Key Highlights:

- Freight Technologies, Inc. (FRGT, Financial) partners with Bayer Crop Science to enhance supply chain efficiency.

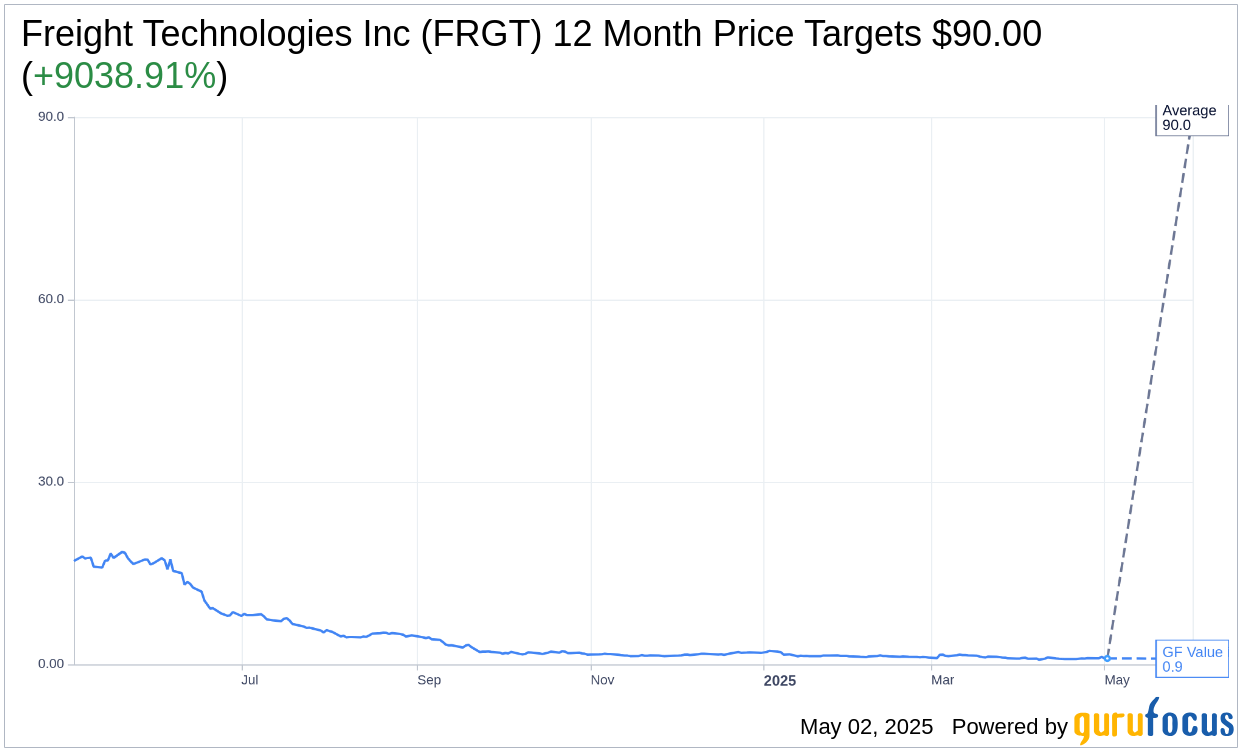

- Wall Street analysts predict a significant upside for FRGT, with a one-year price target of $90.00.

- Current GF Value estimates suggest a potential downside, highlighting possible market volatility.

Freight Technologies, Inc. (FRGT) has strategically advanced its operations by integrating the Fr8App platform with Bayer Crop Science's Blue Yonder Transportation Management System. This innovative collaboration is designed to optimize Bayer's supply chain processes through automated data exchanges, leading to improved shipment visibility, heightened efficiency, and reduced lead times. Such advancements are poised to potentially transform supply chain dynamics.

Wall Street Analysts' Forecast

Wall Street analysts present an optimistic outlook for Freight Technologies Inc (FRGT, Financial), positing an average one-year target price of $90.00. With unanimous high and low estimates pegged at $90.00, this projection denotes a remarkable anticipated upside of 9,038.91% from the current trading price of $0.98. For further insights, investors can delve into the Freight Technologies Inc (FRGT) Forecast page.

The consensus from a singular brokerage firm assigns Freight Technologies Inc (FRGT, Financial) an average brokerage recommendation of 2.0, reflecting an "Outperform" status. This rating is part of a scale where 1 indicates a Strong Buy, and 5 represents a Sell, underscoring a confident investor sentiment towards FRGT's potential performance.

Additionally, according to GuruFocus estimates, the projected GF Value for Freight Technologies Inc (FRGT, Financial) in the upcoming year stands at $0.93. This suggests a potential downside of 5.56% from the current market price of $0.9848. The GF Value is a crucial metric, calculated based on historical trading multiples, the company's past growth trajectories, and future performance forecasts. Investors seeking a deeper understanding can access detailed data on the Freight Technologies Inc (FRGT) Summary page.