Key Highlights:

- Telephone and Data Systems (TDS, Financial) reports a first-quarter GAAP loss with significant revenue decline.

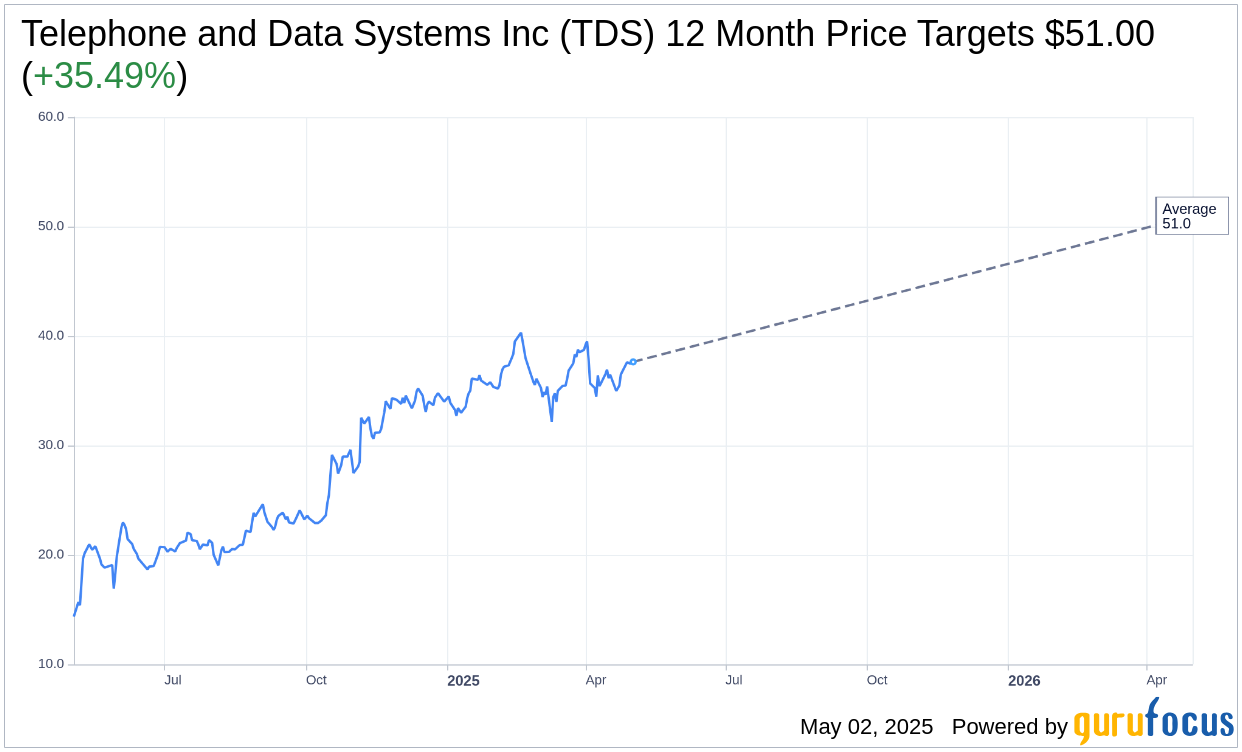

- Analysts project an upside potential of 35.49% based on current price targets.

- GuruFocus estimates indicate a significant downside, projecting the GF Value to be notably lower than the current trading price.

Financial Performance Overview

Telephone and Data Systems (TDS) recently reported their first-quarter financial results, revealing a GAAP loss per share of $0.09. The company's revenue dropped to $1.15 billion, representing an 8.7% decline compared to the previous year. Looking ahead, TDS has set ambitious targets for 2025, planning a capital expenditure between $375 million and $425 million aimed at expanding their fiber optic infrastructure.

Analysts' Price Projections

According to forecasts from one analyst, the average price target for Telephone and Data Systems Inc (TDS, Financial) is set at $51.00, with both the high and low estimates aligning with this target. This suggests a potential upside of 35.49% from the current trading price of $37.64. For more detailed projections, refer to the Telephone and Data Systems Inc (TDS) Forecast page.

Brokerage Recommendations

Presently, the consensus among three brokerage firms suggests holding TDS stock, with an average recommendation rating of 2.7 on a scale where 1 is a "Strong Buy" and 5 signifies a "Sell." This rating implies a cautious but steady outlook on the stock's performance in the near term.

GF Value Analysis

GuruFocus estimates the GF Value for Telephone and Data Systems Inc (TDS, Financial) to be around $15.94 in the next year, indicating a potential downside of 57.65% from the current market price of $37.64. The GF Value considers historical trading multiples, past business growth, and future performance estimates to determine what the stock should ideally be trading at. Investors can access more detailed data on the Telephone and Data Systems Inc (TDS) Summary page.

Overall, while analysts foresee a potential upside, the GuruFocus valuation presents a more cautious perspective. Investors are encouraged to explore all data points and make informed decisions based on the comprehensive analyses available on GuruFocus.