Raymond James analyst Bobby Griffin has revised the price target for Upbound Group (UPBD, Financial), lowering it from $40 to $35, while maintaining an Outperform rating on the stock. According to Griffin, Upbound's first quarter performance was robust, surpassing expectations primarily due to higher than anticipated revenue figures. The analyst notes that although Rent-A-Center's same-store lease portfolio is experiencing some year-over-year pressure because of stricter decision-making processes, there is a positive aspect as lease charge-offs have decreased both compared to the previous year and sequentially. This suggests that management is effectively navigating the current challenging environment.

Wall Street Analysts Forecast

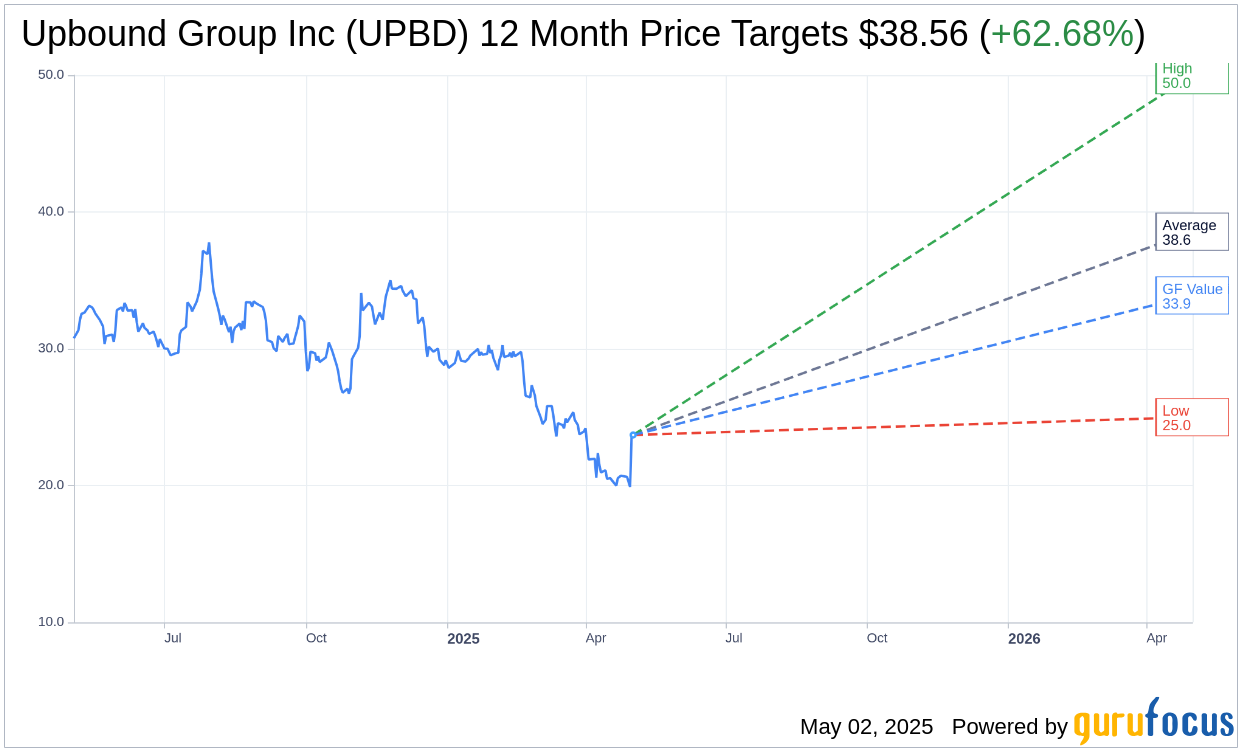

Based on the one-year price targets offered by 9 analysts, the average target price for Upbound Group Inc (UPBD, Financial) is $38.56 with a high estimate of $50.00 and a low estimate of $25.00. The average target implies an upside of 62.68% from the current price of $23.70. More detailed estimate data can be found on the Upbound Group Inc (UPBD) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Upbound Group Inc's (UPBD, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Upbound Group Inc (UPBD, Financial) in one year is $33.90, suggesting a upside of 43.04% from the current price of $23.7. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Upbound Group Inc (UPBD) Summary page.

UPBD Key Business Developments

Release Date: May 01, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Upbound Group Inc (UPBD, Financial) reported a 7.3% increase in first-quarter revenue, driven by strong performance from AEMA and the addition of Bridget.

- AEMA achieved nearly 9% year-over-year GMV growth, with improved lease charge-offs and adjusted EBITDA margins.

- Bridget's acquisition has been successful, with a 35% increase in revenue and a 26% rise in subscribers year-over-year.

- The company generated $127 million in free cash flow, nearly four times larger than the previous year's first quarter.

- Upbound Group Inc (UPBD) has a strong balance sheet with $312 million in liquidity, supporting continued growth and capital allocation priorities.

Negative Points

- Rent A Center's same-store sales were down 2% year-over-year due to tightened underwriting and removal of higher loss products.

- The company faces potential impacts from tariff changes, which could affect market expectations and consumer confidence.

- Bridget's cash advance loss rate was 2.4%, indicating some risk in the cash advance segment.

- Rent A Center's revenue declined by 4.9% due to fewer company-owned stores and a streamlined product lineup.

- The macroeconomic environment remains uncertain, with potential headwinds from inflation and trade policy changes.