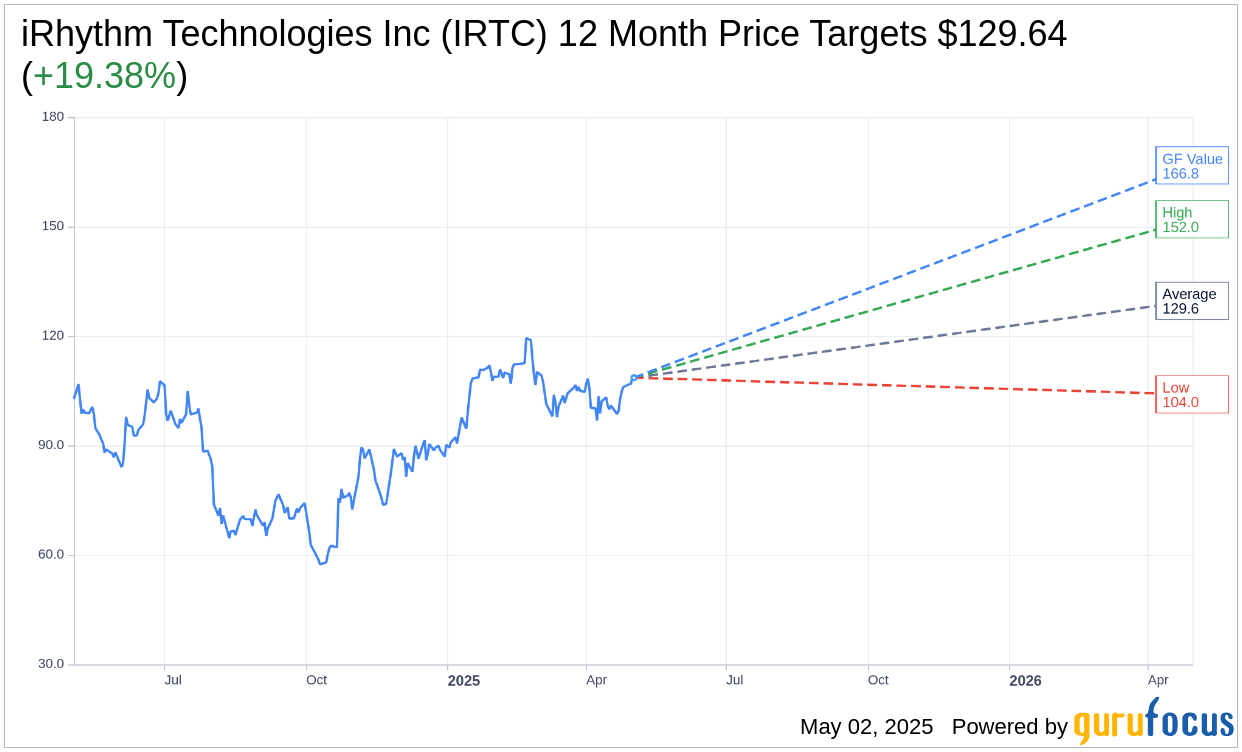

Based on the one-year price targets offered by 11 analysts, the average target price for iRhythm Technologies Inc (IRTC, Financial) is $129.64 with a high estimate of $152.00 and a low estimate of $104.00. The average target implies an upside of 19.38% from the current price of $108.59. More detailed estimate data can be found on the iRhythm Technologies Inc (IRTC) Forecast page.

Based on the consensus recommendation from 13 brokerage firms, iRhythm Technologies Inc's (IRTC, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for iRhythm Technologies Inc (IRTC, Financial) in one year is $166.79, suggesting a upside of 53.6% from the current price of $108.59. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the iRhythm Technologies Inc (IRTC) Summary page.

IRTC Key Business Developments

Release Date: May 01, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- iRhythm Technologies Inc (IRTC, Financial) reported a strong start to 2025 with a revenue of $158.7 million, representing over 20% growth compared to the first quarter of 2024.

- The company achieved significant market penetration in the US and international markets, with strong demand for its XO monitor and GOAT products.

- iRhythm surpassed 10 million cumulative patient reports, highlighting its commitment to superior patient care.

- The company is expanding into primary care channels, with nearly one-third of long-term continuous monitoring volumes now originating from primary care physicians.

- iRhythm is making progress in international markets, including a commercial launch in Japan, and is working on improving reimbursement rates through clinical evidence.

Negative Points

- The company is facing challenges with reimbursement rates in Japan, which are currently set at the Holter monitoring rate, impacting expected revenue contributions.

- iRhythm continues to incur significant legal and consulting fees related to FDA remediation efforts and DOJ subpoena activities.

- The company is experiencing pricing headwinds in the US market, which could impact revenue growth.

- There are ongoing concerns about tariffs and their potential impact on supply chain and costs.

- Despite strong revenue growth, iRhythm reported an adjusted net loss of $30.3 million for the first quarter of 2025.