An analyst from Baird, Joe Vruwink, has revised the price target for Procore (PCOR, Financial), increasing it from $77 to $83. This adjustment follows an evaluation of the company's performance after its first-quarter results. Despite the changes in the price target, the analyst maintains an Outperform rating on the stock, indicating a positive outlook for Procore's future prospects.

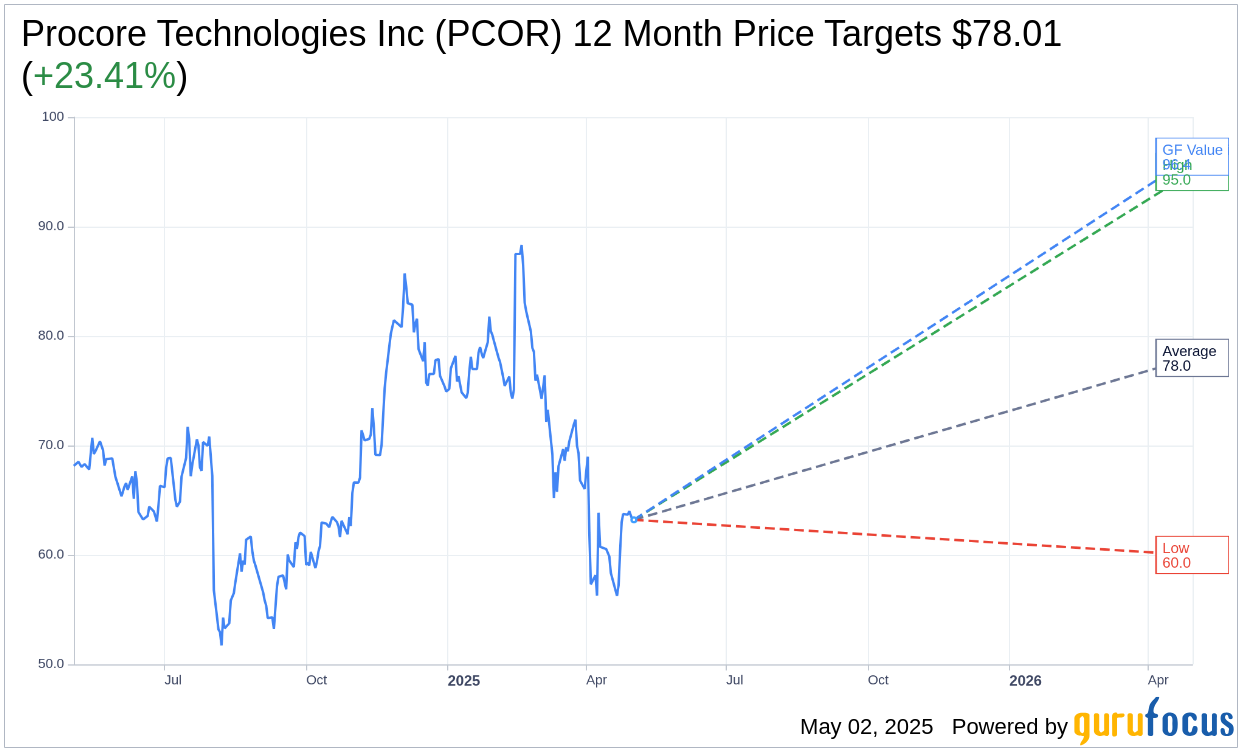

Wall Street Analysts Forecast

Based on the one-year price targets offered by 18 analysts, the average target price for Procore Technologies Inc (PCOR, Financial) is $78.01 with a high estimate of $95.00 and a low estimate of $60.00. The average target implies an upside of 23.41% from the current price of $63.21. More detailed estimate data can be found on the Procore Technologies Inc (PCOR) Forecast page.

Based on the consensus recommendation from 22 brokerage firms, Procore Technologies Inc's (PCOR, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Procore Technologies Inc (PCOR, Financial) in one year is $96.39, suggesting a upside of 52.49% from the current price of $63.21. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Procore Technologies Inc (PCOR) Summary page.

PCOR Key Business Developments

Release Date: May 01, 2025

- Revenue: $311 million in Q1, up 15% year over year.

- International Revenue Growth: 18% year over year; 20% on a constant currency basis.

- Non-GAAP Operating Income: $32 million, with a non-GAAP operating margin of 10%.

- Current RPO Growth: 20% year over year.

- Current Deferred Revenue Growth: 15% year over year.

- Share Repurchase: Approximately $100 million returned to shareholders by repurchasing 1.5 million shares at an average price of $68.96.

- Q2 2025 Revenue Guidance: Expected between $310 million and $312 million, representing 9 to 10% year over year growth.

- Q2 2025 Non-GAAP Operating Margin Guidance: Expected between 11% and 11.5%.

- Full Year Fiscal 2025 Revenue Guidance: Between $1.286 billion and $1.29 billion, representing 12% year over year growth.

- Full Year Fiscal 2025 Non-GAAP Operating Margin Guidance: Between 13% and 13.5%, implying year over year margin expansion of 300 to 350 basis points.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Procore Technologies Inc (PCOR, Financial) reported a 15% year-over-year revenue growth in Q1, indicating strong financial performance.

- The company has over 2,400 customers contributing more than $100,000 in annual recurring revenue (ARR), showcasing a robust customer base.

- Procore's international revenue grew by 18% year-over-year, with a constant currency growth of 20%, highlighting successful global expansion.

- The company is leveraging AI to enhance its platform, aiming to improve productivity and reduce risk for customers, which could drive future growth.

- Procore's strategic focus on long-term growth opportunities, such as international expansion and product cross-sell, positions it well for sustained success.

Negative Points

- The uncertainty surrounding tariff policies poses potential risks to Procore's demand environment, which could impact future financial performance.

- Procore experienced some disruption due to its go-to-market transition, which may continue into Q2 as the organization adapts to the new model.

- Currency headwinds slightly impacted international revenue growth, which could continue to be a challenge if exchange rates remain unfavorable.

- The company's gross margin was lower this quarter compared to previous quarters, which may raise concerns about cost management.

- Procore's guidance for Q2 indicates a deceleration in revenue growth, reflecting a cautious approach amid macroeconomic uncertainties.