The Wendy's Co (WEN, Financial) released its 8-K filing on May 2, 2025, reporting its first-quarter results for the period ending March 30, 2025. The company, known as the second-largest burger quick-service restaurant chain in the United States, faced a challenging quarter with global systemwide sales declining by 1.1% to $3.4 billion. Despite the decrease, Wendy's added 68 net new restaurants and achieved a record 20.3% in global digital sales mix.

Performance and Challenges

The Wendy's Co (WEN, Financial) reported a decrease in total revenues, primarily due to lower sales from company-operated restaurants, reduced advertising funds revenue, and decreased franchise royalty revenue. These declines were partially offset by an increase in franchise fees. The U.S. segment experienced a 2.6% decline in systemwide sales, while the international segment saw an 8.9% increase, highlighting the contrasting performance across regions.

The company's challenges were exacerbated by commodity inflation, a decline in traffic, and labor rate inflation, which impacted the U.S. company-operated restaurant margin. These factors are critical as they directly affect profitability and operational efficiency in the competitive restaurant industry.

Financial Achievements and Metrics

Despite the challenges, The Wendy's Co (WEN, Financial) returned $173.5 million to shareholders through dividends and share repurchases, demonstrating a commitment to shareholder value. The company declared a quarterly cash dividend of $0.14 per share, payable on June 16, 2025.

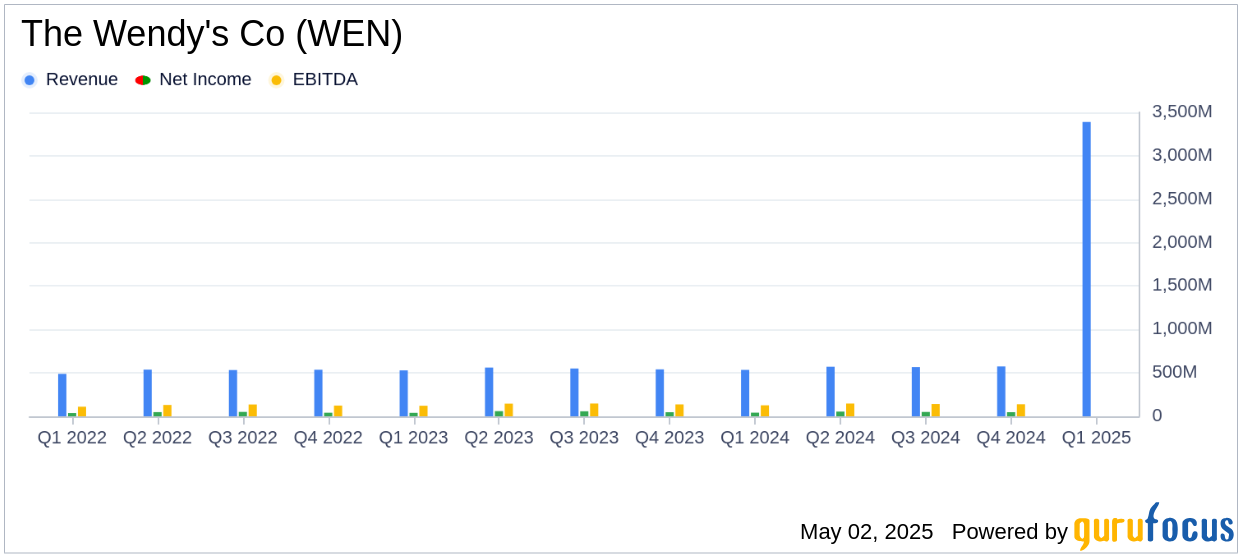

Key financial metrics include a decrease in net income, primarily due to reduced investment income and increased interest expenses, partially offset by higher operating profit. Adjusted EBITDA also declined, driven by increased general and administrative expenses and decreased franchise royalties.

Income Statement and Balance Sheet Insights

The income statement revealed a decline in U.S. company-operated restaurant margins due to inflationary pressures and reduced traffic. The balance sheet showed a strategic focus on expanding the restaurant footprint, with 68 net new openings contributing to future growth potential.

“We continued to deliver for our customers during the first quarter. In the U.S. we held both traffic and dollar share in a challenging consumer environment, and in our International business we grew systemwide sales by 8.9%,” said Kirk Tanner, President and Chief Executive Officer.

Analysis and Outlook

The Wendy's Co (WEN, Financial) faces a challenging environment in the U.S. market, with inflation and consumer behavior impacting sales. However, the company's strategic priorities, including digital sales growth and international expansion, provide a pathway for long-term growth. The focus on franchise support and operational efficiencies will be crucial in navigating the current economic landscape.

Overall, while The Wendy's Co (WEN, Financial) missed analyst estimates with a reported revenue of $3.389 billion against the estimated $525.41 million, the company's strategic initiatives and shareholder returns highlight its resilience and potential for future growth in the competitive quick-service restaurant industry.

Explore the complete 8-K earnings release (here) from The Wendy's Co for further details.